The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Checking Account

A checking account is a service provided by financial institutions (banks, credit unions, etc.) which allows individuals and businesses to deposit money and withdraw funds from an account. The terms of this type of account vary from institution to institution; but, in general, it's an account where you can use personal checks in place of cash to pay for your purchases. Many checking accounts allow the use of electronic debit cards or Automated Teller Machine (ATM) cards. These allow you to purchase items at a retail store or make cash withdrawals without having to write a check or make a withdrawal from the institution.

Most financial institutions offer some form of checking account service. Some institutions may require a minimal initial deposit before establishing a new account, along with proof of identity and address. A typical checking account is handled through careful posting of deposits and withdrawals. To use your checking account you first must purchase a supply of checks which contain all of the essential routing and mailing information. When a check is filled out correctly, the recipient treats it the same as cash and completes the transaction. After this check has been deposited into the recipient's own account, the recipient's financial institution files the check electronically and the check writer's institution receives the cancelled check and amount to be debited (withdrawn) from your account. This process continues for every check written against your account.

Things to know about your checking account:

- Shop around for the best deal, preferably an account without a monthly maintenance fee.

- Most financial institutions offer several accounts to choose from with different features, fees, interest rates, and opening balance requirements.

- Keep your checkbook ledger up to date by recording all transactions, including ATM withdrawals, fees, purchases you make using a debit card, and any other deductions or deposits. As the owner of the checking account, you are ultimately responsible for keeping track of your available funds.

- Compare your checkbook balance to your monthly statement immediately. Most institutions allow 60 days from the day you receive your statement to dispute any unauthorized or fraudulent activity.

- Avoid overdrawing your account, which can happen if you write a check, authorize a debit, or attempt to withdraw (by mistake) more money than you have in your account. Please understand financial institutions charge fees when this happens.

- Consider Internet (online) banking. This service allows you to make payments or move money from one account to another through your financial institution's website instead of writing or mailing paper checks. This will save you money by avoiding postage charges and the purchase of paper checks.

- Online banking allows you to monitor your account without having to wait for the statement.

- Overdraft protection helps avoid overdraft fees when you don't have enough money in your account. You should contact your financial institution to obtain a copy of its policy and/or agreement explaining how this product works and the associated cost.

Joint Accounts

A joint account is an account shared by two or more individuals. Any joint account owner can make deposits to or withdrawals from the account without authorization from the other joint account holder. Joint accounts are riskier than two individual accounts but many people find that pooling their income into a joint account makes paying bills easier. Keep in mind that once funds are co-mingled in a joint account, there is nothing the bank can do to protect either party if the other withdraws all the funds from the account. One benefit from a joint account is if two people open an account together and one dies, the other party is able to access the remaining balance in the account.

BillPay Accounts

BillPay is another option many financial institutions offer to assist you with making monthly payments to your creditors. This is generally handled through a third party but you would contact your financial institution to set up this program. You will be required to provide your financial institution with all the creditor's information (name, account number, amount, etc.). You can either set this as a reoccurring debit or you can manually schedule it each month. Basically, BillPay allows you to electronically make payments to your creditors in lieu of writing a check.

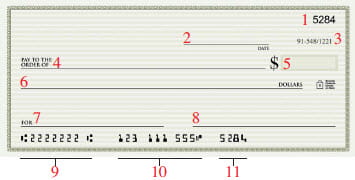

Parts of a Check

- Check Number. Every check in your checkbook has a unique number. The purpose of this is so you can track each check and balance your account.

- Date. This is where you fill in the date that you are writing the check. Several variations of dates are acceptable including: January 1st, 2012, 1/1/12, or Jan. 1, 2012.

- Institution's identification code. These numbers are specific to your institution and are used by other institutions when a check is deposited so they know where the check is coming from.

- Pay to the Order of. Write the name of the person or organization to whom you are writing the check in this space. For example, if you're writing a check to John Doe, put his full name here. Make sure to accurately write the name of the person or organization or they won't be able to deposit the check.

- Declare the amount of the check. This is the total dollar amount you are paying someone using numbers. For example, if you are writing a check for five hundred dollars, put $500.00.

- Clearly print or write the check amount. Use words for the dollars and cents. For example, for $500 use "Five Hundred Dollars and Zero Cents."

- The memo space is optional, but can serve as a good reminder. As an example, if you're paying your rent you may want to put "rent" in this space.

- Sign the check with your name. Without the check holder's signature, another institution won't accept the check. The payee signs the back of the check before depositing it.

- Routing number. This number helps the depositing institution identify the institution the check is coming from.

- Your unique account number. When the depositing institution sends the request to your institution for the withdrawal, this number identifies which account the money is coming from.

- Check number. This is your check number displayed again.

Easy Steps for Balancing Your Personal Checking Account

- Enter your checkbook register balance.

- In order to balance your checkbook register to your bank statement, first add any credits (+) such as deposits or interest which are not already recorded in your checkbook register. Do not include checking reserve transfers. Write your new checkbook balance on Line 2.

- Now subtract any debits (-) such as checks, debit card transactions, ATM withdrawals, and any other fees not recorded in your checkbook register. Do not include checking reserve payments.

- Enter the ending balance from the Checking Account Summary section of your bank account on Line 4.

- In the box provided, list any deposits you have made that are NOT listed on your bank statement. Write the total on Line 5. Be sure to include cash advances or transfers from another account. Do not include checking reserve transfers.

- Add Line 4 and Line 5. Enter the total amount on Line 6.

- In the box provided, list and total all checks and withdrawals including debit card transactions, ATM withdrawals, BillPay payments, automatic payments, and transfers from the account that are not listed on your statement. Write the total amount on Line 7.

- Subtract Line 7 from Line 6. Enter the amount on Line 8.

- Enter zero on line 9 if you do not use non-checking reserve. If you use checking reserve, enter the amount shown as the ending balance on the checking reserve statement page. If there has been no checking reserve activity, you will have no checking reserve statement page.

- Subtract Line 9 from Line 8. Enter the amount on Line 10.

- Compare your adjusted account balance (Line 10) to your adjusted checkbook register balance (Line 3). They should be the same. If they are not the same, review the process. Common checkbook errors include addition, subtraction, and transposition errors.

| Checkbook Register Balance | (1) |

| Adjusted Checkbook Balance (Credits) | (2) |

| Adjusted Checkbook Balance (Debits) | (3) |

| Statement Ending Balance | (4) |

| Total of Unlisted Deposits | (5) |

| TOTAL | (6) |

| Total of Outstanding Checks/Withdrawals | (7) |

| TOTAL | (8) |

| Checking Reserve Balance | (9) |

| Adjusted Account Balance | (10) |