The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

State Aid Resources

Download the infographic as a PDF.

More information on MPSERS state aid fund payments

-

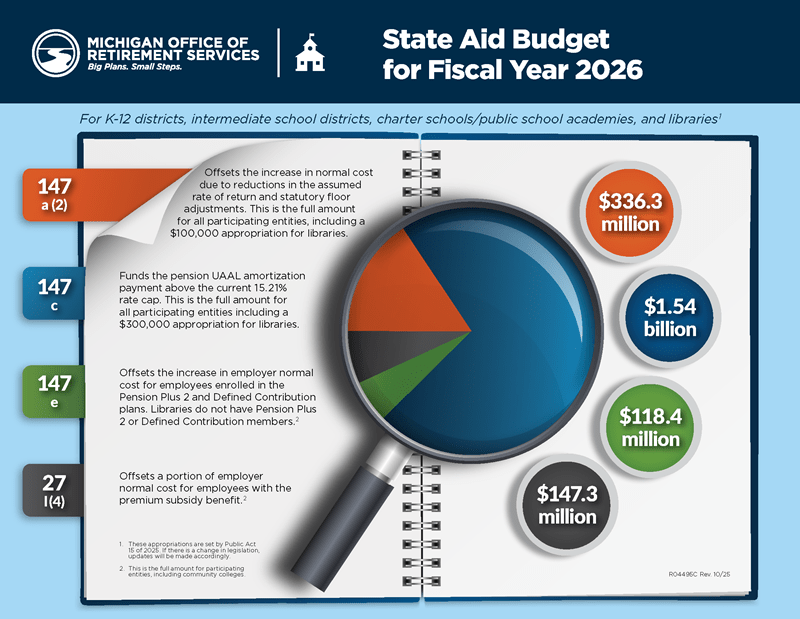

MPSERS Cost Offset

This payment offsets a portion of the retirement contributions owed by the reporting unit for the fiscal year in which it is received.

- Sec. 201(4)(a) — community colleges.

-

MPSERS Normal Cost Offset

This payment offsets normal cost increases due to decreases in the assumed rate of return and normal cost floor adjustments.

- Sec. 147a(2) — K-12 districts, ISDs, PSAs, libraries.

- Sec. 201(4)(b) — community colleges.

- Sec. 236(9) — universities.

-

MPSERS Reforms Defined Contribution Payment

This payment offsets the increase in employer normal cost for employees in the Pension Plus 2 and Defined Contribution plans.

- Sec. 147e — all reporting units except universities and libraries.

-

MPSERS UAAL Rate Stabilization

This payment funds the pension UAAL amortization payment above the UAAL rate cap (15.21% non-universities, 25.73% universities). It is passed through reporting units to ORS and appears on employer statements as UAAL Rate Stabilization Invoice.

- Sec. 147c — K-12 districts, ISDs, PSAs, libraries.

- Sec. 201(5) — community colleges.

- Sec. 236(4) — universities.

-

MPSERS Healthcare OffsetThis payment offsets a portion of employer normal cost contribution rate for employees with premium subsidy healthcare benefit.

- Sec. 27l(4) — all reporting units except universities.

Note: the 27l(4) payments for community colleges and libraries were inadvertently labeled as "27l(2) Emp Healthcare Reimbursement" on the state aid payments. Use the 27l payment received as referenced in this section.