The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Appendix B: Previous Versions of Revised Reporting Information

-

B.00 The purpose of Appendix B

Sections of the Reporting Instruction Manual (RIM) are periodically revised or updated to reflect changes in retirement law, changes in ORS' system of processing reports and records, or other factors. When a section has been revised substantively, the previous version will be moved to Appendix B as a historical record. Each section in this appendix has a RIM section’s previous version. Each section begins by showing the date when it (or part of it) was replaced by a later version, along with a link to the current version.B.01 The Archived Reporting Instruction ManualAs a historical record of the Reporting Instruction Manual that was published and in effect until March 18, 2022, you may review these PDF files:

Archived Reporting Instruction Manual

- Chapter 1: Introduction

- Chapter 2: Websites

- Chapter 3: Who Do I Report? Definition of a Member

- Chapter 4: Reportable and Nonreportable Compensation

- Chapter 5: Reporting Hours for Service Credit

- Chapter 6: Member Benefit Plans and Contributions

- Chapter 7: Payroll Reporting

- Chapter 8: Employer Payment and Statements

- Chapter 9: Retirees Who Return to Work

- Chapter 10: Tax-Deferred Payment Plan

- Chapter 11: Final Payroll Details

- Chapter 12: Managing Web User Accounts

- Chapter 13: Codes & Definitions

- Chapter 14: File Transfer Service (FTS)

- Chapter 15: Programming

Note that the differences between this archived version and the version published on the Employer Information page are matters of formatting and organization, not changes in content (reporting rules or procedures).

In later sections of Appendix B, the previous version reflects a change in content or a substantive reorganization of material.

-

B.02: Previous version of 3.02: Special membership circumstances – weekly workers' compensation

The following subsection of section 3.02: Special membership circumstances was updated on 04/13/2020. The previous version is below.

Weekly workers' compensation

Weekly workers' compensation (WWC) while absent from work is recognized as the same as sick leave pay. Members receiving WWC maintain their membership unless the employer-employee relationship is terminated. Do not report WWC for retirees.

WWC is subject to employer contributions and member contributions for wages reported on a Detail 2 (DTL2) record. WWC wage totals should not be considered part of the gross wage total when calculating member and employer contribution withholding for the Defined Contribution portion of a member benefit plan or for the Personal Healthcare Fund. No part of WWC wages should be entered in the Employer Reporting Wages field on a DTL4 record.

If employees are on WWC and also being paid for working a temporary job, the wages and hours earned for work performed while receiving WWC are reportable compensation. The wages and hours earned working a temporary job would be reported using the employment class code in the job they are performing. See section 7.03.05 Reporting other compensation for a member receiving weekly workers' compensation.

For more information on workers' compensation, see Weekly workers' compensation in section 4.02: Reportable compensation and section 7.03.04: Reporting workers' compensation on a DTL2 record.

This version was in effect from 03/20/2019 through 04/12/2022.

-

B.03: Previous version of 4.02 Reportable compensation – weekly workers’ compensation

The following subsection of section 4.02: Reportable compensation was updated on 04/13/2020. The previous version is below.

Weekly workers' compensation

Weekly workers' compensation (WWC) is considered the same as sick leave pay when absent from work and is reportable compensation unless or until the employer-employee relationship has been terminated.

- Report hours that would have normally been worked by the employee if he or she was not receiving WWC.

- WWC should not be included on a DTL4 record.

- Sick leave pay and payments to bridge the differential between WWC and full wages, if tied directly to a WWC claim, are reportable compensation. ORS may request documentation showing the connection between the payment and a specific WWC claim.

- All WWC reported on a DTL2 record on or after July 1, 2010, regardless of the date it was earned, are subject to employer and member contributions.

- Occasionally, a reporting unit will have employees receiving WWC who also work at temporary jobs. Wages and hours earned for actual work performed while receiving WWC are reportable compensation.

For more information, see Weekly workers' compensation in section 3.02: Special membership circumstances; section 5.08: Employees receiving workers' compensation or section 7.03.04: Reporting workers' compensation on a DTL2 record.

This version was in effect from 03/20/2019 through 04/12/2022.

-

B.04: Revision to 5.08 Employees receiving workers' compensation

The following subsection of section 5.08: Employees receiving workers' compensation was updated on 04/13/2020. The previous version is below.

Weekly workers' compensation (WWC) payments made to your employees while absent from work are considered the same as sick leave pay while absent from work as long as the employer/employee relationship has not terminated. All workers' compensation wages reported on a DTL2 record on or after July 1, 2010, regardless of the date the wages were earned, are subject to employer and member contributions and retiree healthcare for the Defined Benefit portion of a member's benefit plan.

No part of WWC wages is subject to DC contributions for a Defined Contribution, Pension Plus, Pension Plus 2, or Personal Healthcare Fund participant.

You must report hours that would otherwise have been regularly worked by the employee. Since your employees are not penalized with a loss of retirement service credit while receiving workers' compensation, you should not reduce the hours reported.Reportable hours = regular hours that would have been worked by the employee

Category Full Time Part Time Employees paid workers' compensation Hours that would have been regularly worked Hours that would have been regularly worked

For example: An employee is receiving workers' compensation. That employee normally would have worked 80 hours per pay period. Continue to report 80 hours per pay period with the reported workers' compensation wages.

If you have a substitute employee receiving workers' compensation and are unable to determine the number of hours to report, contact Employer Reporting at 800-381-5111 for assistance.

For more information, see Weekly workers' compensation in section 3.02: Special membership circumstances and/or 7.03.04: Reporting workers' compensation on a DTL2 record.

This version was in effect from 03/20/2019 through 04/12/2022. -

B.05: Previous version of 8.01: What needs to be remitted

Section 8.01: What needs to be remitted was updated on 04/13/2020. The previous version is below.

All reporting units are required to remit to ORS the following withholdings:

- The correct employee defined benefit (DB) contributions from the reportable compensation of all Basic 4%, MIP, Pension Plus, and Pension Plus 2 members.

- Tax-Deferred Payments (TDP).

- The correct employee retirement healthcare fund contributions for members with the premium subsidy benefit.

- The correct employer contributions for both pension and healthcare.

- Employee DB contributions for workers' compensation payments, whether the reporting unit is self-insured or has a third-party insurer. Workers' compensation wage totals should be included in reportable compensation (DB) totals for all Basic 4%, MIP, Pension Plus, and Pension Plus 2 members.

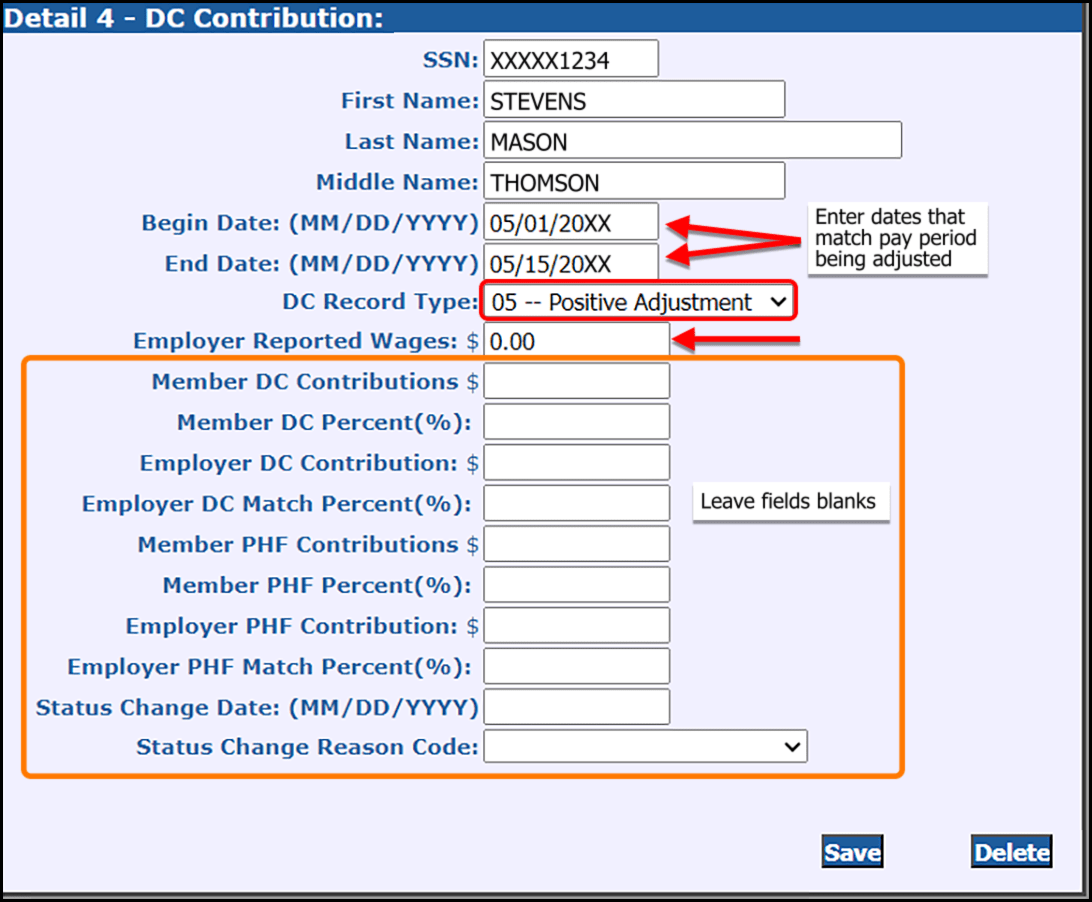

- The correct employer and employee DC contributions from the gross wages of all Pension Plus, Pension Plus 2, Defined Contribution (DC), and Personal Healthcare Fund (PHF) participants. Note: Do not include weekly workers' compensation (WWC), short-term disability (STD), and long-term disability (LTD) wages as part of the gross wage total on a Detail 4 (DTL4) record when calculating member and employer contributions for Pension Plus, Pension Plus 2, DC, and PHF participants. No part of WWC, STD, or LTD wages should be entered in the Employer Reported Wages field on a DTL4 record.

- Employer and employee contributions for retirees, if applicable.

- Additional university payments (non-member/non-ORP contributions).

This version was in effect from 03/20/2019 through 04/12/2022.

-

B.06 Previous version of 4.03 Nonreportable compensation – bonus payments

The following subsection of section 4.03: Nonreportable compensation was updated on 04/13/2020. The previous version is below.

Bonus payments

Bonus payments are payments to employees that are not guaranteed for payment, not associated with additional duties or merit-based activities, or not defined in the contract or union agreement. A payment is considered a bonus if it meets this definition of a bonus, whether or not your reporting unit describes it as a bonus payment.

Bonus payments are nonreportable compensation. Examples of nonreportable bonus payments include but are not limited to: signing bonuses, termination incentive payments, revenue-sharing payments, and payments not documented in advance in the contract for surplus of funds or increased student enrollment. Please contact ORS if you have any questions about the reportability of a payment.

This version was in effect from 03/20/2019 through 04/12/2022.

-

B.07: Previous versions of the Working after retirement – employer guides

The Working after retirement employer guides on the Reporting Retirees page were consolidated into one guide and updated on July 25, 2022. By answering a series of questions, the guide below will give you the reporting instructions prior to July 25, 2022.

These guides should only be used when instructed by ORS for the purpose of making adjustments as a result of an audit finding.

The previous versions of the Working after retirement - employer guides are below.

Please view the Working after retirement - employer guide using the current browser version of Firefox, Google Chrome, Microsoft Edge, and Safari. If you are using an out-of-date browser or Internet Explorer, you may not experience the full effect when viewing the sites.

Select from your reporting unit type:

- K-12 public school districts, charter schools, public school academies, and intermediate school districts.

- Public libraries, museums, and tax-supported community colleges.

- Universities: Central, Eastern, Northern, and Western Michigan, Ferris State, Lake Superior State, and Michigan Technological universities.

-

B.08: Previous version of 1.02.01 Targeted audits and reviews

Section 1.02.01 Targeted audits and reviews was updated on 07/29/2022. The previous version is below.

Public Act 300 of 1980 establishes that ORS is responsible for the administration of the Michigan Public School Employees' Retirement plan and provides the statutory authority for targeted audits and reviews of any reporting unit to ensure proper reporting to ORS.

As part of ORS' ongoing commitment to providing its members with the most fiscally sound and accurate retirement system possible, we may select your reporting unit for an audit as part of the routine audit cycle. We review documentation supporting the member information reported to the system relative to the applicable audit period.

A targeted audit focuses on reporting unit records related to wage, service, and contribution reporting. The list below shows audits and reviews ORS performs routinely.

Audit or Review Name

Description

Payroll Audit

Audit to ensure reporting units are submitting complete wage, service, contribution, and census data on defined members of the retirement system.

Weekly Workers' Compensation (WWC) Audit

Full review of reported wages and hours under the 8000 Class code for Workers' Compensation. Reporting units are required to report WWC.

MPSERS Under 19

Review of all students under the age of 19 to ensure they are being reported correctly.

Independent Contractor

Review of all employees to ensure they are being reported correctly. This audit includes independent contractors and those hired through a third party.

Professional Services Leave (PSL) Audit

Audit to ensure reporting units are reporting PSL time appropriately in compliance with PA 300 of 1980.

Annual Wage Review: Administrators

Annual review of wage increases for members reported using the 1110, 1120, 1130 class codes for compliance with the Normal Salary Increase (NSI).

Annual Wage Review: Non-Administrators

Annual review of wage increases for non-administrative positions for compliance with the Normal Salary Increase (NSI).

Reporting Authorization Certification and Administrator Audit

Annual review of access to the Employer Reporting website as well as appropriate contacts updated with ORS. ORS verifies that each reporting unit is reporting a superintendent or assistant superintendent, and for superintendent who are retirees, ensure that they are being reported correctly.

Inactive Charter Affidavit Review

Review to ensure all Michigan charter schools/public school academies (PSAs) registered with the Michigan Department of Education are reporting appropriately to ORS. Charters/PSAs go in and out of reporting status based on employment of members.

Administrator Contract Review

Complete review of a member's employment contracts and wage detail, to identify reportable compensation and additional fringe benefits, as appropriate for reporting towards their retirement account.

Settlements Review

Review of settlement agreements to identify reportable compensation.

Core Service Determinations

Review of a position description to determine if a job meets the core service criteria for retirees returning to work.

Compensation Determinations

Review of requested documentation to identify reportable compensation.

Other audits and reviews may be conducted as needed to ensure that the retirement system is fulfilling its responsibilities.

Last updated: 03/12/2012

-

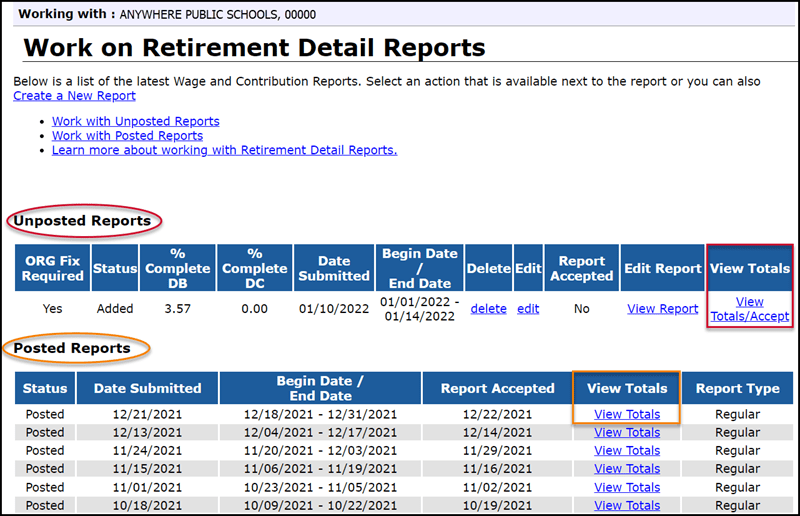

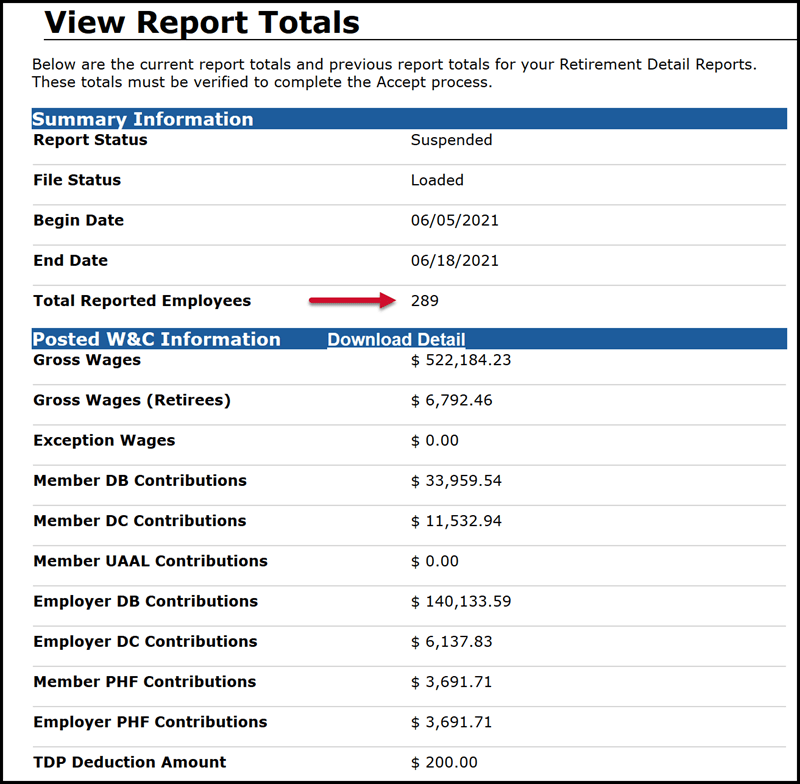

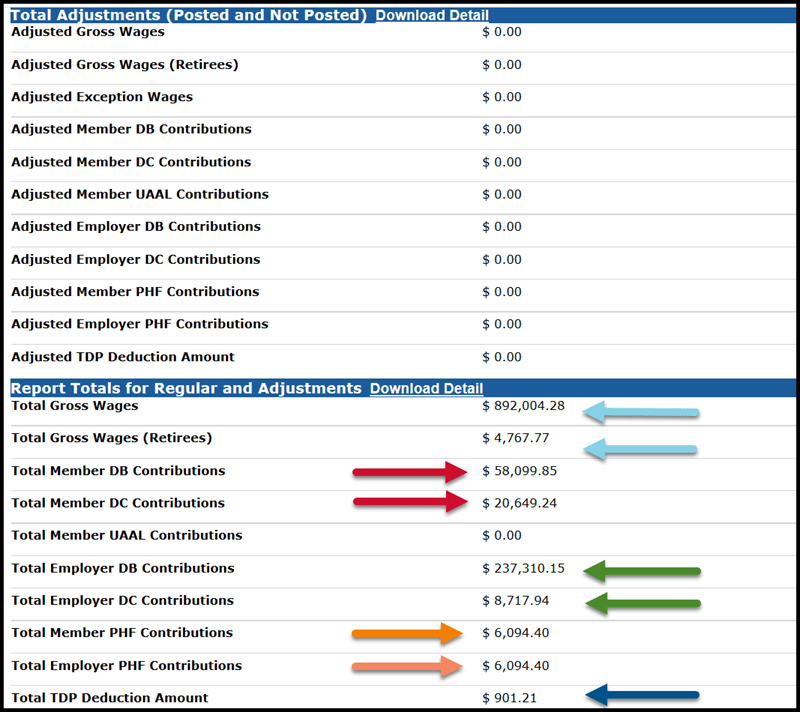

B.09: Previous version of 1.05: Retirement detail reports and records

Section 1.05: Retirement detail reports and records was updated on 07/29/2022. The previous version is below.

Each reporting unit must submit a retirement detail report to ORS each pay period that includes payroll data from your reporting unit. You may use a vender to create your reports that you will upload to ORS, or you may be able to copy forward a new report from the previously posted report or create a blank report in which you will enter data manually. See section 7.01.03: Populating and submitting reports for instructions on these three ways to create and submit your report.

Each report is made up of the following four types of records:

Detail 1 (DTL1) - Member Demographics

ORS depends on your reporting unit for accurate and complete demographic information for your active employees. This includes social security number, name, address, date of birth, and gender.Detail 2 (DTL2) - Wage and Service

All active employees and most retirees who return to work will have one or more DTL2 records for each pay cycle report. It will show all reportable compensation, service (hours worked) and the related member and/or employer contributions due based on the reportable compensation. For those with the Defined Contribution plan and some retirees, employers make contributions on a DTL2 record although no member contributions are due. For reporting procedures for DTL2 records, see also the following sections:- 7.02.03 Reporting tax-deferred payment (TDP) deductions on a Detail 3 (DTL3) record

- 7.03.00: Detail 2 (DTL2) records - common error messages

- 7.03.01: Multiple DTL2 records for different employment class codes

- 7.03.02: Reporting coaches wages on a DTL2 record

- 7.03.03: Reporting summer spread wages on a DTL2 record

- 7.03.04: Reporting workers' compensation on a DTL2 record

- 7.03.05 Reporting other compensation for a member receiving weekly workers' compensation

- 7.03.06: Reporting professional services leave/professional services released time on a DTL2 record

- 7.03.07: Reporting wages without hours on a DTL2 record

- 7.03.08: Reporting retiree wages and hours on a DTL2 record

- 7.03.09: Reporting final wages for a deceased employee

Detail 3 (DTL3) - TDP Deductions

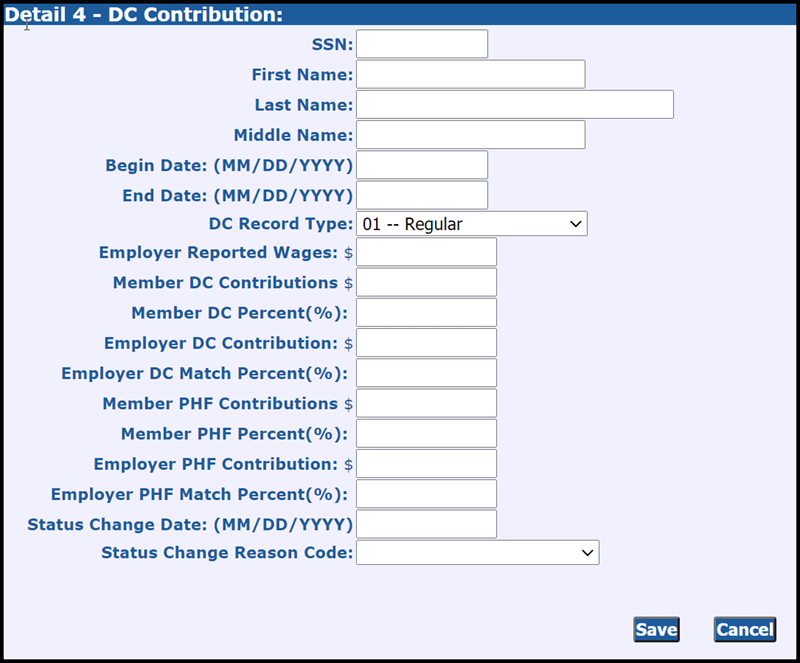

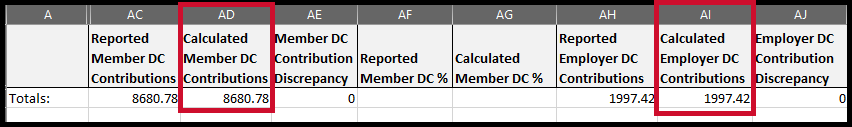

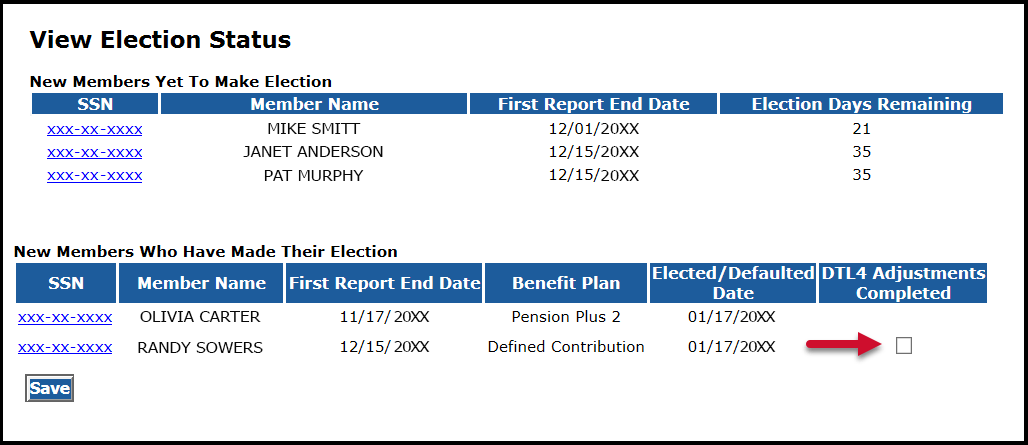

DTL3 records report tax-deferred payment (TDP) deductions for employees who have active or open TDP agreements with your reporting unit. TDP agreements were frequently used for the purchase of service credit. Instructions for managing TDP agreements are found in Chapter 10. For reporting procedures for DTL3 records, see also section 7.02.03 Reporting tax-deferred payment deductions on a Detail 3 (DTL3) record.Detail 4 (DTL4) - Defined Contribution and Personal Healthcare Fund information

DTL4 records report an employee's gross wages; the DC contributions for employees in the Defined Contribution Plan, Pension Plus, Pension Plus 2, or the Personal Healthcare Fund; and the deferred compensation for Basic/MIP members with Premium Subsidy who elect to participate in the State of Michigan 457 Plan. Gross wages are defined differently than reportable compensation. In 2022, DTL4 records will be required for all MPSERS members. This detail record is also used to report a change in employment status such as termination and termination date.When ORS receives the data in these detail records, the system runs it through a batch process of edits and validations to make sure the information is being reported in the correct format, and then posts the valid information to the member accounts. The reporting unit is responsible for working on each report until all records are valid and posted.

Last updated: 03/18/2022

-

B.10: Previous version of 1.07: How reporting units are activated and inactivated

Section 1.07: How reporting units are activated and inactivated was updated on 08/03/2022. The previous version is below.

All schools that receive public funding, including public school academies or charter schools, are considered reporting units, even if they have no employees who must be reported. Schools that have no employees who must be reported are considered inactive but could be changed to active status if they hire employees who must be reported.

Once ORS has received the necessary forms from a newly created institution, we assign it a five-digit employer number also known as a reporting unit number or RU number. We use it for identification and tracking purposes; you will see it or may be asked for it in correspondence and on many online reporting screens. See the New Reporting Units link on the top navigation bar for the required forms.

Employees hired directly by a charter school/public school academy are Michigan Public School Employee Retirement System (MPSERS) members and must be reported to the Office of Retirement Services (ORS). In addition, MPSERS retirees hired through a third party company or as an independent contractor must be reported in certain situations.

Newly opened charter schools/public school academies become reporting units and are assigned a reporting unit number. If the school has no employees who must be reported to ORS, the chief administrator for the school must sign an Affidavit of Non-Reporting Status each fiscal year. If a signed affidavit is on file, the school is considered an inactive reporting unit. If a charter school's status changes so that it must report an employee, ORS changes the reporting unit's status to active.

From time to time reporting units may consolidate, annex, close, or reopen under the direction of the Michigan Department of Education (MDE). In these situations, ORS will need written notice from the affected reporting unit(s) along with notification from MDE and a copy of the reporting unit(s) board minutes concerning the action.

To begin the process, complete the Reporting Unit Status Change: Closing, Inactive, or Annexing (R1048C) form (also found under the Reporting Forms section of the Employer Information website).

Last updated: 05/23/2013 -

B.11: Previous version of 3.02: Special membership circumstances

Section 3.02: Special membership circumstances was updated on 08/03/2022. The previous version is below.

You may have questions when it comes to reporting employees with special membership circumstances, such as the following employees and situations. Review this section to understand whether or not an employee is considered a member in these circumstances.

Athletic officials, referees, and umpires

Community college employees who elect an optional retirement plan (ORP)

Election workers

Fulbright Teacher Exchange program

Independent contractors and third-party workers

Library employees

Professional services leave or professional services released time

Public school academy/charter school employees

Retirees receiving a pension from MPSERS

Sabbatical leave

Student employees

Temporary layoff

Weekly workers' compensationAthletic officials, referees, and umpires

Employees working in the capacity of an athletic official, referee, or umpire may or may not be reported, depending on their relationship with the reporting unit. An employee directly employed by the reporting unit serving in an athletic role or as a referee is considered a member of this retirement system and the wages should be reported using Employment Class Code 1560 - Coaches - Recreational. Anyone not directly employed and paid by the reporting unit serving in the role of an athletic official, referee, or umpire and classified as an independent contractor is not a member and should not be reported. See Independent contractors in section 3.03: Who is not a member for rules and requirements.

Note: Employees who are issued a Form 1099 for wages in an athletic role may still be MPSERS members and should be reported. The fact that Form 1099 is issued is not enough to exclude that employee from reporting requirements per the retirement act.

Last updated: 08/31/2016

Community college employees who elect an optional retirement plan (ORP)

Tax-supported community colleges offer an Optional Retirement Plan (ORP) to all full-time faculty and full-time administrative staff performing professional services. Eligible newly hired employees or newly eligible current employees of these reporting units must decide within the first 90 days of employment or eligibility whether to remain a member of MPSERS or to elect the ORP. Once employees elect to participate in the ORP, the choice is irrevocable as long as they work at that reporting unit.

To offer an existing ORP to eligible new hires or current employees who are now eligible to participate:

- You must offer the employees a 90-day window from their date of hire or from their date of eligibility to elect an ORP. If the employee does not elect ORP within 90 days, the employee remains a member of this retirement system.

- You must report wages to ORS up to the date of election in ORP. Once an election is made, it will be retroactive to the date of eligibility.

- If you reported wages for an employee who has elected ORP after the eligibility date, you must submit adjustments to those pay periods on your next retirement detail report. All employer and member contributions received by ORS retroactive to the eligibility date will be credited to your reporting unit account.

All eligible employees choosing to participate in your ORP may request a refund of their personal contributions and accumulated interest on deposit with the retirement system for the time before the ORP eligibility date. The ORP election must be noted in the Completion by Employer portion of the refund application since the standard justification for a refund request (termination) does not apply.

Note: Universities and community colleges may offer an ORP to retirees of this retirement system. If the retiree chooses to participate in the ORP, the reporting unit is still required to report the retiree wages and hours as stated in this section.

Last updated: 04/09/2012

Election workers

If a person is not a retiree of this retirement system and is working for your reporting unit for the sole purpose of an election, the person is not considered a member and wages and hours are not reportable per PA 150 of 2000.

If a person is already a member of this retirement system, is currently working for your reporting unit, and is assisting with the election, then the election wages and hours are reportable.

If a person is a retiree of this retirement system and is working for your reporting unit in another position, and is assisting with the election, or if he or she is only working for your reporting unit for the election, the wages and hours are reportable.

A retiree is subject to the earnings limits when employed by a reporting unit in an election capacity.

Last updated: 11/02/2020

Fulbright Teacher Exchange program

The Fulbright Teacher Exchange program gives teachers the opportunity to teach in a foreign country while continuing employment with a Michigan public school. Usually, the member teaches in the foreign country for one year and continues to be paid by the reporting unit in exchange for a teacher from the foreign country. The teacher from the foreign country teaches in the same reporting unit and is paid by his or her representative school.

Service performed under this exchange program is reportable if the following criteria are met:

- The employee/employer relationship continues to exist between the reporting unit and the teacher.

- The service performed by the teacher is performed for the reporting unit, just in a different location.

- The reporting unit continues to pay the teacher regular wages for the services performed.

Last updated: 03/13/2012

Independent contractors and third-party workers

An independent contractor is a worker who is self-employed, offers services to the general public, works for a number of people, and sets their own fees or wages. Independent contractors are not employees of your reporting unit and thus are not members of this retirement system. Sometimes it may be unclear whether a worker is an independent contractor or an employee of your reporting unit, but it is important to determine whether to report the worker for retirement purposes.

Employees hired by a third party are not employees of your reporting unit and thus are not members of this retirement system. Do not report third-party employees for retirement purposes unless they are a MPSERS retiree.

If an independent contractor or third-party employee is a MPSERS retiree, they must be reported in some circumstances. See 9: Retirees Who Return to Work. It is the reporting unit's responsibility to know whether or not third-party employees and independent contractors are MPSERS retirees.

Reporting units should use the economic realities test to determine whether an individual is an employee or an independent contractor. The economic realities test includes four (or more) factors, including: (1) control of a worker's duties, (2) payment of wages, (3) right to hire, fire, and discipline, and (4) performance of the duties as an integral part of the employer's business toward the accomplishment of a common goal. All factors are viewed cumulatively, however, and no single factor conclusively establishes the existence or absence of an employer-employee relationship.

Use this comparison guide to help distinguish whether a worker is an employee of a reporting unit or is an independent contractor.

Employee or independent contractor?

Employee

Independent contractor

Works prescribed hours

Works self-determined hours

Does not offer skills or services to the public at large

Offers services to public or to other reporting units under self-determined terms and conditions

Reporting unit furnishes tools and equipment

Furnishes own tools and equipment

Expenses reimbursed

Expenses not reimbursed

Paid a salary or hourly wage

Paid on a per-job basis

Reporting unit provides fringe benefits such as sick days, unemployment insurance, hospitalization insurance, group insurance, paid vacation, etc.

Does not participate in fringe benefits extended to regular employees of the reporting unit

Reporting unit carries liability insurance for employee

Carries own liability insurance

Reporting unit furnishes assistants and determines when and how many are needed

Hires own assistants; determines their compensation, pays their wages from personal resources

Fills a position budgeted by reporting unit as part of ongoing business

Does not fill a position budgeted by reporting unit as part of ongoing business

Cannot realize a profit or loss

Realizes a profit or loss

Reporting unit withholds state and federal taxes

Is responsible for paying their own income taxes and self-employment taxes

The burden of proof to establish the existence of an independent contractor relationship (or a bona fide third-party employment relationship) falls on your reporting unit. The mere existence of a contract that specifies the terms and conditions under which a person is being employed does not necessarily establish that the person is a self-employed, independent contractor or, in cases where the individual is otherwise employed through a third party, whether they are a third-party employee.

The distinction between employees and self-employed independent contractors has become increasingly significant over time because of the different way these workers are treated under certain laws, particularly the Michigan Public School Employees Retirement Act and the Internal Revenue Code. Whether or not a worker is an employee or an independent contractor affects your reporting unit's employer contributions as well as the member's right to retirement benefits.

Note: As it pertains to non-retirees who are engaged to perform reporting unit service as an employee of a third-party, MPSERS reserves the right to determine whether the employment (or dual employment, as applicable) constitutes reportable service in view of the totality of the circumstances using the economic reality test.

These are general guidelines intended to help your reporting unit reach a conclusion and are not intended to force a specific conclusion. The burden of proof to establish the existence of an independent contractual relationship falls on your reporting unit.

Last updated: 11/16/2021

Library employees

Employees of a library that has separated from the local school district continue their membership in this retirement system and are reported on your retirement detail report only if one or both of the following conditions are met:

- The district library adopts a resolution to become a reporting unit of this retirement system and agrees to remit to ORS the amount due for all employer and member contributions. The employee was performing library service at the time of the separation.

- The employee performed service for a library before the separation occurred and was rehired at the same library.

The employment class code depends on the position of the individual member.

An employee of a library that separated from a local school district who did not perform services for that same library before the separation occurred is excluded from membership in this retirement system.

Last updated: 03/08/2012

Professional services leave or professional services released time

Professional services leave

Professional services leave (PSL) refers to the wages and hours to be reported for a public school employee who leaves their normally assigned duties to work in a position for an employee organization or union on a part-time or full-time basis. The public school employee has a contract renewed annually with the employee organization/union for their role.Examples:

- A public school teacher who works part time within the district but also holds a position as union board secretary receiving a contracted compensation by the employee organization or union for their position.

- A public school employee who leaves normally assigned duties within the school district to work full time for an employee organization or local union. Their compensation is funded by the employee organization or union.

Last updated: 07/06/2016

Professional services released time

Professional services released time (PSRT) refers to the wages and service to be reported for a public school employee who is released from their normally assigned duties to handle employment matters for an employee organization or union.Example:

- A district secretary leaves their normally assigned duties two hours a day to address employment matters such as employment grievances or contract negotiation issues. The union compensates the school district and/or member for their time addressing these matters. The compensation received from the employee organization group/union for the two hours a day is reportable as PSRT.

Employees on PSL or PSRT are still members of MPSERS and must be reported. It is the reporting unit's obligation to collect employer contributions from the employee organization group or unions which are paid to the retirement system for members performing PSL or PSRT. The retirement act (MCL 38.1371(6)) states: "The reporting unit shall be reimbursed those sums paid to the retirement board pursuant to subsection (5) by the member or the public school organization on a current basis."

Employer contributions are the total percentage of reportable compensation charged to all MPSERS reporting units. Contributions are the sum of Pension Normal Cost, Pension UAAL, Early Retirement Incentive Program, Health Normal Cost, Health UAAL, MPSERS UAAL Rate Stabilization and (in 2014) the One-Time MPSERS Liability Prepayment.

See section 7.03.06: Reporting professional services leave/professional services released time on a DTL2 record for more information.

Last updated: 07/06/2016

Public school academy/charter school employees

The eligibility requirements for a public school academy (PSA) or charter to become a reporting unit of this retirement system are:

- All reporting unit academies are covered by this retirement plan except a reporting unit academy where the employees are employees of Grand Valley State University, Michigan State University, Oakland University, Saginaw Valley University, University of Michigan, or Wayne State University.

- Personnel hired directly by the academy/school are retirement system members.

- Personnel contracted through an outside company, rather than hired by the academy/school, are not eligible to participate in this retirement plan.

Other than the specific exception noted in the first bullet above, all public school academies and charter schools are reporting units of this retirement system. Active employees should only be reported to ORS if they are hired by the PSA/charter school directly, and not indirectly through a third party or as an independent contractor. If the PSA/charter school hires a MPSERS retiree, either directly or indirectly, please review the 9: Retirees Who Return to Work to determine how to report them.

Last updated: 03/16/2012

Retirees receiving a pension from MPSERS

A person who is retired and is receiving a pension from MPSERS is excluded from active membership. A MPSERS retiree must be separated from all reporting unit employment, including volunteer service, for at least one calendar month following the retirement effective date before being eligible to work in a Michigan public school.

A person receiving a pension from another retirement system administered by the state of Michigan is not recognized as a MPSERS retiree and must be reported as an active MPSERS employee.

Although retirees receiving a MPSERS pension are not considered active members, you must still report their wages and hours in most cases. See 9: Retirees Who Return to Work and section 13.02.01: Detail 2 records - employment class codes and definitions for more information.

Last updated: 05/29/2015

Sabbatical leave

Members on sabbatical leave maintain their membership status during their leave (as long as they have accrued service credit in the past two years), but they do not receive retirement service credit. Do not report sabbatical wages and hours on the retirement detail report for any member while on sabbatical leave. Do not submit any wages or hours until the member returns to work. See also Extended leave of absence (more than two years) in section 3.03: Who is not a member.

Last updated: 08/25/2015

Student employees

Students not employed by a community college

If you have a student employee (not employed by a community college) who is 19 years old or older and is not enrolled in classes as a full-time student at your reporting unit, he or she is a MPSERS member.

- Report a student 19 years old or older who is working for your reporting unit at any time of the year if the person is enrolled full time as a student in a different reporting unit.

- Report a student 19 years old or older who is working for your reporting unit during the summer (unless the student is enrolled in and attending summer school full time).

- Report an employee under age 19 if working in a permanent position and not a student.

PA 123 of 1998 excludes from membership anyone under age 19 employed by your reporting unit "in a temporary, intermittent or irregular seasonal or athletic position," whether a student or not.

A person employed by your reporting unit while also enrolled in and attending classes as a full-time student in your reporting unit is not a member of this retirement system, regardless of age. "Enrolled and attending" is defined as effective the first day a student begins classes full time within your reporting unit.

Students employed by a community college

Employees who are full-time students should not be reported to ORS. Effective July 2, 2018, do not report employees who are part-time students and whose first day worked with any community college was July 2, 2018, or after. For employees who are part-time students whose first day worked with any community college was prior to July 2, 2018, follow these steps:

- Check the member benefit plan link. See section 7.06.01: Determining a member's benefit plan.

- If there is No Record on File, do not report.

- If there is an existing benefit plan on file, and you're not sure if the previous student opted in or opted out of membership, please contact ORS.

Last updated: 07/26/2018

Temporary layoff

Members terminated by temporary layoff retain membership status for a period of one year following the layoff date. Do not submit any wages or hours on DTL2 records until the member returns to work.

However, if a member who is temporarily laid off has a Tax-Deferred Payment (TDP) Agreement, continue to submit Detail 3 - TDP Deductions (DLT3) records for the member, using a TDP Deduction Amount of $0 and Deduction Reason Code 8 (No Deduction - Temporary Layoff), until the member returns to work. For more information see section 7.02.03 Reporting tax-deferred payment (TDP) deductions on a Detail 3 (DTL3) record or section 13.03: Detail 3 records - TDP adjustment record type codes and deduction reason codes.

Last updated: 03/07/2012

Weekly workers' compensation

Weekly workers' compensation (WWC) while absent from work is recognized as the same as sick leave pay. Members receiving WWC maintain their membership unless the employer-employee relationship is terminated. Do not report WWC for retirees.

WWC is subject to employer contributions and member contributions for wages reported on a Detail 2 (DTL2) record. If the employee requires a DTL4 record and your reporting unit uses a third-party insurance provider to pay WWC, do not include workers' compensation in the wage total for the Employer Reported Wages field on a DTL4 record. If your reporting unit is self-insured for workers' compensation, include WWC wage totals in the Employer Reported Wages field on a DTL4 record.

If employees are on WWC and also being paid for working a temporary job, the wages and hours earned for work performed while receiving WWC are reportable compensation. The wages and hours earned working a temporary job would be reported using the employment class code in the job they are performing. See section 7.03.05 Reporting other compensation for a member receiving weekly workers' compensation.

For more information on workers' compensation, see Weekly workers' compensation in section 4.02: Reportable compensation and section 7.03.04: Reporting workers' compensation on a DTL2 record.

Last updated: 04/13/2022

-

B.12: Previous version of 3.03: Who is not a member

Section 3.03 Who is not a member was updated on 08/03/2022. The previous version is below.

Some types of reporting unit employees are specifically excluded from membership and reporting in this retirement system.

Employees excluded under certain acts or programs

Extended leave of absence (more than two years)

New employees of certain universities

Optional retirement plan (ORP) employees at universities or community colleges

Reporting unit board members

Transitional youth or youth training program enrolleesEmployees excluded under certain acts or programs

A person employed by your reporting unit under one of the following programs is excluded from membership in this retirement system if the program exists as a result of any of the following acts or programs:

- Michigan Youth Corps Act (1983 PA 69).

- Workforce Investment Act of 1998 (U.S. Public Law 105-220, 112 Stat. 936).

- Michigan Community Service Corps program (1983 PA 259).

- Senior Community Service Employment program (U.S. Public Law 89-73).

- Michigan's PATH program.

Exception: If a person was regularly employed by a reporting unit prior to participation in these programs, the person is a member and must be reported. Regular employment is defined as:

- Continuous employment rendered.

- With one reporting unit.

- In a permanent position.

- For which retirement service credit was earned.

This regular employment could have occurred at any time in the past.

Last updated: 03/13/2012

Extended leave of absence (more than two years)

An employee on an approved leave of absence is considered an active member until two years have passed without service credit (hours) being earned. Once an employee on leave has passed that threshold, ORS considers the employee to be terminated for the purposes of retirement benefits and treats the employee as a deferred member (if vested in the retirement system) or an inactive member (if not vested).

This is in accordance with the retirement act as amended in 2012, which states: "a public school employee includes a public school employee on an approved leave of absence that does not exceed 2 years from the date the employee ceases to accumulate service credit" (MCL 38.1306(6)).

Your reporting unit may continue to consider this employee as on a leave, and there is still an employer-employee relationship, but ORS considers them to be terminated for retirement benefit purposes. ORS rules regarding terminated, deferred, or inactive members apply to this employee as well.

Notes:

- Members receiving workers' compensation are not considered to be on an extended leave of absence. For more information see Weekly workers' compensation in section 3.02: Special membership circumstances or sections 7.03.04: Reporting workers' compensation on a DTL2 record and 7.03.05 Reporting other compensation for a member receiving weekly workers' compensation

- Members on professional services leave are not considered to be on an extended leave of absence. Professional services leave is renewed each year. For more information see Professional Services Leave or Professional Services Released Time in section 3.02: Special membership circumstances of this chapter or section 7.03.06: Reporting professional services leave/professional services released time on a DTL2 record.

Last updated: 07/06/2016

New employees of certain universities

Newly hired employees of the seven universities listed below are excluded from membership in this retirement system unless they earned service as a member of this retirement system for one of these universities before Jan. 1, 1996.The universities are:

- Central Michigan University.

- Eastern Michigan University.

- Ferris State University.

- Lake Superior State University.

- Michigan Technological University.

- Northern Michigan University.

- Western Michigan University.

Members hired by these universities between Jan. 1, 1996, and March 28, 1996, were retirement system members from the date of hire until March 28, 1996, and then became ineligible for membership. If you must report employees in that category and need more information, Contact ORS Employer Reporting.

Last updated: 12/27/2018

Optional retirement plan (ORP) employees at universities or community colleges

Community colleges and universities that participate in MPSERS can offer their employees an optional retirement plan (ORP). Employees of these reporting units who elected the ORP are excluded from membership.

When a retiree from this retirement system earns wages from a participating reporting unit, the retiree is subject to earnings limitations or the loss of pension payments and insurance premium subsidies. This includes retirees who have elected an ORP. Your reporting unit must report retiree wages to ORS; however, the retiree is responsible for tracking wages to make sure that the earnings limit is not exceeded.

For more information see Community college employees who elect an optional retirement plan (ORP) in section 3.02: Special membership circumstances of this chapter.

Last updated: 07/01/2018

Reporting unit board members

A person who is not regularly employed by a reporting unit and who is serving as a reporting unit board member is not a member of this retirement system and must not be reported for retirement purposes.

Last updated: 11/04/2020

Transitional youth or youth training program enrollees

An employee hired through participation in any of the programs below who is not regularly employed, is not a member of the MPSERS system and should not be reported to ORS. If the employee is hired permanently by the reporting unit as a result of the program, they would become a MPSERS member effective the date of their permanent hire.

- A person enrolled in a Neighborhood Youth Corps Program.

- A person participating in a program through Michigan Rehabilitation Services.

- A person hired as part of the Michigan youth corps or Michigan community service corps.

- A person enrolled in a transitional public employment program as defined in the Comprehensive Employment and Training Act of 1973.

Last updated: 06/19/2014

-

B.13: Previous version of 7.03.00: Detail 2 (DTL2) records - common error messages

Section 7.03.00: Detail 2 (DTL2) records - common error messages was updated on 08/03/2022. The previous version is below.

Detail 2 records provide vital information for calculating the pension of a member with a defined benefit plan. Several factors make the accurate reporting of wages and hours complex. Some employees work in different positions, earning different wages in each. In addition, the Retirement Act defines what types of pay are considered compensation when it comes to reporting and making contributions to the pension system, and only reportable compensation should be included on a DTL2 record. Amendments to the Retirement Act have revised benefit plans and structures, how certain types of compensation must be reported, who must be reported, and so on.

Some of the complexities of DTL2 records lead to common errors. The table below lists common error messages and explains how to fix them.

Common DTL2 record error messages

Error Message

– suspended records

How To Fix

S - The member is reported more than once, each of record's class code and wage code are not unique, begin, end dates overlap.

OR

S - The record being reported matches a posted record with the same wage code, class code, begin/end date, which is not allowed. Please review and either update the wage code, class code, and/or record dates or delete the record.

Our system does not allow more than one DTL2 record with the same wage code/class code combination for the same begin and end dates. If you need two DTL2 records to report wages and hours for one member for the same pay period on the same report, select a different class code for the second record. See section7.03.01: Multiple DTL2 records for different employment class codes.

If you have entered multiple records for adjustments, you may not have entered the correct begin and end dates. Check the download detail to see if the begin and end dates are correct. Change the dates on any incorrect DTL2 records.

S - This ORS account is missing at least one of these data elements: First/Last Name, Date of Birth, Address or Gender. If a DTL1 record is on this report with all these elements, no action is required. If no DTL1 record exists, please submit one. The DTL2 record will post after the DTL1 record posts.

The ORS database does not have all the demographics required for this member. We may be missing all of the data or just pieces of the data included on a DTL1 record. ORS depends on your reporting unit for the most current address.

If there is no DTL1 record for this person on your report, add one to update our system. You must complete the entire record, including the country code and zip code (skip the postal code field unless the member lives outside of the USA), date of birth and gender. If any of these data are missing, the record will suspend again.

See section7.02.01: Reporting member demographics data on a Detail 1 (DTL1) record.

S - The pay rate is greater than 100 but the contract begin and end dates are not reported.

When a pay rate is $100.00 or more, the system assumes that the employee is salaried. ORS requires contract begin and end dates on these DTL2 records. Enter contract begin and end dates on the record. If there is no contract, use the begin and end dates of the fiscal year: 7/1/20xx - 6/30/20xx.

S - Suspended for election window.

This record will remain suspended until the member elects or defaults into a benefit plan per statute.

S - The original record corresponding to the adjustment record is not posted.

The original record with the same begin and end date as this adjustment record is unposted and must be posted before this record can post.

S - This adjustment record created net wages of zero for this pay period but did not adjust hours to equal zero. If wages should be zero, hours should also be zero. Enter the number of hours needed on this adjustment record to make the net hours for this pay period equal to zero.

Enter the number of hours displayed on theView Employee Infoscreen originally reported for the pay period being adjusted.

S - Record reported with negative adjustment caused the account balance to go negative.

Wages and/or hours are greater than the original record posted for that pay period, or class code does not match the original record. Use theView Employee Infoscreen to obtain the correct information.

S - Pay rate < 100 and the hourly rate computed by dividing the Employer rpted Wages by hours < rptd Pay Rate; or improper class code, wages or hours were submitted.

Either report an annual pay rate or calculate a new hourly pay rate by dividing wages by hours reported.

For adjustments: If the original record is reported with an hourly pay rate, add the wages and hours of the positive adjustment record to the original record and divide the hours into the wages to calculate a new pay rate.

Or check that the proper class code was used.

S - The Begin and/or End date is between the report's begin and end date and the wage code is 05, 06, 15, 16, 25, 26, 45, 46, 75, 76, 85 or 86

If this an adjustment for a previous pay period, edit the begin and end dates to match the original pay period.

If this record is for the current pay period, change the wage code to 01, 08, 09, 11 for active members or to 07 for retirees.S - The Employer reported Wages are equal to zero and the wage code is not 06, 16, 26, 46, 76 or 86.

Hours cannot be reported without wages unless this is an adjustment to a posted record containing wages. Add wages to the record or, if this is a negative adjustment, correct the wage code.

S - MPSERS member account is missing.

There is no MPSERS account for this SSN. Add a completed DTL1 record that includes name, full address including country code, date of birth, and gender. See section7.06.03: Completing DTL1 records for new employees.

S - Record reported with a Negative adjustment and the amount is greater than the original amount posted for the period, or the employment class code does not match the original class code submitted for this period.

Compare the wages and hours on theView Employee Infoscreen to the information reported on the adjustment record. If these are correct, check whether the begin and end dates and the class code match the original record.

S - ORS does not have a record of this member ever having worked at this reporting unit. Please verify the SSN. If it is accurate, make certain wages have been reported for this member.

A member cannot be reported with wage code 09 or 08 if no record from this reporting unit that contains wages and hours has posted yet.

S - The hours are equal to zero or doesn’t have hours and the employment class code is 9003, 9004, 9005, 9013, 9014, 9015, 9023, 9024, 9025, 9033, 9034, 9035, 9043, 9044 or 9045 and the wage code is 07, 75, 76.

These wage and class codes are for reporting retirees. Retirees must be reported with hours. Add hours to the record. See section7.03.08: Reporting retiree wages and hours on a DTL2 record.

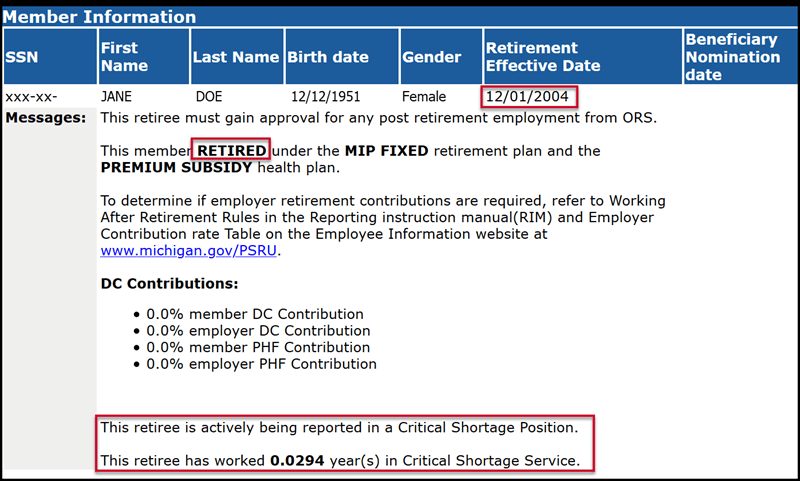

S - Member has reached Critical Shortage Service credit limit.

The member has been reported in a Critical Shortage position and has or will exceed the Critical Shortage limit allowed by law. Check the Member Benefits link to see if any Critical Shortage hours are remaining. See the retiree example in section7.06.01: Determining a member's benefit plan.

S - The reported wage code is 08 and 85 and is used outside of summer month reporting.

Summer spread wages (wage code 08) can only be reported from June to September. Add hours to the record or, if no hours should be reported, change the wage code to 09. See sections7.03.03: Reporting summer spread wages on a DTL2 recordand/or7.03.07: Reporting wages without hours on a DTL2 record.

Error: Payroll Spans more than one service credit year.

The begin and end date on the record must be within the same fiscal year, starting 7/1 ending 6/30.

S - The Class Code is 9003, 9004, 9005 and the record's begin date is not 1 month after the retirement effective date; or the member is active and a retiree class code was used.

Wages for a retiree can only be reported for 30 days after the retirement effective date, unless you are reporting summer spread wages with wage code 08 and 0 hours.

S - The employment class code is 9001 or 9002, but the exception wages are equal to zero.

Enter the amount of exception wages earned in the exception wages field when using employment class code 9001. See section7.03.06: Reporting professional services leave/professional services released time on a DTL2 record.

Class code 9002 is no longer valid.Last updated: 03/18/2022

-

B.14: Previous version of 7.03.08: Reporting retiree wages and hours on a DTL2 record

Section 7.03.08: Reporting retiree wages and hours on a DTL2 record was updated on 08/04/2022. The previous version is below.

Report retirees using a Detail 2 (DTL2) record and a Detail 4 (DTL4) record. There is no difference between retiree DTL4 records and active member DTL4 records.

The laws regarding working after retirement affect employer contributions, potential earnings limits, and other concepts covered in section 9: Retirees Who Return to Work and the Working after retirement - employer guide. The ORS Employer Reporting system uses the employment class code on the DTL2 record to distinguish between retirees in different situations as it affects employer contributions. To ensure accuracy in reporting retirees, ORS offers tools to help you report retirees employed by your reporting unit. For accurate reporting, you must review these tools for each retiree.

- The Member Benefit Plans screen will verify that your new employee is a MPSERS retiree. In addition, the Member Benefit Plans screen gives you a retirement effective date and shows information about critical shortage service credit hours when appropriate. See section 7.06.01: Determining a member's benefit plan. You will need this information when using the Working after retirement - employer guide (see below).

- The Working after retirement - employer guide is a tool that provides the retiree employment class code for reporting, and states whether UAAL is due.

Reporting retirees' hourly wages

For retirees who return to work on an hourly basis, report the hours and gross wages according to your payroll calendar on the pay cycle when it was paid, not earned. See section 9.01: Earnings of retirees who return to work for the rules on reporting retiree earnings. Note that for retirees only, even payments that are considered nonreportable for active members should be included on the DTL2 and DTL4 records as reported wages. In addition, retiree wages must always be reported with hours.Reporting retirees with a contract

Always report according to your payroll calendar, even if your reporting unit arranges a contract with a retiree and chooses to pay that person a predetermined amount for the year. If your reporting unit chooses to pay a retiree over 26 pay periods, report the wages in the actual pay periods they are paid. Always include hours on a retiree's DTL2 record so it does not suspend.For example:

A reporting unit negotiates a contract with a retiree for $13,000 in total compensation for working two hours a day at $25/hour.

- $25/hourly rate.

- 2 hours a day ($50/day rate).

- 10 business days a pay period.

- 26 pay periods.

50 x 10 = 500 x 26 pay periods = $13,000

On your DTL2 record, report 20 hours and $500 gross wages for each pay period throughout the payroll calendar. Do not change the hours or wages for the retiree in a way that is inconsistent with your payroll calendar.

If a retiree works in more than one position, you may combine all wages and hours onto one DTL2 record under one employment class code as long as the class code is valid for the wages being reported. If the positions have different pay rates, use additional DTL2 records using a different, valid retiree class code on each record.

Wage codes

For all retiree DTL2 records, use wage codes 07, 75, or 76.- Use wage code 07 - Retiree Wages to report regular retiree wages and hours.

- Use wage code 75 - Retiree Wages Positive Adjustment for positive adjustments.

- Use wage code 76 - Retiree Wages Negative Adjustments for negative adjustments.

For more information on wage codes, see section 13.02.02: Detail 2 records - wage codes.

Employment class codes and UAAL requirements

To determine the appropriate employment class code and whether unfunded actuarial accrued liability (UAAL) contributions are due, follow the instructions in the Working after retirement - employer guide. For more information on class codes, see section 13.02.01: Detail 2 records - employment class codes and definitions for the full list.Report retiree gross wages, hours, and employer UAAL contributions (if required) on a DTL2 record.

DTL2 record fields for reporting retirees

- Reported Wage Code - Wage codes 07, 75, and 76 are the only wage codes that can be used to report wages with a retiree class code. See section 13.02.01: Detail 2 records - employment class codes and definitions.

- Employer Reported Wages - Enter wages paid. See section 9.01: Earnings of retirees who return to work.

- Employee Contributions - Leave this field blank. Retirees do not make defined benefit employee contributions.

- Employer Contributions - If UAAL is due on this retiree, enter employer contributions here.

- Employment Class Code - Enter the code determined by the Working after retirement - employer guide.

- Contract Begin Date: (MM/DD/YYYY) - Enter only if Pay Rate is equal to or greater than $100.00.

- Contract End Date: (MM/DD/YYYY) - Enter only if Pay Rate is equal to or greater than $100.00.

This version was in effect from 06/03/2022 until 08/04/2022

-

B.15: Previous version of 7.05.08: Adjusting wages or hours on a DTL2 record

Section 7.05.08: Adjusting wages or hours on a DTL2 record was updated on 08/05/2022. The previous version is below.

- On a DTL2 record, enter the begin and end dates of the record you are adjusting (typically a prior pay period). Use the View Employee Info screen to verify the begin and end dates used on the original record. The dates on the adjustment record must match the dates on the original record. If you are adjusting wages or hours for a pay period before Oct. 1, 2002, do not submit an adjustment record. Complete the Request for Adjusting Records Prior to October 1, 2002 (R3489C).

- Populate the Retirement Hours field if needed. Always use a positive number.

- Select the appropriate adjustment wage code from the drop-down box. For a negative adjustment the negative wage code must correspond to the wage code used to post the original wages. Use the View Employee Info link to verify the wage code used on the original wages and see the table in section 13.02.02: Detail 2 records - wage codes for the correct corresponding wage code.

- Populate the Employer Reported Wages field if needed. Always use a positive number.

- You may populate the Employee and Employer contribution fields if you wish. ORS will calculate the amount for both fields when the adjustment record runs through batch processing. The calculated amount can be seen on the Download Detail after batch processing, and the reported column will be blank if you do not fill them in.

- If you are making a positive adjustment record, enter a Pay Rate (required for positive adjustments.)

- Select the appropriate employment class code from the drop-down box. The class code must be identical to the class code used to post the original wages. Use the View Employee Info link to verify the class code used on the original record. If a positive adjustment record is reporting wages/hours not previously reported, a different class code may be used.

- If the pay rate is or was $100.00 or more, you must populate the Contract Begin Date and Contract End Date fields.

- Populate the Frequency of Pay field if needed.

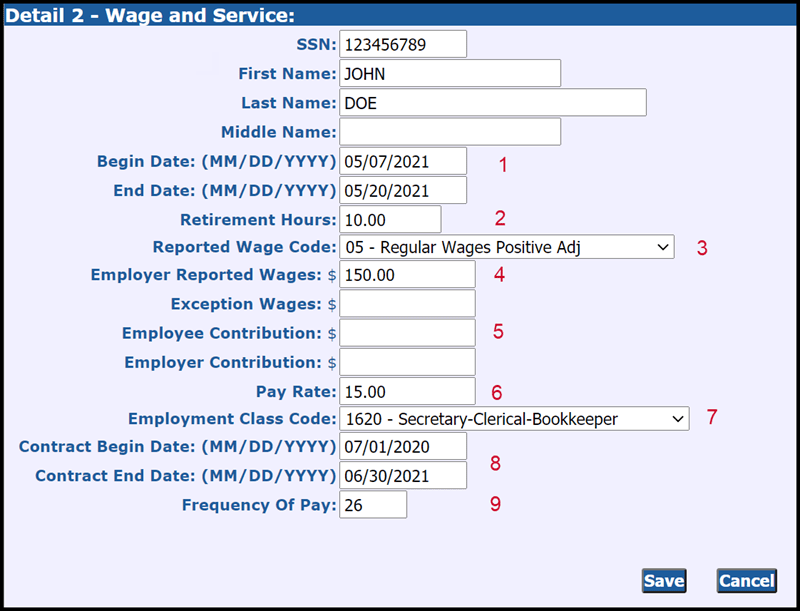

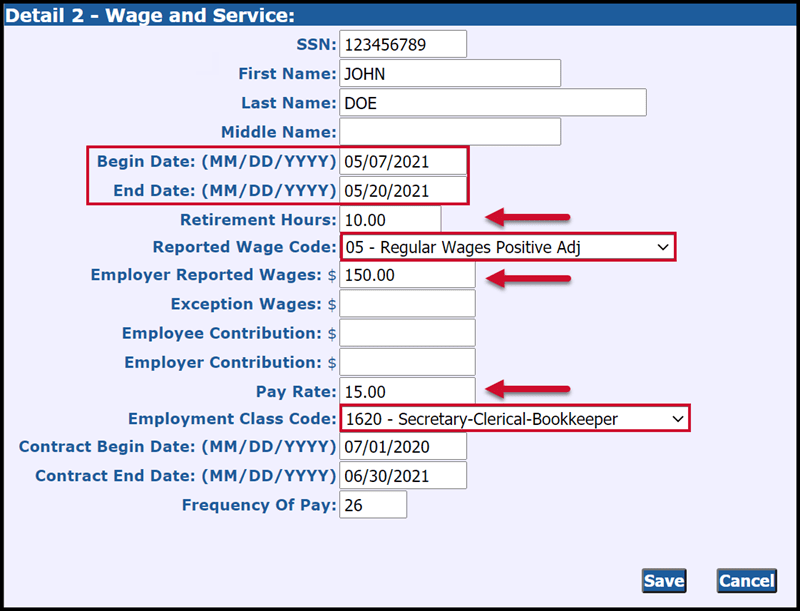

Example 1: Positive adjustment to regular wages

You underreported an employee's wages in a pay period ending 05/20/2021 by $150. You are making this adjustment in the pay period ending 6/17/2021. The original record, for the pay period ending 5/20/2011, contained the following data:Wage Code:

01

Begin Date:

05/07/2021

End Date:

05/20/2021

Wages:

$2,000

Hours:

80.00

Class Code:

1620

Pay Rate:

26.88

In the 06/17/2021 report, you will report two DTL2 records: one for the current pay period regular wages (as you normally would) and a second for the adjustment, as follows:

DTL2 record - current pay period

DTL2 record for adjustment

Wage Code:

01

Wage Code:

05 (positive adjustment to regular wages)

Begin Date:

06/07/2021

Begin Date:

05/07/2021

End Date:

06/20/2021

End Date:

05/20/2021

Wages:

$2,500.00

Wages:

$150.00

Hours:

0.00

Class Code:

1620

Pay Rate:

26.88

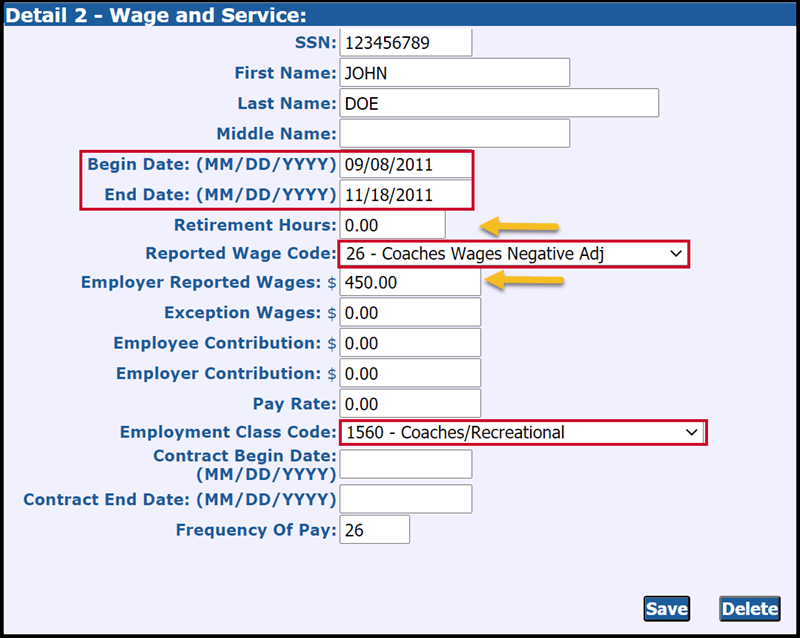

Example 2: Negative adjustment to coaches wages

Your reporting unit overreported coaches' wages (wage code 11) for an employee in the pay period ending 11/18/2011. You are making this adjustment in the pay period ending 05/20/2021.The original pay period record ending 11/18/2011 contained the following data:

Wage Code:

11

Begin Date:

09/08/2011

End Date:

11/18/2011

Wages:

$2,900.00

Hours:

245.00

Class Code:

1560

Pay Rate:

10.00

In your current report (pay period end date 05/20/2021), you will enter a DTL2 record as follows:

Wage Code:

26 (negative adjustment to Coaches Wages)

Begin Date:

09/08/2011

End Date:

11/18/2011

Wages:

$450.00

Hours:

0

Class Code:

1560

Pay Rate:

0.00

Adjustment records and contributionsWhen making an adjustment, you will also need to calculate the correct member contribution amounts to be withheld from the employee's pay. If the wages are being paid in the same fiscal year (July 1-June 30) in which they were earned, use the same member contribution rate that you used for the last set of posted wages for that school fiscal year.

For example, you have an employee who has posted earnings of over $15,000 in a tiered benefit plan at the time you make the adjustment. Even if you are adjusting pay periods earlier in the year when the member contribution percentage was lower, you will use the current member contribution rate.

If the wages are being paid for a previous fiscal year, use the same member contribution rate that you used for the last set of posted wages for that fiscal year. If you are reporting current wages along with the adjustment, these may require separate calculations.

The employer contribution rate for any adjustment is the rate in effect for the adjustment record's pay period end date. So, employer contributions for adjusted wages paid in the fall for the previous school fiscal year (July 1 - June 30) are calculated using the previous fiscal year's contribution rate.

Make adjustments to prior pay periods on your most current unposted payroll report. Any employer and employee contribution payment required as a result of a positive adjustment record is due on the same date as payment for the report on which the adjustment appears.

This version was in effect from 05/30/2017 until 08/05/2022.

-

B.16: Previous version of 9.00: Retirees who return to work

Section 9.00: Retirees who return to work was updated on 08/05/2022. The previous version is below.

Reporting units are required to submit retirement detail reports on a wage and service paid basis, including, but not limited to, retirees employed by a third party or as an independent contractor.

MPSERS retirees who return to work to a MPSERS reporting unit may have an impact on their pension and insurance premium subsidies. The retiree and the employing reporting unit have an important responsibility in this process.

- The retiree is responsible for understanding the working after retirement rules and how they affect their pension and insurance premium subsidy. Resources for retirees are available on the ORS member information website for retirees who return to work.

- The reporting unit is responsible for accurately reporting retirees to ensure the guidelines of the working after retirement rules are met.

The rules for reporting retirees are broken down into multiple categories which include the reporting unit type, the retiree's effective date of retirement, and the type of post-retirement employment.

In addition, you may need to determine whether the retiree is employed as a critical shortage position, instructional coach, school improvement facilitator, school renewal coach or high impact leadership facilitator, substitute teacher, national service member, at a school with a COVID-19 learning plan, or by a university that is considered a reporting unit as a former teacher or administrator who returned to work in a teaching or research capacity.

Reporting resources

ORS offers tools to help you report retirees employed by your reporting unit. For accurate reporting, you must review both tools for each retiree.

- The Member Benefit Plans section of the Employer Reporting website will verify that your new employee is a MPSERS retiree. In addition, the Member Benefit Plans link gives you the retirement effective date, years available in a critical shortage position, and information on employer and employee contribution rates when appropriate. This information will be specific to each employee.

- The Working after retirement - employer guide verifies the ORS Employment Class Code, if unfunded actuarial accrued liability (UAAL) is due, and if a Detail 4 record is required.

For instructions on how to report a retiree, see sections 7.03.08: Reporting retiree wages and hours on a DTL2 record.

Definitions

critical shortage: The critical shortage exemption applies to K-12 public school districts, charter schools, public school academies, and intermediate school districts only.

In some cases, you may have to determine if the retiree is hired under a critical shortage position. The critical shortage positions are defined by the Michigan Department of Education and updated periodically. See a list of critical shortage positions here.

Public Act 267 extended the critical shortage exemption until July 1, 2025 and removed the three-year maximum that a retiree can work in a critical shortage position.

instructional coach: As defined by the Michigan Department of Education, instructional coaches are hired by intermediate school districts (ISD) or educational service agencies (ESA) through the Regional Assistance Grant to provide support to Priority Schools depending on the needs identified by the school. These coaches can be provided in the areas of math, reading, writing, science, social studies, and a multi-tiered system of support.

school improvement facilitator: A school improvement facilitator works with and through an intermediate school district (ISD) or educational service agency (ESA) to provide services to Title I Priority Schools to help implement a formal school improvement plan as defined by the Michigan Department of Education.

school renewal coach or high impact leadership facilitator:

These positions must be employed directly by the reporting unit as part of a program that supports teams of school principals and teacher leaders in elementary schools by doing all the following:

- Providing intense professional development, support, and money for renewal projects for teams of school leaders in a number of project schools that are implementing a set of new literacy essentials.

- Placing a trained team of school renewal coaches or high impact leadership facilitators in each project school.

- Providing a lower level of professional development support and funding for leaders in additional schools.

- Applying a set of proven school leadership practices for school renewal and sustainable implementation.

- Providing training, support, and oversight for the school renewal coaches or high impact leadership facilitators as a coordinator or supervisor of that work.

substitute teacher: A substitute teacher is an individual working under a permit issued by the Michigan Department of Education under Public Act 451 of 1976 MCL 380.1233 and 1233b, as well as Teacher Certification Code (Administrative Rules) Part 4: R 390.1141-1145. Michigan schools often use the term for any individual who is asked to step into a position and cover for the certified teacher who is reported or documented as the teacher of record. However, there are situations where the substitute is in fact the appropriate individual to be reported as the teacher of record.

national service member: An individual enrolled in a federally-funded national service program such as AmeriCorps State and National or VISTA and is placed at a service site that is a reporting unit.

COVID-19 learning plan: As defined in MCL 388.1698a of Public Act 94 of 1979.

This version was in effect from 07/31/2019 until 08/05/2022

-

B.17: Previous version of 9.02: Core services (only applies to retirees who retired from July 1, 2010 to July 1, 2022)

Section 9.02: Core services (only applies to retirees who retired from July 1, 2010 to July 1, 2022) was updated on 08/05/2022. The previous version is below.

The retirement system has determined that core services are those services that are important to the central purpose of a reporting unit. A list of core services can be downloaded here.

Retirees with a retirement date on or after July 1, 2010, who are employed by a third party or as an independent contractor, and who perform any core services for a participating Michigan public school (including any charter school), forfeit their pension and retiree healthcare subsidy until the core services employment ends.

This version was in effect from 06/18/2018 until 08/05/2022

-

B.18 :Previous version of 13.02.01: Detail 2 records - employment class codes and definitions

Section 13.02.01: Detail 2 records - employment class codes and definitions was updated on 08/05/2022. The previous version is below.

Detail 2 - Wages and Hours (DTL2) records require two important codes: employment class codes and wage codes (explained in section 13.02.02). Employment class codes define members' positions with your reporting unit. You'll see that most of them correspond to the Michigan Department of Education Salary Object Codes. Include these codes in the DTL2 records on your retirement detail reports.

1110 - Superintendent 1680 - Attendance 1120 - Assistant Superintendent 1690 - Other Operation & Service 1130 - Administrative Assistant 1790 - Other Special Payments 1150 - Principal 1810 - Administration 1160 - Supervision 1820 - Professional - Education 1170 - Program/Department Direction 1830 - Professional - Business 1180 - Research 1840 - Professional - Other 1190 - Other Administration 1850 - Technical 1210 - Curriculum 1860 - Operation & Service 1220 - Counseling 1870 - Teaching (Temporary) 1230 - Library 1880 - Sub Clerical 1240 - Teaching 1890 - Other 1250 - Consulting 1910 - Sal - OT Administrative 1260 - Instructional Media 1920 - Sal - OT Professional Education 1270 - Visually Handicapped Media 1930 - Sal - OT Professional Business 1280 -Speech & Language Therapist 1940 - Sal - OT Professional Other 1290 - Other Professional Education 1950 - Sal - OT Technical 1310 - Accounting 1960 - Sal - OT Operation & Service 1320 - Auditing 1970 - Sal - OT Teaching 1330 - Legal 1980 - Sal - Clerical - Admin Support 1340 - Personnel 1990 - Sal - OT Other 1350 - Architect - Engineer 8000 - Workers' Compensation 1390 - Other Professional Business 8500 - Short Term Disability 1410 - Medical - Dental 9001 -Professional Services Leave/Professional ServicesReleased Time 1430 - Psychological 9003 - Retiree - Teacher 1440 - Social Work 9004 - Retiree - Administrator 1450 - Nursing 9005 - Retiree - Other 1470 - Physical Therapy 9013- Critical Shortage Retiree (Teacher) 1480 - Occupational Therapy 9014- Critical Shortage Retiree (Admin) 1490 - Other Professional 9015- Critical Shortage Retiree (Other) 1510 - Data Processing 9023- 3rd Party Retiree (Teacher) 1530 - Purchasing 9024- 3rd Party Retiree (Admin) 1540 - Testing 9025- 3rd Party Retiree (Other) 1550 - Crafts & Trades 9033*- Non-CS Direct Hire Retiree (Teacher) 1560 - Coaches - Recreational 9034*- Non-CS Direct Hire Retiree (Admin) 1590 - Other Technical 9035*- Non-CS Direct Hire Retiree (Other) 1610 - Vehicle Operation 9043- 3rd Party Core Services(Teacher) 1620 - Secretary - Clerical - Bookkeeper 9044- 3rd Party Core Services(Admin) 1630 - Aide 9045- 3rd Party Core Services(Other) 1640 - Custodian 9510 - Supplemental Employment 1 1650 - Food Service 9520 - Supplemental Employment 2 1660 - Security & Monitor 9530 - Supplemental Employment 3 1670 - Laborer Administration - Salaried

Definition: A grouping of assignments concerned with establishing and administering policy in connection with operating the reporting unit.

- 1110 Superintendent - An assignment to perform the head executive management activities of a school system.

- 1120 Assistant Superintendent - An assignment to assist the superintendent in performing the head executive management activities of a school system.

- 1130 Administrative Assistant - An assignment to perform professional activities.

- 1150 Principal (School Direction & Management) - An assignment to perform the activities of directing and managing the operation of a school for which policy and program plans have been broadly established.

- 1160 Supervision - An assignment to supervise staff members and manage a function, a program, or a supporting service. This includes program coordinators and compliance officers.

- 1170 Program-Department Direction - An assignment to direct a program, department, function, or a supporting service.