The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

6.03.06: State of Michigan Roth 457 Plan contributions

Since Sept. 22, 2025, all MPSERS members can make contributions to a Roth 457 Plan through Voya Financial.

The State of Michigan Roth 457 Plan is available to all employees, including retirees who work after retirement; employees with a savings component as part of their benefit plan (those in the Pension Plus Plan, Pension Plus 2 Plan, or the Defined Contribution Plan); and employees in a defined benefit plan who choose to defer compensation to a Defined Contribution Plan (with no employer contribution). Contributions to a Roth 457 Plan are withheld from the member’s post-tax earnings and can be made only by a member; employer mandatory and matching contributions are pretax only and continue to go to the member’s 401(k) Plan.

If an employee chooses to make some or all contributions to their Roth 457 account through Voya, the reporting unit will be notified through the View DC Feedback File screen. The DC feedback file includes a column labeled Effective Report End Date — ORS expects the changes to take effect by that date. See section 7.04.01: View DC Feedback File and section 7.02.04: Reporting DC wages and contributions on a DTL4 record.

For employees with the Personal Healthcare Fund (PHF) benefit who elect to contribute only to the Roth 457 account, the first 2% should be reported in the Roth PHF fields (amount and percentage). If an employee is contributing to both account types, the first 2% should be reported in the existing PHF fields (amount and percentage). See the following examples, where both employees are in Pension Plus 2 Plan and contribute 6% to Voya.

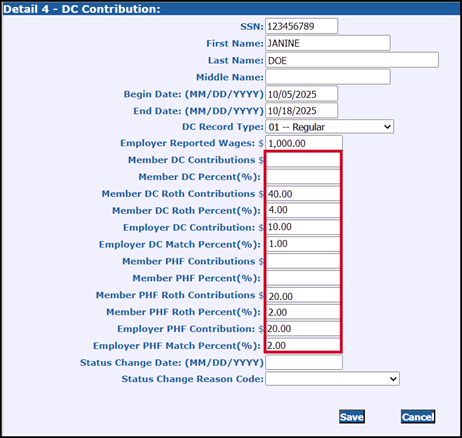

In the first example (below) the employee opted to put all contributions (6%) into their Roth 457 account. On a Detail 4 - DC Contribution (DTL4) record, the first 2% is reported in the Member PHF Roth Contributions fields.

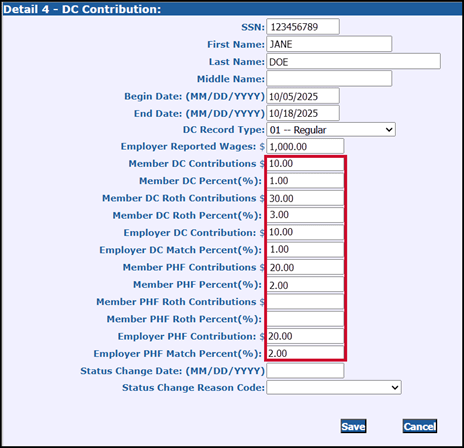

In the second example (below) the employee opted to split their contributions — 3% for regular (pretax) contributions and 3% for Roth (post-tax) contributions. On a DTL4 record, the first 2% is reported using the Member PHF Contributions fields.

Updated: 01/21/2026