The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.02.04: Reporting DC wages and contributions on a DTL4 record

7.02.04: Reporting DC wages and contributions on a DTL4 record

With legislative changes to the Michigan Public School Employees’ Retirement System in 2010, 2012, and 2017, defined contribution (DC) retirement plan elements were added to what was previously a defined benefit (DB) retirement program. See section 6.01: History of the retirement benefit plans for more detail. Beginning May 2022 both Detail 2 (DTL2) and Detail 4 (DTL4) records are required for all reportable employees.

DC contributions are made as follows:

- Members who first worked for MPSERS between July 1, 2010, and Jan. 31, 2018, are members of the Pension Plus* benefit plan. See section 6.03.03: Pension Plus and Pension Plus 2 plans.

- Members who first work between Feb. 1, 2018, and June 30, 2024 may elect the Pension Plus 2* plan (see section 6.03.03: Pension Plus and Pension Plus 2 plans) or default to the DC plan (see section 6.03.04: Defined Contribution (DC) plan and Basic/MIP Converted to DC plan).

- Members who first worked Sept. 4, 2012, or after also receive a defined contribution Personal Healthcare Fund (PHF).

- Pension Plus members who first worked Sept. 4, 2012, or later were also given an option to elect the DC plan in place of the Pension Plus plan.

- In 2012, Basic and MIP members were offered a one-time election to participate in the DC plan and/or a PHF.

- In May 2022, Basic and MIP members and retirees with the premium subsidy healthcare option can participate in the State of Michigan 457 Plan (see section 6.03.05: State of Michigan 457 Plan for DB members).

- Members who first work on or after July 1, 2024, may elect either the Pension Plus 2 plan or the DC plan. If they do not elect, they will default to the Pension Plus 2 plan.

*Both the Pension Plus and Pension Plus 2 plans combine a DB component and a DC component.

The DC portion of the Pension Plus plan, Pension Plus 2 plan, the DC plan, and the PHF require the employer to withhold member contribution rates upon first being reported or after first electing the DC or PHF option. Contribution percentages are determined by the type of member benefit plan and healthcare plan and calculated based on gross wages.

Once an account has been established at Voya Financial the member may increase or decrease their DC contribution, including changing it to 0%. A change in the member contribution amount for a member in the Pension Plus, Pension Plus 2, or DC benefit plan, and for those who have the PHF, may result in a change to the employer contribution percentage as well. For all members with a PHF, the first 2% of DC contributions must go into the PHF and must be matched 100% by the employer. The percentage and dollar amounts must be reported on a DTL4 record in the Member and Employer PHF Contributions $ and % fields. Any member contributions over 2% are reported in the Member and Employer DC fields on the DTL4 record and matched at 50% up to 1% for Pension Plus plan members and up to 3% for DC members. Even if a member changes their contribution to 0%, the employer must continue to report DC wages and make employer mandatory contributions.

The View DC Feedback File link on Things To Do menu provides the reporting unit with updates on member deduction changes. See section 7.04.01: View DC Feedback file for information.

Report member and/or employer gross wages and contributions to the DC plan for members in Pension Plus, Pension Plus 2, the DC plan, and anyone with the PHF on a Detail 4 - DC Contribution (DTL4) record on your payroll reports each pay period. For DB members with the State of Michigan 457 Plan, report gross wages and member contributions (only) on a DTL4 record.

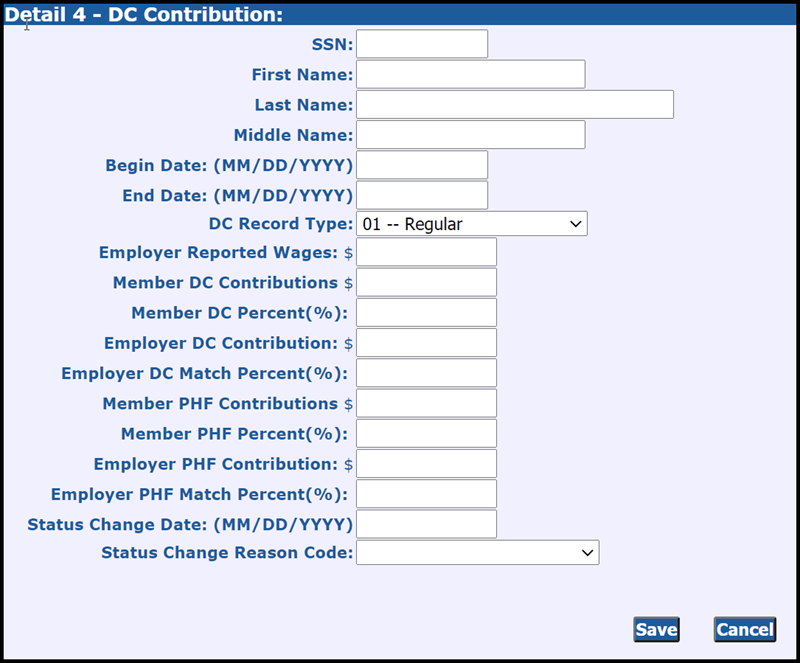

Here's a blank DTL4 record, followed by an explanation of each field.

- SSN

- First Name

- Last Name

- Middle Name

- Begin Date: (MM/DD/YYYY): This is the begin date of the reporting period for contributions being withheld.

- End Date: (MM/DD/YYYY): This is the end date of the reporting period for contributions being withheld.

- DC Record Type:

- 01 - Regular: for contributions withheld for the current pay period

- 05 - Positive Adjustment: for contributions not reported previously or in addition to contributions reported in a prior pay period

- 06 - Negative Adjustment: for contributions over reported in a prior pay period

- Employer Reported Wages: This is for gross wages for the pay period that include compensation reported on the member's W-2 or 1099R form as earnings for services performed for the reporting unit, including but not limited to amounts deferred or contributed to an annuity at the election of the member. Wages for workers' compensation, short-term disability and long-term disability are not considered gross wages for the DC plan or a plan with a DC component or PHF and should not be included in this field. (This amount may be different from the amount used as reportable compensation on the DTL2 record for the same employee.)

- Member DC Contributions $: The dollar amount of the defined contribution (DC) or deferred compensation percentage deduction for the member. It must be formatted as 0.00.

- Member DC Percent (%): The percentage amount of the member defined contribution (DC) or deferred compensation contribution. It must be formatted as 0.00

- Employer DC Contributions $: The dollar amount of the defined contributions (DC) employer percentage deduction. It must be formatted as 0.00. (There is no employer DC contribution dollar amount for deferred compensation contributions.)

- Employer DC Match Percent (%): The percentage amount of the DC employer match contribution. It must be formatted as 0.00 (There is no employer DC match percent amount for deferred compensation contributions.)

- Member PHF Contributions $: The dollar amount of the member Personal Healthcare Fund contribution. It must be formatted as 0.00. If there is no PHF contribution, enter 0.00 in the field.

- Member PHF Percent (%): The percentage amount of the member PHF contribution. It must be formatted as 0.00. If there is no PHF contribution, enter 0.00 in the field.

- Employer PHF Contributions $: The dollar amount of the employer PHF match contribution. It must be formatted as 0.00. If there is no PHF contribution, enter 0.00 in the field.

- Employer PHF Match Percent (%): This is the percentage amount of the PHF employer match. It must be formatted as 0.00. If there is no PHF match, enter 0.00 in the field.

- Status Change Date: (MM/DD/YYYY):* Populate this field only if the member is temporarily or permanently terminating from the reporting unit. If the member is terminating, you must also populate the Status Change Reason Code field. If there is no termination, leave the field blank.

- Status Change Reason Code:* Populate only if the member is temporarily or permanently terminating from the reporting unit. If the member is terminating, you must also populate the Status Change Date field. If there is no termination leave the field blank.

*These two fields must either both be blank or both be populated. The record will suspend if one field is populated and the other is not.

Submit only one DTL4 record for each member for each pay period begin and end date. If a member has more than one DTL2 record for the pay period, the DTL4 record must include total gross wages.

Last updated: 07/01/2024