The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

11.03.02: DC Converted employee did not work for your reporting unit on Feb. 1, 2013

From the List Of Retirement Applicants screen, click the active hyperlink to open the Final Payroll Details screen for the member with a DC Converted plan. The process of completing the FPD can be broken down into four sections. The instructions for completing each section are below:

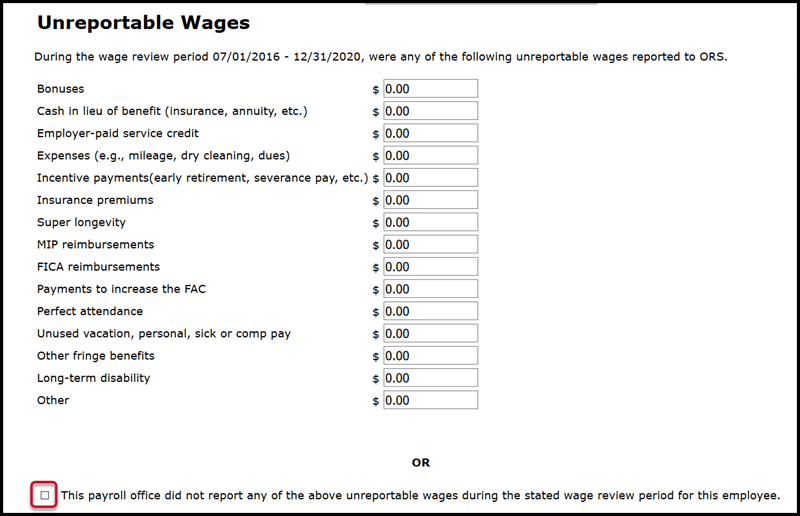

Reportable and unreportable wages

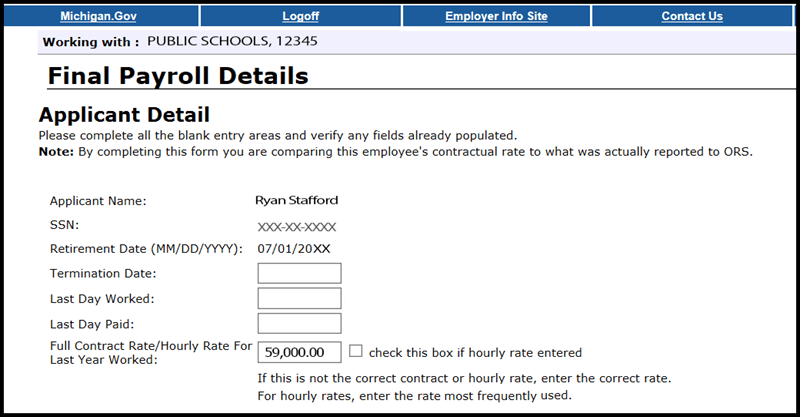

Applicant Detail

- The first section is called Applicant Detail. The employee's name, last four digits of their Social Security number, and retirement effective date will automatically be pre-populated based on the employee's application.

Enter the employee's Termination Date, Last Day Worked, and Last Day Paid using the mm/dd/yyyy format.

- If the employee has not provided a termination date, use the last day paid.

- The Last Day Worked is the last day the employee earned service hours.

- The Last Day Paid is the pay period end date of the last pay cycle.

- Review the Full Contract Rate/Hourly Rate For Last Year Worked field. For DC Converted applicants, the contract rate must reflect the rate in place before the first full pay period with a begin date on or after Feb. 1, 2013, the effective start date of the DC Converted retirement plan. Since you do not have wage data for that period, contact ORS Employer Reporting at ORS_Web_Reporting@Michigan.gov to confirm this amount and whether the amount is an hourly rate (if hourly, check the box).

Reportable and unreportable wages

- You may skip the part called Reportable Wages Above the Base Rate. The next part is Unreportable Wages. Since you have no DB wage data for the period shown, check the box at the bottom of the section. (The FPD cannot be successfully submitted if nothing in this section is entered.)

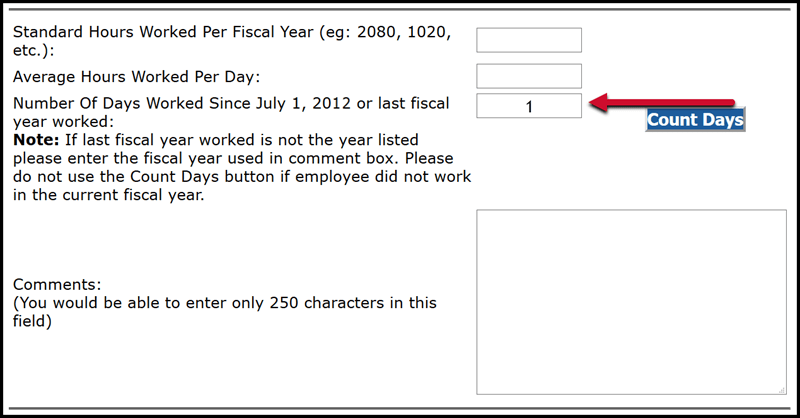

Hours and days

- You may skip the next section, called Carryover (Usually Summer Spread). The following section is for reporting hours and days. You may skip the fields called Standard Hours Worked Per Fiscal Year and Average Hours Worked Per Day.

In the field called Number of Days Worked Since July 1, 2012, enter 1. You do not have this information, but the FPD will not be accepted without a number other than zero in this field.

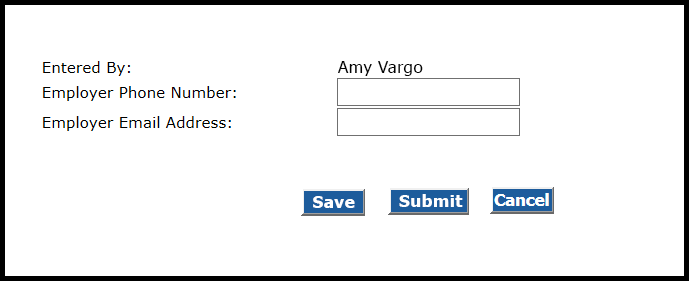

Save and submit

- The last section of the FPD includes fields for your name, phone number, and email address. Your name will be automatically pre-populated. You can submit a completed FPD or save it and come back at a later time. The Save button saves everything except for the information on this final screen.

- When you have completed all fields, click Submit. When you submit the FPD, a calculation will automatically run that will compare the Certified Reportable Wages entered on the FPD to the Wages Based on Contract housed on the ORS database. If the amounts match, the retirement system accepts the FPD and sends a confirmation message. If the amounts do not match, you will receive an error message. See section 11.04 How to balance an FPD.

Last updated: 04/02/2021