The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

11.04: How to balance an FPD

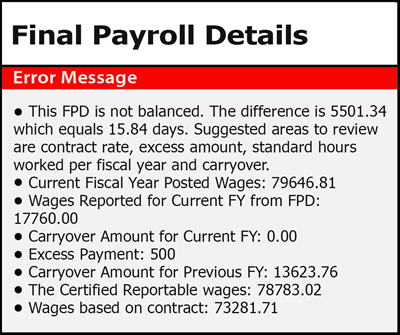

If your final payroll detail (FPD) is not balanced you will receive an error message. In order to make adjustments so that it will balance, it helps to understand how ORS determines whether it balances. Many of the terms below may appear within the error message.

ORS requires that the certified reportable wages from the FPD match the wages based on the contract (from the ORS database). It determines whether they match by running a balancing calculation. First, it calculates a daily rate, as follows:

- The full year's base contract amount divided by hours normally worked per fiscal year = hourly rate.

- The hourly rate multiplied by the hours normally worked per day = daily rate.

Next, the system uses those numbers to calculate the number of days of earnings difference (the tolerated variation), as follows:

- The number of days entered on the FPD minus the number of days in the ORS database, divided by the daily rate = number of days of earnings difference.

If this number is below a certain threshold, the FPD is considered balanced. If it is above the threshold, the FPD needs to be balanced and you will receive an error message like the one below:

- The certified reportable wages may be greater or lesser than the wages based on contract. Check all sections of the FPD and correct any errors, using these guidelines:

- The wages reported for the current fiscal year on the FPD may be too high or too low. See step 2 in section 11.02 How to submit FPDs (excluding DC Converted members) or step 2 in section 11.03 How to submit FPDs for DC Converted members.

- The amount listed for excess payment (excess amount on the FPD screen) may be too high or too low. You may have missed some reportable wages or included some incorrectly. See step 5 in section 11.02 or step 4 in section 11.03 for a DC Converted member.

- The carryover wages for current FY may be too high or too low. See step 7 in section 11.02 or step 6 in section 11.03 for a DC Converted member.

- The standard hours worked per fiscal year may be too high or low. See step 8 in section 11.02 or step 7 in section 11.03 for a DC Converted member.

- The number of days worked since July 1 may be too low. See step 10 in section 11.02 or step 9 in section 11.03 for a DC Converted member.

- Resubmit the FPD so that the balancing calculation will run again.

- When the final payroll detail balances, you will be directed to Print This Page Summary for Your Records.

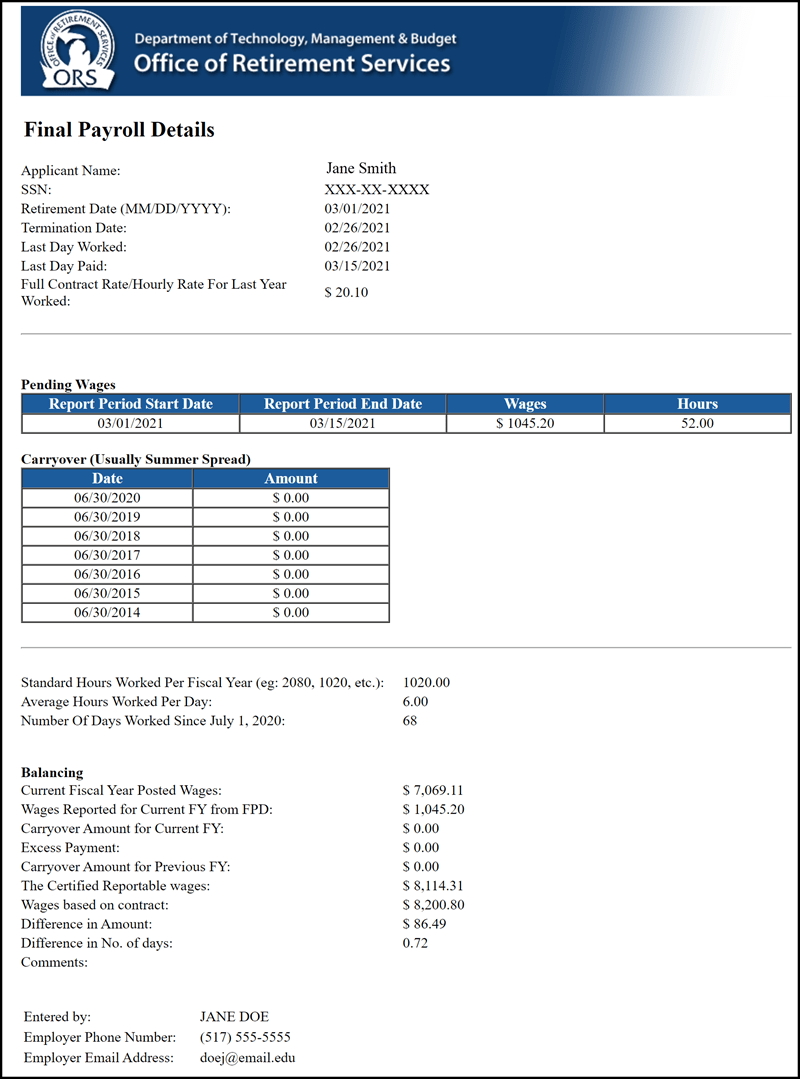

Click Print Summary to receive an FPD summary like the example here:

4. Click Return to Retirement Applicant List.

Last updated: 04/02/2021