The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

11.03.01: DC Converted employee worked for your reporting unit on Feb. 1, 2013

11.03.01: DC Converted employee worked for your reporting unit on Feb. 1, 2013

From the List Of Retirement Applicants screen, click the active hyperlink of the DC Converted member to open the Final Payroll Details screen. You will enter the information necessary for the retirement system to calculate your retiring employee's pension. The process of completing the FPD can be broken down into five sections. Instructions for completing each section are below:

Reportable and nonreportable wages

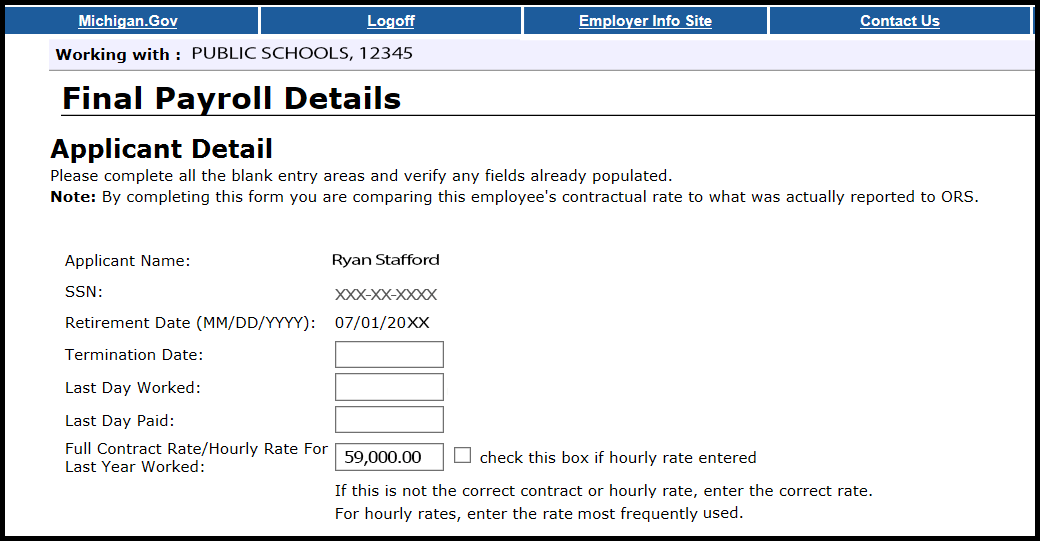

Applicant Detail

- The first section is called Applicant Detail. The employee's name, last four digits of their Social Security number, and retirement effective date will automatically be pre-populated based on the employee's application.

Enter the employee's Termination Date, Last Day Worked, and Last Day Paid using the mm/dd/yyyy format.

- Enter the Termination Date. If the employee has not provided a termination date, use the last day paid. Note: This date may or may not be well before the retirement effective date if the employee left your reporting unit but didn't retire at that time.

- The Last Day Worked is the last day the employee earned service hours.

- The Last Day Paid is the pay period end date of the last pay cycle.

- Review the Full Contract Rate/Hourly Rate For Last Year Worked field.

For DC Converted applicants, the contract rate must reflect the rate in place before after the conversion to DC on Feb. 1, 2013.

If the amount is not correct, enter the correct hourly rate or full contract rate for this employee.

To avoid common errors, please note the following:

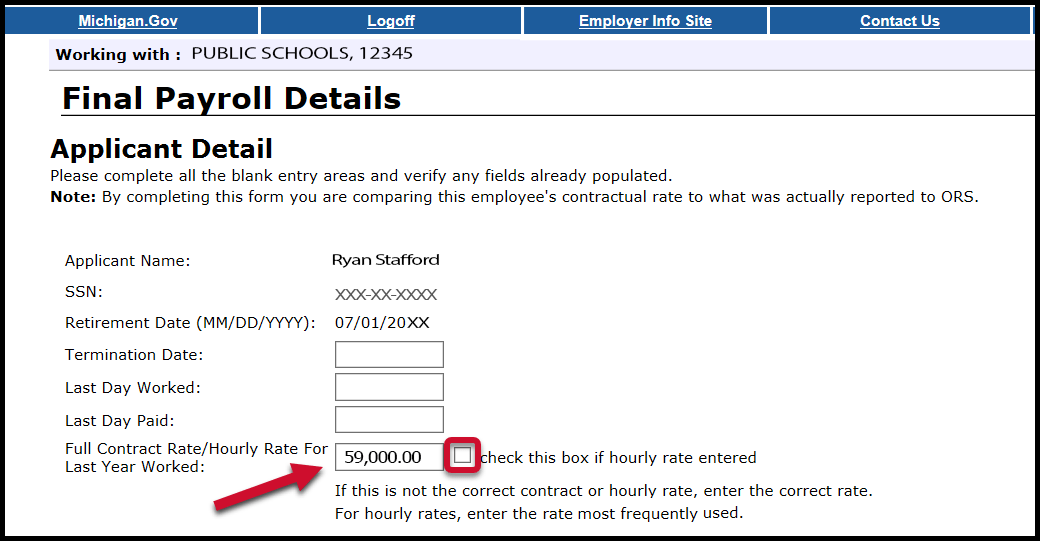

- If the employee earned an hourly rate, be sure to check the box next to the hourly rate.

- If the employee had more than one hourly rate, calculate and enter the average hourly rate.

If the employee did not work the full school fiscal year, check the last reported Detail 2 (DTL2) record before Feb. 1, 2013, for a prorated contract amount. If no amount is reported, enter the full contract amount.

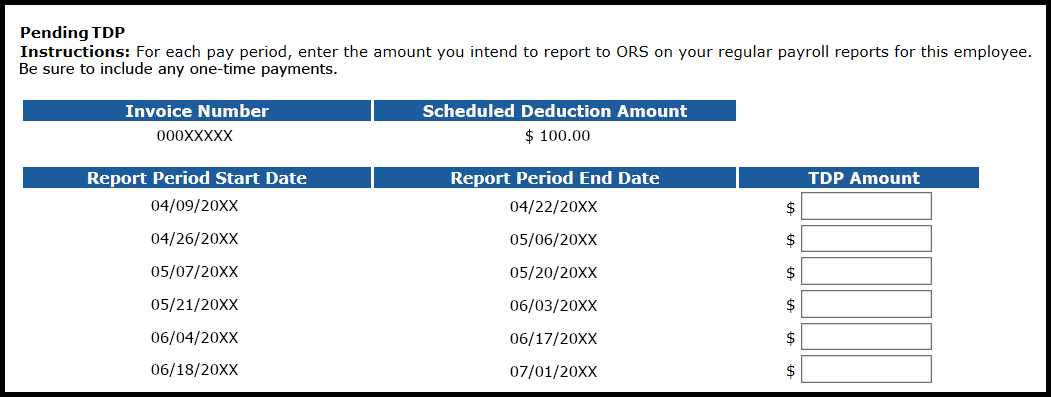

Pending TDP

- The Pending TDP section appears only if the applicant has an open, active tax-deferred payment (TDP) agreement. For each pay period listed, enter the amount you intend to report to ORS on your regular payroll reports for this employee. Be sure to include any one-time payments. If the employee is not paying off the TDP agreement, enter 0 (zero) in the TDP Amount field.

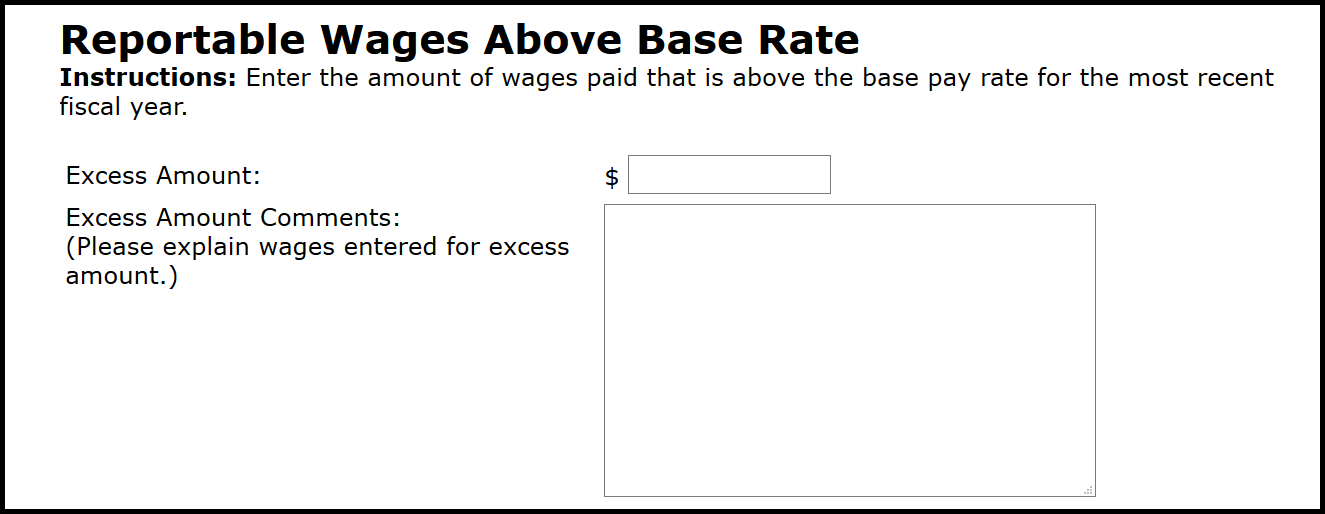

Reportable and nonreportable wages

- The next section is called Reportable Wages Above the Base Rate. Enter the amount of any reportable wages that were paid above the base pay rate in fiscal year 2013 (July 1, 2012, through Feb. 1, 2013, the effective start date of the DC Converted retirement plan). In addition, enter the wage amount paid for the remainder of the 2013 fiscal year (Feb. 1, 2013, through June 30, 2013, the wages earned after converting to the Defined Contribution plan). Add all amounts together for one total amount for the Excess Amount field. If the total reportable wages above the base rate is of more than one type, list the individual payment amounts and the explanation for each one in the Comments text box provided.

For example: A member received $500 in merit pay, earned $344.50 in overtime pay, and the remainder of their DC wages totaled $2,450.00. In the comment box enter:

Merit Pay: $500.00

Overtime Pay: $344.50

DC Wages: $2,450.00

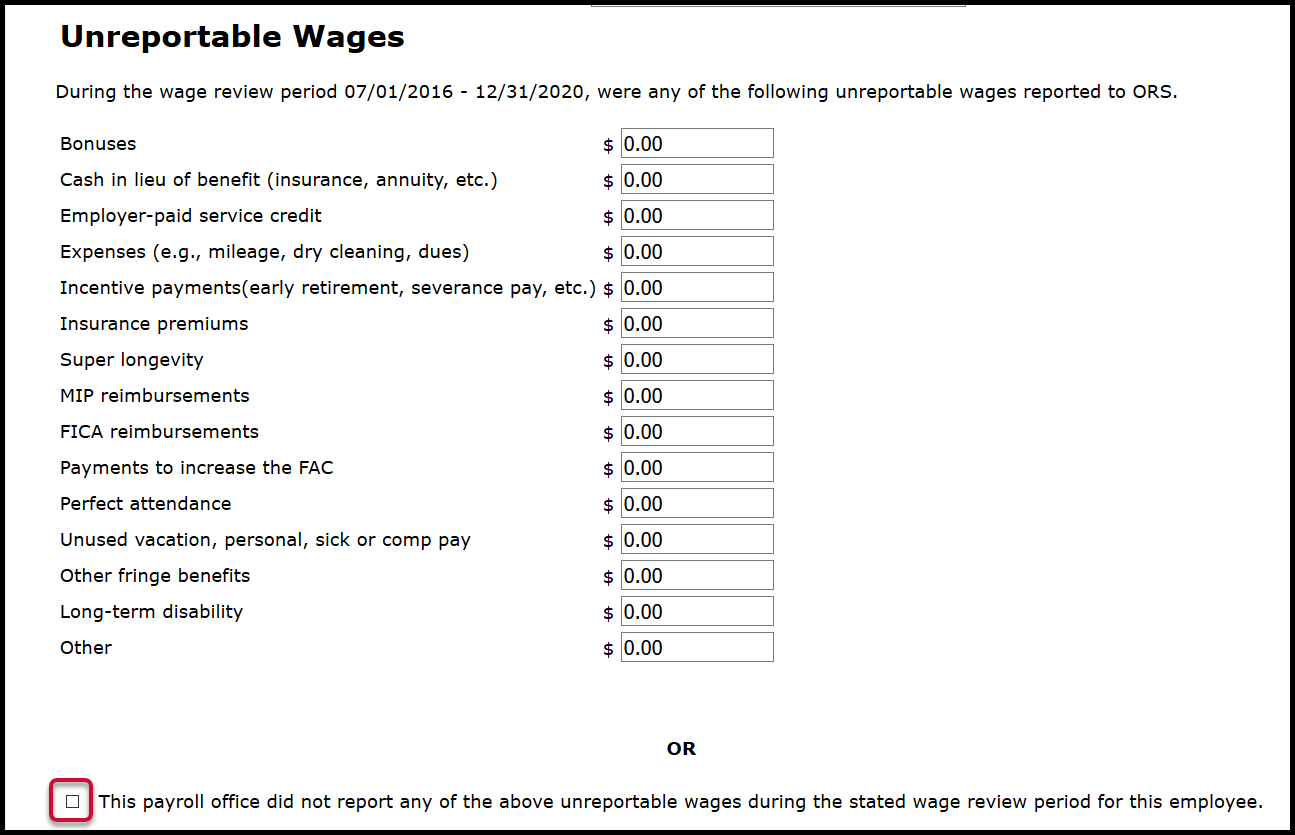

- In the Unreportable Wages section, enter any of the listed types of unreportable (nonreportable) wages that were reported on a DTL2 record before the first full pay period with a begin date on or after Feb. 1, 2013. See section 4.03: Nonreportable compensation.

If you enter an amount for any of the nonreportable compensation types, you will receive a message after you submit the FPD advising you to create a negative adjustment for any pay period that included unreportable compensation.

If you enter no amounts on any line, check the box at the bottom of the section. (The FPD cannot be successfully submitted without something in this section.)

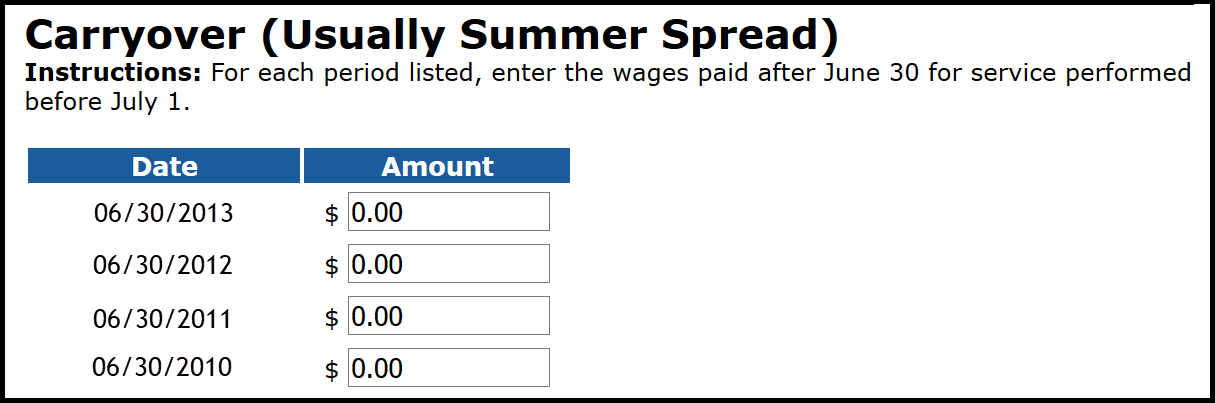

- The next section is called Carryover (Usually Summer Spread). Enter wages paid after June 30 for service performed before July 1 for each listed fiscal year-end date listed.

Carryover wages can be either summer spread wages (Wage Code 08) or trailing wages, which refers to regular wages and hours reported with a begin date before July 1 and paid in July, using Wage Codes 01, 05, 11, or 25. Report both types of carryover wages here.

Please note:

- Summer spread wages that were originally reported correctly with Wage Code 08 will be pre-populated. For more information on summer spread wages, see summer spread wages in section 4.02: Reportable compensation or 7.03.03: Reporting summer spread wages on a DTL2 record.

- The Final payroll detail e-learning module found in section 11.05 Additional resources for completing FPDs provides examples and practice with this step.

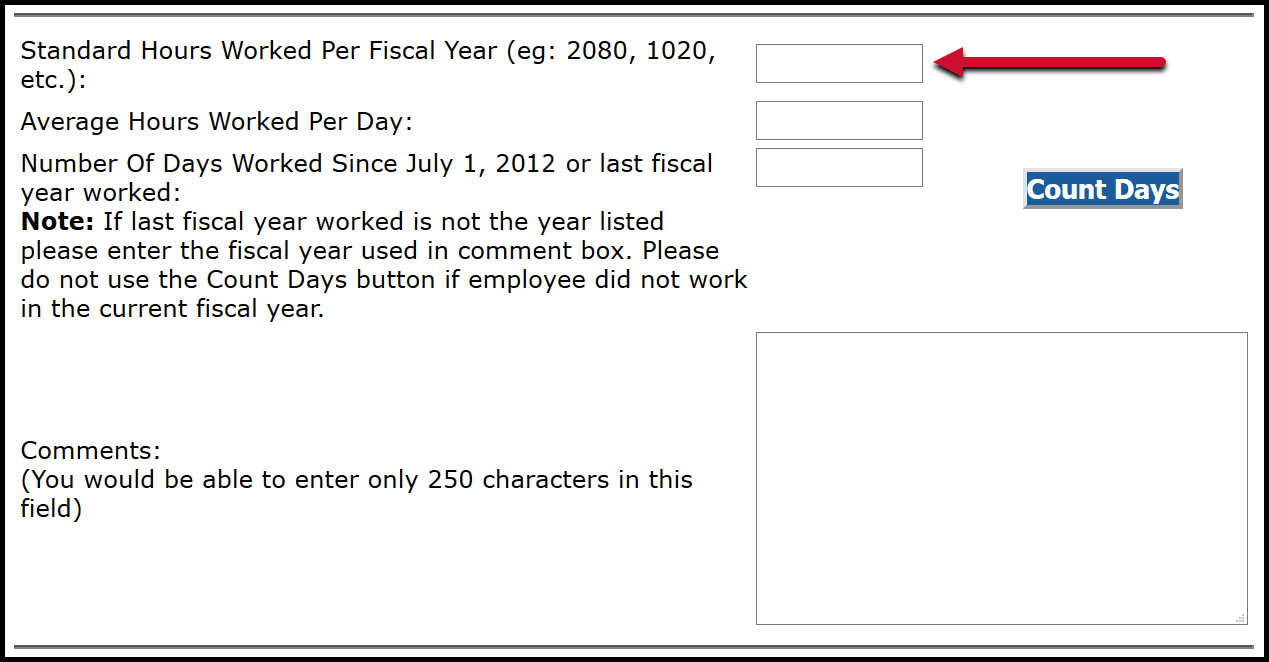

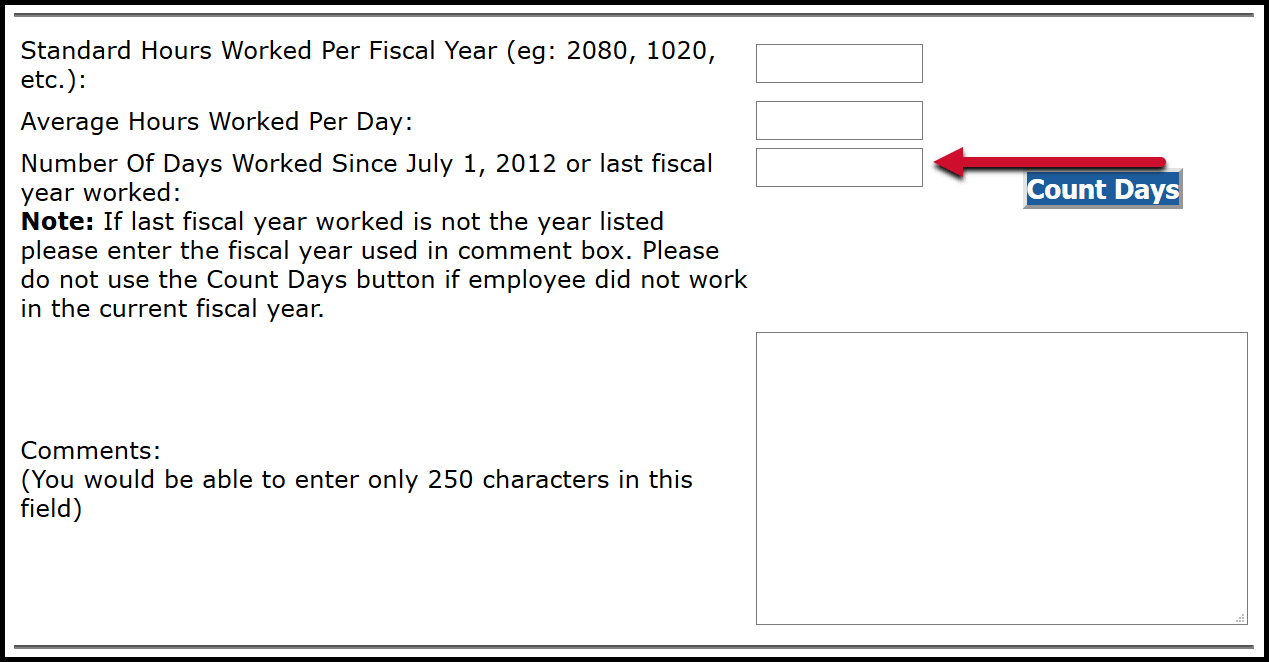

Hours and days

- The next section is for reporting hours and days. In the field Standard Hours Worked Per Fiscal Year, enter the standard number of hours the employee was normally scheduled to work before your first full pay period with a begin date on or after Feb. 1, 2013, the effective start date of the DC Converted retirement plan. For example: 2,080 hours or 1,020 hours.

If the member was an hourly employee, enter the total amount of hours reported in fiscal year 2013.

- In the Average Hours Worked Per Day field, enter the number of hours the employee was normally scheduled to work per day before your first full pay period with a begin date on or after Feb. 1, 2013.

- In the Number of Days Worked Since July 1, 2012 field, enter the actual number of days the employee worked between July 1, 2012, and Feb. 1, 2013.

In the Comments field, enter the actual fiscal year you are providing hours for, or explain any issues with hours or number of days worked.

Save and submit

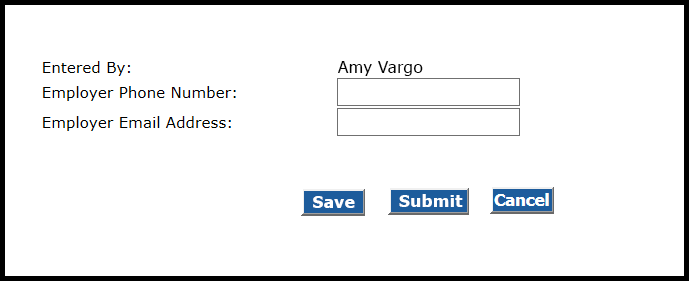

- The last section of the FPD includes fields for your name, phone number, and email address. Your name will be automatically prepopulated.

You can submit a completed FPD or save it and come back later. The Save button saves everything except for the information on this final screen.

- When you have completed all fields, click Submit. When you submit the FPD, a calculation will automatically run that will compare the Certified Reportable Wages entered on the FPD to the Wages Based on Contract housed on the ORS database. If the amounts match, the retirement system accepts the FPD and sends a confirmation message. If the amounts do not match, you will receive an error message. See section 11.04: How to balance a final payroll detail (FPD).

Last updated: 04/02/2021