The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.03.03: Reporting summer spread wages on a DTL2 record

The wage codes for reporting summer spread wages are:

- Wage code 08 - Summer Spread Wages

- Wage code 85 - Summer Spread Positive Adjustment

- Wage code 86 - Summer Spread Negative Adjustment

Some full-time employees who normally work ten months out of the year opt to spread out their pay so they continue to receive paychecks over the summer. Summer spread wages must have a report begin date range of June 1 through Sept. 30; otherwise, the record will suspend. There are two steps to reporting these summer spread wages:

- When you report these employee wages and hours throughout the school year, report wages using wage code 01, and report actual hours.

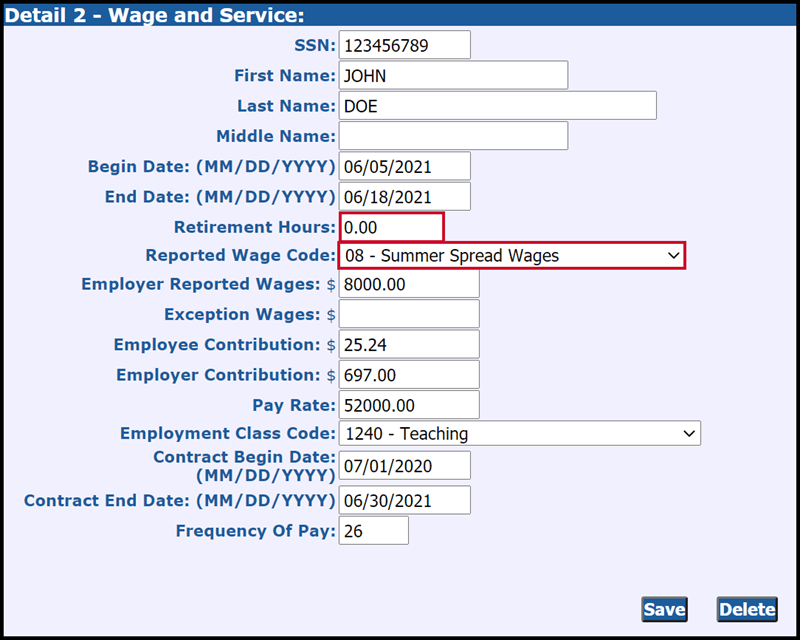

- Once you start to report the wages that are being paid out over the summer, use wage code 08, the normal class code, and do not report any hours. See the image below.

For a teacher who is being paid through the summer and is also working as a summer school teacher, report the pay using two separate DTL2 records. Because these are different wage codes, you can't combine the records.

- Create a record for the regular wages (wage code 01 and class code 1240 - Teacher) and report the summer school hours.

- Create a second record for the summer spread wages (08), without any hours. Use class code 1240.

Adjustments to summer spread wages

To add hours to wages posted incorrectly without hours using wage code 08 - Summer Spread requires two steps:

- Subtract the posted wages using wage code 86 - Summer Spread Negative Adjustment.

- Add a positive adjustment record using wage code 05 - Regular Wages Positive Adjustment to add both wages and hours. Include the pay rate on the positive adjustment record.

Last updated: 05/30/2017