The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Qualifying for Your Pension

Qualifying for Your Pension

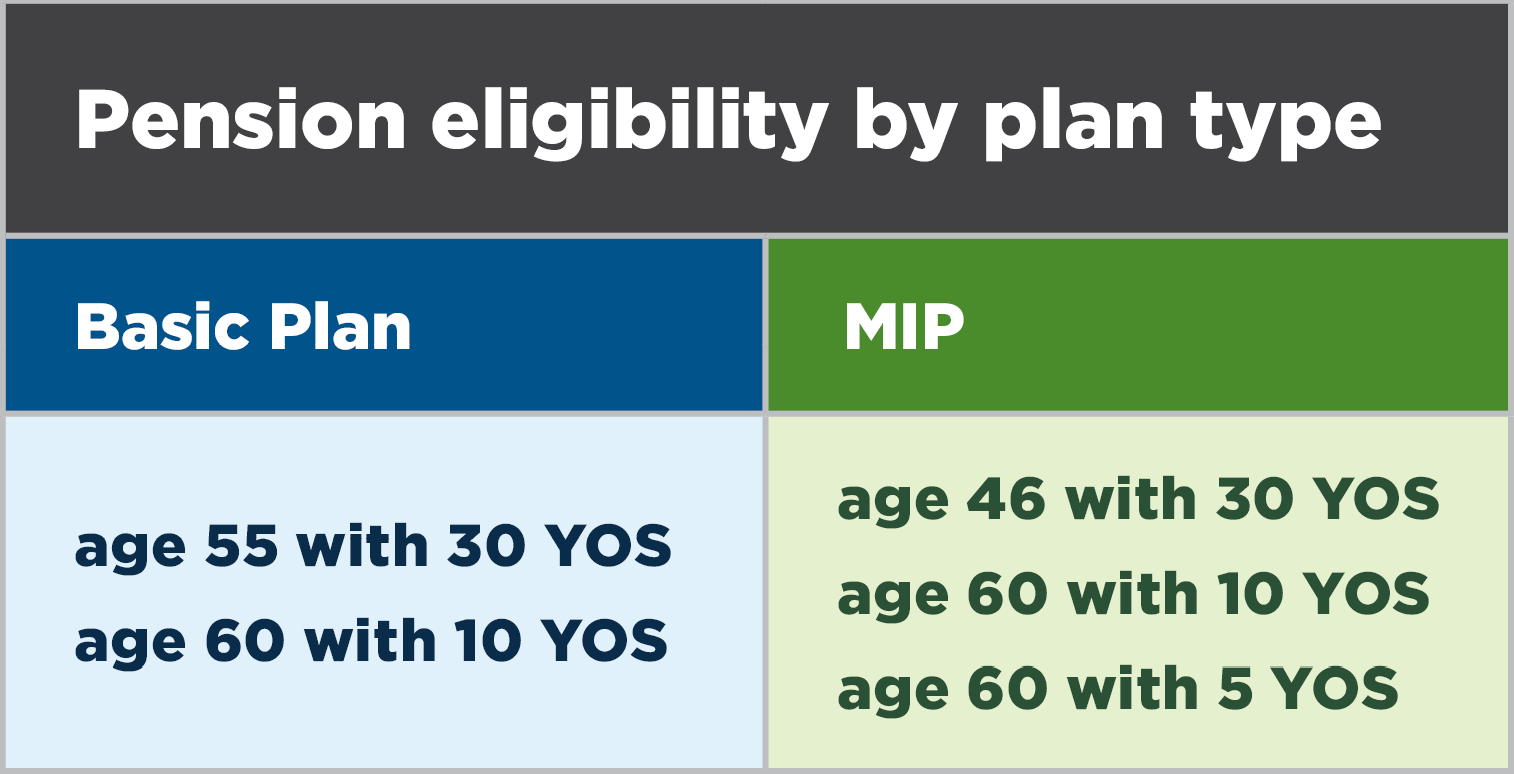

To be eligible for a monthly retirement pension, you must meet minimum age and service requirements as described here. These requirements vary depending on whether you're a Basic Plan or Member Investment Plan (MIP) member.

- Full Retirement Provisions.

- When You're Vested.

- Early Reduced Retirement Provisions.

- Summer Birthday Provision.

- Your Retirement Effective Date.

- If You Become Disabled.

Full Retirement Provisions

MIP Members

As a MIP member, you'll qualify for full retirement under any of the following provisions:

- MIP 46 with 30. You qualify for full retirement at any age with at least 30 years of service (YOS). However, if you've purchased universal buy-in service credit, you must be at least age 46. At least 15 YOS must be earned through the Michigan Public School Employees' Retirement System.

- MIP 60 with 10. You're eligible for your pension at age 60 with at least 10 years of earned service credit.

- MIP 60 with 5. If you're age 60 and you have at least 5 YOS, you qualify for a pension if you have earned service credit in each of the five school fiscal years immediately before your retirement effective date and you terminated your public school service immediately before your retirement effective date. A school fiscal year runs from July 1 through June 30. Note: You must work within the month of your 60th birthday.

Basic Plan Members

As a Basic Plan member, you qualify for a full retirement under the following provisions:

- Basic 55 with 30. You'll qualify for your pension when you're at least age 55 and have 30 or more YOS. At least 15 YOS must be earned through the Michigan Public School Employees' Retirement System.

- Basic 60 with 10. You qualify for a pension at age 60 with at least 10 years of earned service credit.

When You're Vested

You're vested when you have enough service to qualify for a pension though you may not yet meet the age requirement, when you have the equivalent of 10 years of full-time public school employment. If you're in the MIP DC Converted or Basic DC Converted Plan, you'll continue to earn credit toward pension eligibility as long as you remain employed under the retirement system. Learn more on how earning and purchasing service affects your pension eligibility.

Early Reduced Retirement Provisions

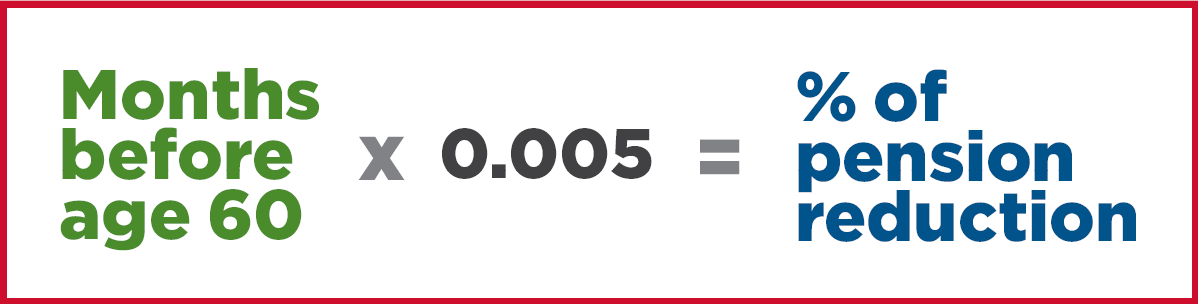

Whether you're in the Basic Plan or the MIP, you can take an early reduced retirement as early as age 55 if you have at least 15 but fewer than 30 YOS. Your pension amount is permanently reduced by one-half of 1% for each month you take your pension before age 60 (6% per year).

You must be an active member to be eligible for the early reduced retirement. An active member is someone who is still working under the retirement system and earning creditable service. If you terminate employment before the month you reach pension eligibility age, you become a deferred member, rather than an active member (see Summer Birthday Provision). Deferred members don't qualify for the early reduced pension provision.

To retire under the early reduced pension provision, you must meet all the following conditions:

- You worked in the month of your 55th birthday (an exception may apply if you were born in a summer month; see Summer Birthday Provision).

- You have at least 15 but fewer than 30 YOS, with at least 10 YOS earned under this system.

- You earned creditable service in each of the five school fiscal years before — including the month immediately before — your retirement effective date. The fiscal year in which you are retiring counts in the five years. (Learn more about earning service credit.)

- You terminated Michigan public school service immediately before your retirement effective date.

If you're thinking about an early reduced retirement, be sure to verify you meet these requirements before you terminate employment to be sure you qualify.

Deferred Retirement Provision

If you leave public school employment after you're vested but before the month you reach pension eligibility age, you're choosing to defer your pension. Be sure to apply for your pension before your 60th birthday — the amount won't be any higher, and you could lose money if you wait. (Note: If you already had 30 YOS at the time you terminated employment, you should apply as soon as you meet the minimum age requirement — age 46 for MIP and age 55 for the Basic Plan.)

Deciding Between a Deferred or Early Reduced Retirement

If you're between ages 55 and 60 and leaving public school employment, you might face a choice between taking an early reduced retirement or deferring your retirement until you meet age eligibility. Calculate your pension both ways before deciding — your choice could affect your lifetime pension amount.

Your choice will also affect your eligibility for an insurance premium subsidy and when it may begin. Before you make your decision, be sure you fully understand the requirements for premium subsidy eligibility.

Deferred vs. Early Reduced Retirement

If you're between ages 55 and 60 and leaving public school employment, you might face a choice between taking an early reduced retirement or deferring your retirement until you meet age eligibility. Your choice could affect your eligibility for an insurance premium subsidy and when it may begin. View this module to learn more about these options.

Running time: 7:45

Summer Birthday Provision

Suppose you were born in July, August, or September, expect to terminate employment in June, and you want to take an early reduced rather than a deferred retirement. Suppose that as of your birthdate you'll meet all the requirements for an early reduced pension, but as of your termination date you won't be old enough. To prevent a penalty for those who stop working when school ends in June but whose birthday falls in a summer month, a special provision applies.

If you're applying for a full retirement (other than the MIP 60 with 5) or an early reduced retirement, and your 46th, 55th, or 60th birthday falls in July, August, or September, we'll consider you an active (not deferred) member if you meet both of the following conditions:

- You're a regularly employed 10-month employee who does not normally work during the summer months (substitute employees and those employed on an irregular basis do not qualify) and

- You file your retirement application before the end of the school year preceding the summer in which your birthday occurs.

In a summer birthday situation, your retirement effective date will be the first day of the month following your birthday in which you reach the required age to satisfy the full or early reduced retirement provision, as displayed below.

Example: If your qualifying birthday is in August, your retirement effective date would be Sept. 1.

Retirement Provision

MIP

Qualifying Birthday: 46th (with 30 YOS) OR 60th (with 10 YOS)

Basic Plan

Qualifying Birthday: 55th (with 30 YOS) OR 60th (with 10 YOS)

Early reduced (MIP or Basic Plan)

Qualifying Birthday: 55th (with at least 15 YOS)

Summer Birthday Provision

Is your birthday in July, August, or September? Do you want to know how that affects when you can you retire? View this module to learn about the summer birthday provision.

Running time: 6:00

Your Retirement Effective Date

Your retirement effective date is the first day of the month following the month in which you satisfy the eligibility requirements, and you terminate employment in Michigan public schools.

You cannot work for a participating Michigan public school or college, even as a volunteer, in the month of your retirement effective date. Additionally, if you anticipate working for the State of Michigan in the month of your retirement effective date, other restrictions could apply. Contact ORS for details before completing your retirement application.

You must have a bona fide termination of employment before your retirement effective date. A bona fide termination is a complete severing of your employee-employer relationship, and you cannot have a promise of reemployment or a contract for future employment in place before your termination of employment.

You must submit your retirement application forms and any required documentation before we can make an eligibility determination. At that time, we'll also review your eligibility for an insurance premium subsidy.

Note: You'll be able to enroll in the plan's health, dental, prescription drug, and vision insurance as of your retirement effective date. However, if you purchased service credit July 1, 2008, or later, the date you'll be eligible for an insurance premium subsidy could be later. See Your Insurance Benefits for details.

Counting Other Michigan Government Public Service

Public Act 88 — Reciprocal Retirement Act of 1961 helps public servants who have worked either full time or part time for more than one Michigan governmental unit but perhaps fall short of pension eligibility with any or all of them. Combining years of service from multiple employers can help you qualify for a pension, but the other service won't count in the calculation of your pension amount. Public Act 88 of 1961 can't be used to qualify someone for survivor or disability benefits; it can only be used for a regular retirement pension.

For more information, visit Service Credit: Earnings and Purchasing.

If You Become Disabled

If you become totally and permanently disabled while a public school employee and you do not meet the age and service requirements for a full retirement, you may qualify for a disability retirement. Keep in mind, your disability application must be received within 12 months after terminating public school employment (unless there are extenuating circumstances). For more information, see Disability Benefits.