The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Enrollment: When Coverage Begins

Enrollment: When Coverage Begins

Your timelines and enrollment process will depend on whether you, your spouse, and eligible dependents are:

Enrolling at retirement

Retiree coverage for yourself, your spouse, and dependents can begin on your retirement effective date or up to 90 days past your retirement date if you'll have insurance coverage with your school employer after you retire. Make sure you determine the correct effective date and submit your enrollment request and proofs in a timely manner so you don't have a lapse in your coverage and you won't be duplicating coverage. Check with your school employer to find out when your present insurance plan(s) will terminate and review the timely application and proofs section. Determining the correct effective date is very important because we can't refund any premiums once they've been withheld from your pension.

Personal Healthcare Fund (PHF)

If you have the PHF and you want to enroll in the retirement system's insurance plans, you must enroll at retirement.

Timeline for your enrollment effective date at retirement

To ensure your coverage begins on your requested insurance enrollment date, follow these guidelines for submitting your insurance enrollment and required proofs to the Michigan Office of Retirement Services (ORS).

Health insurance and prescription drug coverage: To ensure your health and prescription drug insurance enrollment begins on your requested insurance enrollment date, follow these guidelines for submitting your enrollment request and required proofs.

- Non-Medicare: If we receive your enrollment request and all required proofs the month before your retirement effective date, your insurance coverage can begin on your retirement effective date. If we receive your enrollment request and all required proofs in the month of your retirement effective date, your coverage can begin the first of the following month. If we receive your enrollment request and all required proofs more than 30 days after your retirement effective date, your coverage will begin the first of the sixth month after we receive your enrollment request and all required proofs.

- Medicare: If we receive your enrollment request and all required proofs more than one month before your retirement effective date, your insurance can begin on your retirement effective date. If we receive your enrollment request and all required proofs in the month before your retirement effective date, your coverage will begin the first of the second month. If we receive your enrollment request and all required proofs within 30 days of your retirement effective date, your coverage will begin the first of the second month. If we receive your enrollment request and all required proofs more than 30 days from your retirement effective date, your coverage will begin the first of the sixth month after we receive your enrollment request and proofs.

Dental and vision coverage: For all applicants, your dental and vision insurance coverage can begin the first of the month after we receive your enrollment request and proofs.

If you have a retroactive retirement date

Insurance enrollments are not retroactive. Coverage can begin no earlier than the first day of the month after we receive your enrollment request and required proofs for non-Medicare enrollees and will begin no earlier than the first of the second month if the enrollee is on Medicare. This applies even if your retirement effective date is retroactive.

For disability retirees

If you're a disability pension recipient, insurance coverage will begin on your retirement effective date or the first of the month following approval of your disability, whichever is later.

Enrolling after retirement

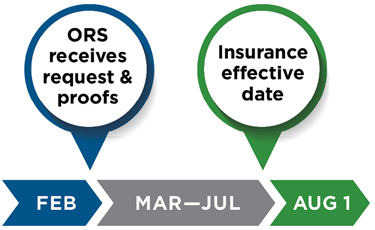

If you have the premium subsidy benefit and are enrolling yourself, your spouse, or dependents in insurance after retirement, your coverage will begin on the first day of the sixth month after ORS receives all required forms and proofs (unless you have a qualifying event). For example, if we receive your Insurance Enrollment/Change Request (R0452C) form with proofs Feb. 10, your coverage will begin Aug. 1 (see timeline below).

PHF

If you have the PHF, you cannot enroll in any retirement system insurance plan after your retirement effective date.

If you aren't sure whether you have the PHF or the premium subsidy benefit, log in to miAccount and refer to your Account Summary.

Timeline for enrollment without a qualifying event

If you have a qualifying event

If you, your spouse, or an eligible dependent have a qualifying event (such as change in family status or involuntary loss of other group coverage), and you have the premium subsidy benefit, your coverage can begin as early as the first of the month after we receive your enrollment request and required proofs. Refer to the timely application and proofs section for more details on required time frames.

If you have the PHF, you cannot enroll in any retirement system insurance plan after your retirement effective date.

ORS must receive your completed enrollment request and proofs within 30 days of the qualifying event. If you do not meet this time frame, your insurance coverage will begin the first day of the sixth month from the date we received your completed enrollment request and proofs.

If ORS receives your completed enrollment request and proofs within 30 days of the qualifying event, and you meet other eligibility requirements, your insurance start date depends on if you have Medicare, and when you submit your request and proofs to ORS.

Non-Medicare: For retirees who do not have Medicare, coverage can begin the first of the month after we receive your completed enrollment request and proofs. For example, if ORS receives your enrollment request and proofs July 10, your coverage will begin Aug. 1.

Medicare: For retirees with Medicare, your coverage can begin the first of the second month after we receive your enrollment request and proof of the qualifying event. For example, if ORS receives your enrollment request and proofs of the qualifying event July 10, your coverage will begin Sept. 1. Learn more about how Medicare works with your coverage.

Qualifying Event Examples

The following are considered qualifying events for the purpose of adding or removing a dependent. You'll need to provide proof of the qualifying event. Photocopies of proofs are preferred because we will not return originals. See the Proofs Required for Insurance Coverage table below for more details.

- Involuntary loss of coverage in another group plan. Provide a statement on letterhead from the terminating group insurance plan explaining who was covered, what type of coverage it was, why coverage is ending, and the date coverage ends.

- Adoption. Acceptable proof is adoption papers. See Dependent Coverage for more information.

- Birth. Acceptable proof is a government-issued birth certificate.

- Divorce. For enrollment, provide a statement on letterhead from the terminating group insurance plan explaining who was covered, what type of coverage it was, why coverage is ending, and the date coverage ends. For disenrolling a former spouse, no proof is needed.

- Marriage. Acceptable proofs are a government-issued marriage certificate and your spouse's government-issued birth certificate — both are needed.

- Medicare Part B enrollment. Acceptable proof is a letter from the Social Security Administration showing confirmation of Part B enrollment. This qualifying event applies if the enrollee was previously terminated or denied enrollment in the retirement system's insurance plans because they did not have Part B coverage.

If you're changing insurance coverage, ORS will adjust your premiums, if needed, the month your new insurance becomes effective. We cannot refund premiums withheld before or in the month you report the change. If you're adding a spouse or dependent due to marriage, birth, or adoption, be sure to submit your enrollment request and proofs within 30 days of the event or their coverage will begin on the first day of the sixth month after ORS receives the required forms and proofs.

Non-Qualifying Events

The following examples are not considered qualifying events for the purpose of adding or removing a spouse or dependent:

- Dropping other coverage because premiums increase.

- Receiving a stipend in lieu of coverage.

- Termination of coverage for failure to pay your premiums.

- Lapse of coverage due to late enrollment in Medicare.

Changing plans

If you're currently enrolled in any health insurance plan with the retirement system, you can change your enrollment to another plan regardless of your Medicare status. Your change in coverage will be the first day of the second month after we receive your enrollment request and required proofs. For example, if ORS receives your change request and required proofs Jan. 10, your coverage with the new plan will begin March 1.

Required Proofs for Enrollment

Send photocopies. Do not mail in original documents; they will not be returned.

If you want to ...

Enroll your spouse in insurance, you must have:

- Government-issued marriage certificate and your spouse's government-issued birth certificate, or valid passport, or valid driver's license, or valid state ID.

- If enrolled in Medicare or other insurance plan you must have:

- Medicare information:

- Medicare number.

- Medicare effective dates.

- Insurance plan information, including:

- Policy number.

- Type of coverage (health, dental, vision, prescription drug).

- Who is enrolled.

- Medicare information:

Enroll your dependent in insurance (under age 26), you must have:

- Government-issued birth certificate for each dependent.

- If you're the adoptive parent you must have a sworn statement with the date of placement or a court order verifying placement is required.

- If you're the legal guardian you must have court orders to prove guardianship.

- If enrolled in Medicare or other insurance plan you must have:

- Medicare information:

- Medicare number.

- Medicare effective dates.

- Insurance plan information, including:

- Policy number.

- Type of coverage (health, dental, vision, prescription drug).

- Who is enrolled.

- Medicare information:

- Government-issued birth certificate for each dependent.

- Current letter from the attending physician detailing the disability, stating the child is:

- Totally and permanently disabled, and

- Incapable of self-sustaining employment.

- IRS Form 1040 that identifies the child as your dependent.

- If you're the adoptive parent you must have a sworn statement with the date of placement or a court order verifying placement is required.

- If you're the legal guardian you must have court orders to prove guardianship.

- If enrolled in Medicare or other insurance plan you must have:

- Medicare information:

- Medicare number.

- Medicare effective dates.

- Insurance plan information, including:

- Policy number.

- Type of coverage (health, dental, vision, prescription drug).

- Who is enrolled.

Enroll your disabled dependent in insurance, you must have:

Prove your involuntary loss of coverage, verifying your qualifying event, you must have a statement on letterhead from the terminating group insurance plan explaining:

- Who was covered.

- What type of coverage it was.

- Why coverage is ending.

- Date the coverage ends.

Enroll your dependent parent(s) or parent(s)-in-law in insurance, you must have:

-

Proof of age for your parent(s) or parent(s)-in-law. Only one of the following is required:

- Government-issued birth certificate, or

- Valid driver's license, or

- Valid state-issued ID, or

- Valid passport.

- Proof of residency, in the parent or parent-in-law's name. Only one of the following is required:

- 1099/1098 tax form for previous year, or

- Current voter registration card, or

- Valid driver's license, or

- Valid state-issued ID.

Insurance coverage always begins on the first day of a month. |