The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

10.04.02: Submitting Detail 3 (DTL3) records

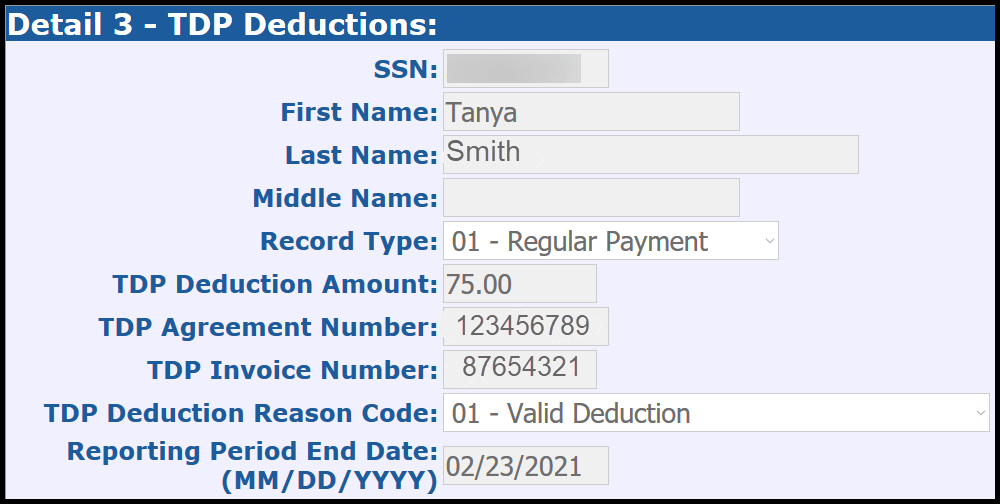

Detail 3 (DTL3) records report tax-deferred payment (TDP) deductions for your employees to ORS and can be uploaded to ORS within your payroll reports with the remainder of your DTL records. The DTL3 record includes the employee's Social Security number, name, record type, deduction amount, agreement number, invoice number, deduction reason code, and the reporting period end date. You will only submit DTL3 records for employees who have active or open TDP agreements with your reporting unit.