The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

10.04.04: TDP deduction codes

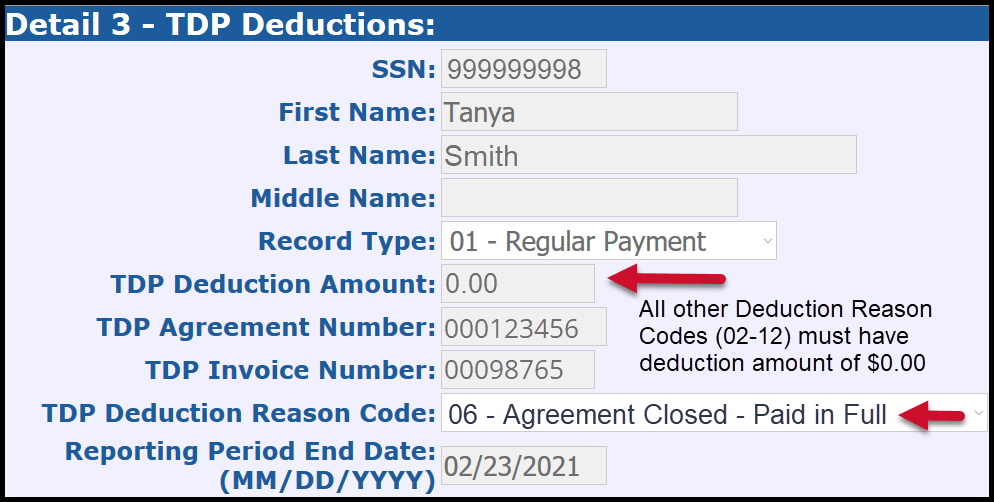

Tax-deferred payment (TDP) deduction reason codes indicate either that you are submitting a payment or the reason you're not submitting a payment. It is important to use the correct TDP deduction reason code each time you submit a DTL3 record. See section 13.03: Detail 3 records – TDP adjustment record type codes and deduction reason codes for a complete listing of these codes.

Note the following about TDP deduction reason codes:

- Records reporting a dollar amount in the TDP deduction amount field will always use the deduction code 01 – even if it's the final deduction or a TDP adjustment.

- Records reporting deduction code 02 starts the 90-day window the employee must transfer the agreement/addendum to a new employer.

- Records reporting deduction codes 04, 05, and 06 indicate that there will be no more deductions. Report one of these codes once with a $0 and then permanently remove the record from your report.

- Records reporting a deduction code 06 will always suspend. The error message returned will either confirm that the TDP agreement is paid in full, or it will inform you that a balance remains. If there is a balance due, you may use the View Employee Info page for the posted history of payments or request a TDP history from ORS to verify posted payments. The Download TDP Agreement Details link listed under View Employee Info will indicate the remaining balance on an employee's billing.

- Records reporting deduction codes 07, 08, 09, and 10 indicate an unpaid leave of absence. Continue to submit DTL3 records with one of these codes for the duration of the employee's leave of absence. When the employee returns to work, you should start using the regular 01 deduction code with a dollar amount.

Last updated: 04/13/2012