The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

2.01: The Employer Reporting website

The Employer Reporting website is your tool for reporting the required information for each of your employees. With each pay cycle report, your reporting unit will transfer or upload employee data from your record system onto ours via this website. The per-pay-period reporting keeps each member's retirement account up to date.

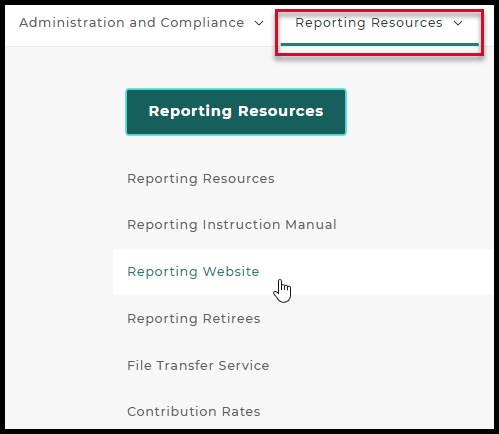

A link to the Employer Reporting website can be found under the Reporting Resources navigation tab at the top of this website.

You may wish to make this link a favorite or bookmark on your web browser. The site is available seven days a week from 5:00 a.m. to 10:29 p.m.

You will use the Employer Reporting website to do the following tasks, depending on your access level:

- Create and manage reporting unit web user accounts.

- Submit, review, correct, and accept retirement detail reports.

- View important messages for your reporting unit.

- Review previously reported and posted retirement detail transactions for individual employees.

- Review your employees' tax-deferred payment balances.

- Update employer contact information.

- Review Defined Benefit and Defined Contribution employer statements.

- Access the DC Feedback File.

- Verify a member's benefit plan.

- Submit final payroll details for retirement applicants.

- Make a payment to ORS.

The procedure for logging in to the Employer Reporting website for the first time depends on the type of web user you are. If you are not sure what type of web user you are, see section 1.03.01: Web user account types for more information.

For Web Administrators and Payment Processors, ORS creates the account and provides the user a temporary password. For Employer Reporting and Member Inquiry, the user or the Web Administrator can create the User ID and the password. See the following sections for detailed instructions for creating an account:

- 12.02: Creating a web user account and ID (for Employer Reporting or Member Inquiry)

- 12.06: Creating a Payment Processor account

- 12.05: Forgotten MILogin User ID and Password

Last updated: 09/14/2015