The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

8.02: Payment due dates and late fees

8.02: Payment due dates and late fees

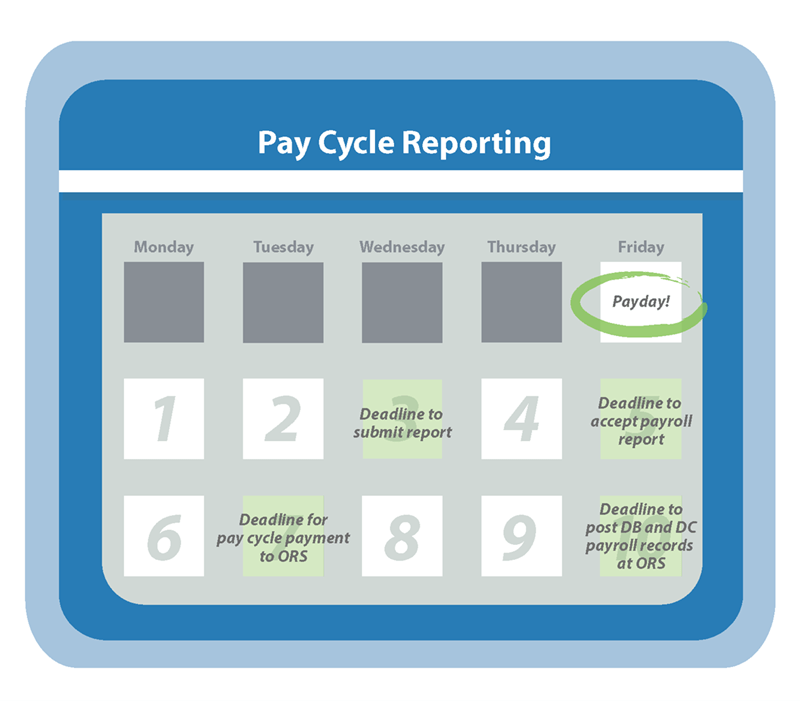

ORS has designated a schedule of payment due dates based on payroll cycle dates. Failure to submit payment by the due date will result in late fees and interest charges. The retirement statute, Public Act 300 of 1980, specifically MCL 38.1342(7), provides for the assessment of interest and late fees to be charged to any reporting unit that fails to submit contributions or reports/records by the established due date.

The reporting unit is responsible for sending the correct member contributions to ORS regardless of the amount withheld from the members' wages or workers' compensation payments. Corrections to member contributions should be handled directly with your employees. The reporting unit is also responsible for sending correct employer contributions. The amount calculated by ORS from your payroll report is available on the download detail. See section 7.01.08: Using the Download Detail link for more information.

Note: Some payments to employees are not reportable compensation. See section 4.03: Nonreportable compensation for more information.

Last updated: 04/01/2015