The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

8.04.02: The Pay Cycle Statement

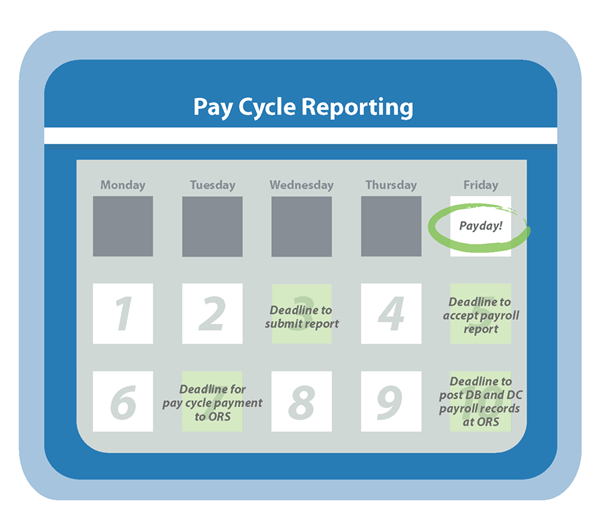

Use the Pay Cycle Statement between day 7 and day 10 of the pay cycle calendar to determine the balance due to ORS.

The Pay Cycle Statement shows what has been calculated for Defined Benefit (DB) and Defined Contribution (DC) member and employer contributions, tax-deferred payments and, once per month, the UAAL Rate Stabilization Payment amount for the statement period displayed on the statement.

The Pay Cycle Statement gives you the DB and DC balances due to ORS on the 7th state of Michigan business day following the end date of a payroll report.

The data on the statement from the Beginning Balance through Retirement Contributions Due is locked on day 7 and will not change. The ACH Payments Received link, Balance Due, Pending ACH Payments, and Balance Due After Pending Payments remain unlocked until day 10 to accommodate status changes in payments made to ORS on day 7.

On day 10, the entire statement is locked and the lines for Pending ACH Payments and Balance Due After Pending Payments is removed.

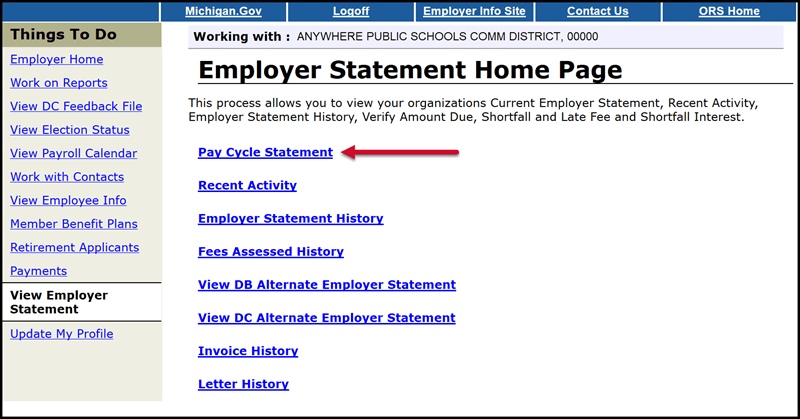

To view the Pay Cycle Statement, log in to the Employer Reporting website, and from the Things to Do left navigation menu click the View Employer Statement link. Then on the Employer Statement Home Page click on the Pay Cycle Statement link.

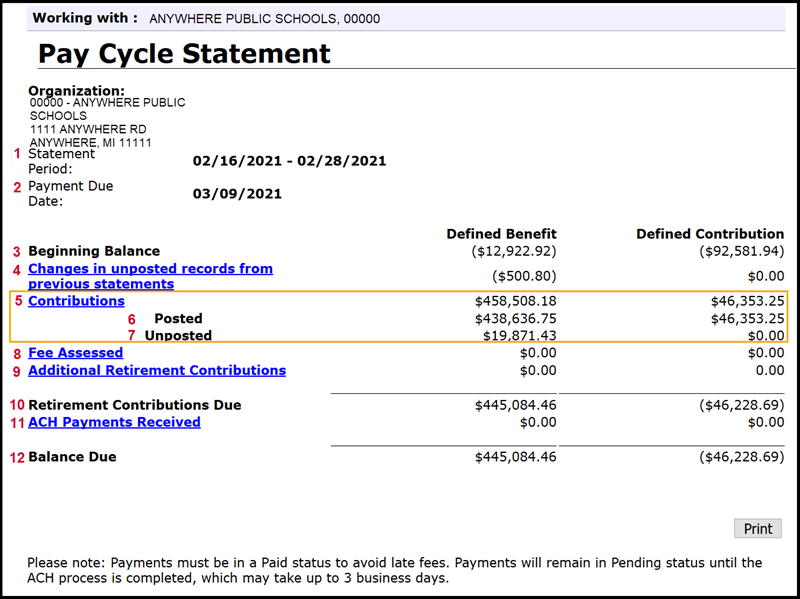

The Pay Cycle Statement after day 10 displays the following:

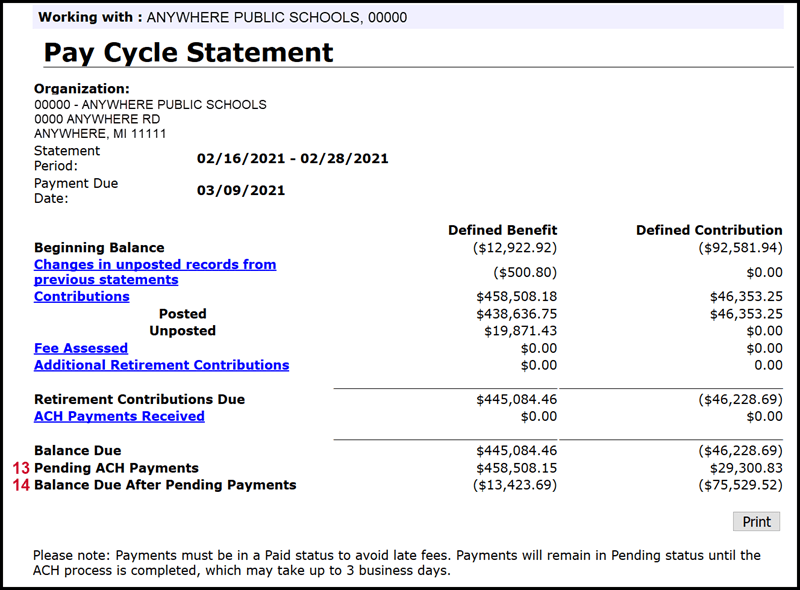

Statement on day 7, but prior to day 10: additional data at the bottom of the form for Pending ACH Payments and Balance Due After Pending Payments. See items 13 and 14.

- Statement Period: The begin and end date of the submitted payroll report that has reached day 7 of the pay cycle.

- Payment Due Date: The payment deadline, day 7 of the pay cycle, for which payment for the report is due to ORS.

- Beginning Balance: The balance due or credit balance carried forward from the previous Pay Cycle Statement.

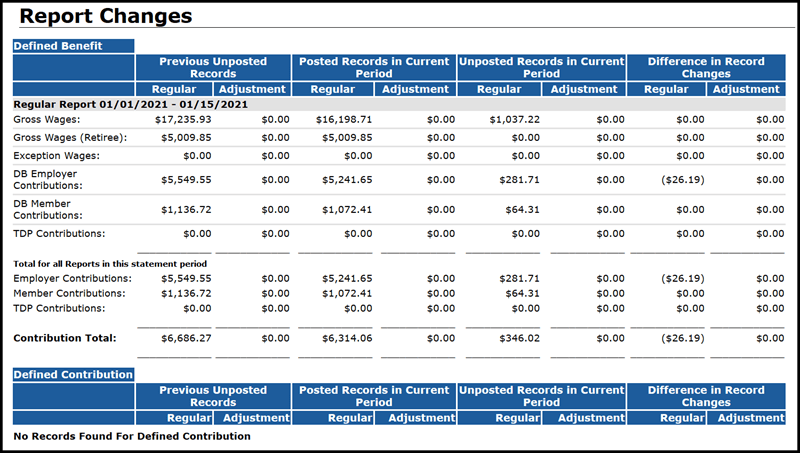

- Changes in unposted records from previous statements: Any credit balance or balance due appearing on this line is from contributions calculated for a now posted DTL2 or DTL4 record(s) that was unposted on a payroll report previous to the current statement period. Click the link to view from which pay period(s) these now posted records have posted and to see any credit or balance due. The information listed does not display individual member information, it displays total contribution amounts. Here's an example of DB report changes that may display on this line (the screen will also include DC information if DTL4 records have posted):

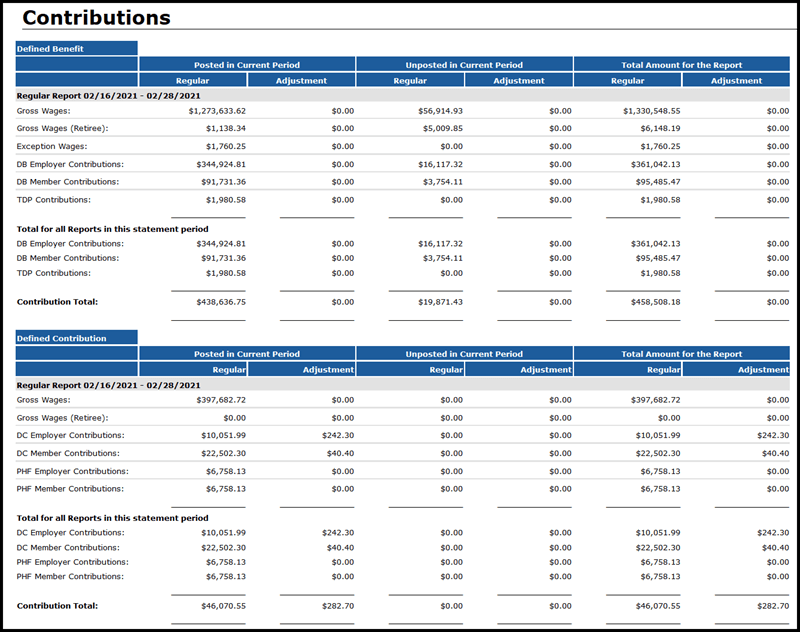

- Contributions: Contributions on this line are the total DB and DC amounts as of day 7 of the pay cycle for the statement period. (This total consists of Posted and Unposted contribution amounts, see numbers six and seven below for more.) Click the link to see a breakdown of contribution totals. Example of the screen:

- Posted: This amount reflects the ORS calculated contribution total for posted DTL2 and DTL4 records. (The total amount calculated may, or may not, match the contributions reported by the RU on the actual DTL2 and DTL4 records.)

- Unposted: This amount reflects the contribution amount reported on the DTL2 and DTL4 records submitted by the reporting unit. This amount may, or may not, match the amount calculated by ORS, but it is the amount due to ORS on day 7. When these unposted records eventually post at the ORS-calculated contribution amount, any amount under- or over- reported by the reporting unit on the originally submitted report will be reflected on the Pay Cycle Statement for the statement period in place when the records post. (Changes will show on Pay Cycle Statement, the Changes in unposted records from previous statements link. See number four above.)

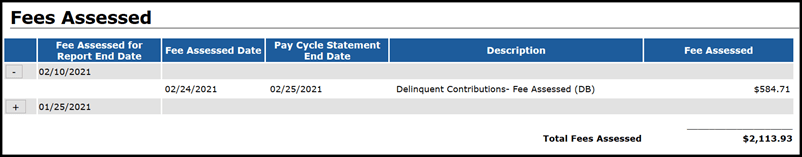

- Fee Assessed: This shows the amount of any fees and/or interest due resulting from delinquent contributions and incomplete reports. Click the link to see the date the fee(s) was assessed, the report date for which the fee was assessed, the Pay Cycle Statement end date, description of the fees/interest, and the dollar amount for each. Example:

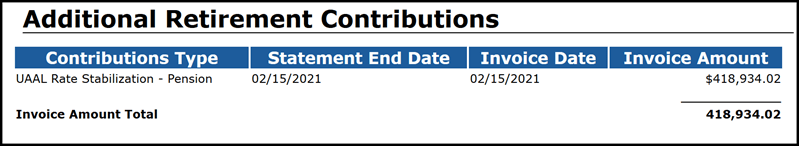

- Additional Retirement Contributions: This is where ORS shows the monthly UAAL Rate Stabilization invoice information. The due date for this payment always coincides with the payment due date for a regular payroll report so it is included on the Pay Cycle Statement once per month (except September and October, and only in November for nine libraries). Click the link to see the invoice data. Example:

- Retirement Contributions Due: Total DB and DC amounts due to ORS on day 7 of the pay cycle.

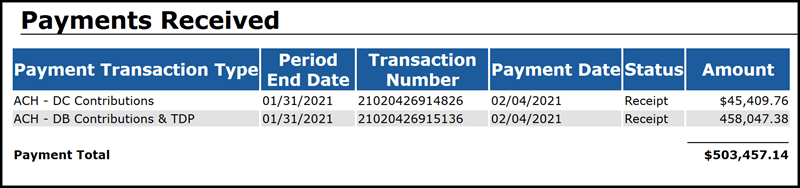

- ACH Payments Received: This reflects any payment received by ORS within the pay cycle of the previous statement period. Click the link to see payment transaction type, period end date, transaction number, payment date, status, and amounts. (This amount can change up through day 10 of the pay cycle if pending payments made by day 7 change to Paid status by day 10.) Example:

- Balance Due: Displays any balance due or credit to the reporting unit as of day 7. Any balance due of $100 or more that is unpaid will generate late fees. Payment of any remaining balance can be made to ORS on day 7 and will be applied effective that day. (This amount can change up through day 10 of the pay cycle if pending payments made by day 7 change to Paid status by day 10.)

- Pending ACH Payments: (Displays only on statements prior to day 10 of the pay cycle.) Shows any payment made to ORS by day 7 but still in Pending status. If payment is changed to Paid status by day 10 the line will update. This line will be locked on day 10 of the cycle.

- Balance Due After Pending Payments: (Displays only on statements prior to day 10 of the pay cycle.) Shows any balance due after applying any payment still in Pending status. This line will be removed on day 10.

Last updated: 06/19/2019