The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

8.03.04: How to complete the UAAL Remittance Advice Form for Universities (Non-Member/Non-ORP)

8.03.04: How to complete the UAAL Remittance Advice Form for Universities (Non-Member/Non-ORP)

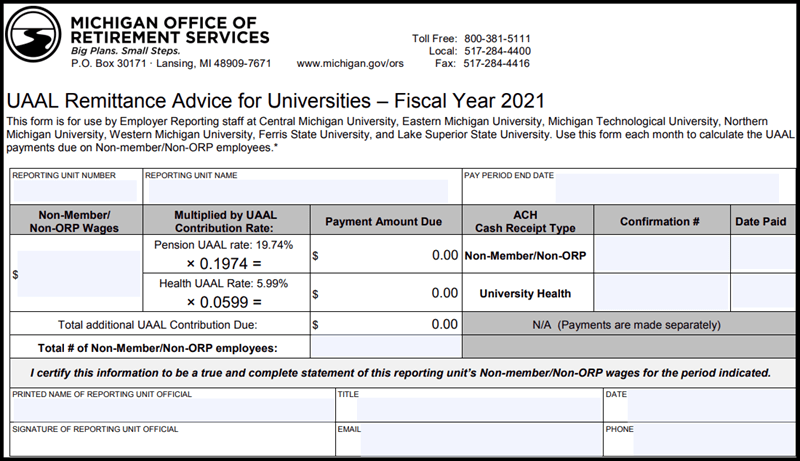

When submitting payments for universities, use the R0411C University Remittance Advice to calculate and record payments remitted for unfunded actuarial accrued liability (UAAL) contributions that universities owe on non-members/non-ORP employees.* Because the form now calculates required payment amounts for you, we recommend that you complete the form online before printing it.

To complete the UAAL Remittance Advice for Universities:

- Complete the first line of the form with your reporting unit information.

- Enter the non-member/non-ORP* wages for the pay period. Hit Enter or Tab.

- The amounts due for both pension UAAL and health UAAL are calculated based on the wages entered. (The total amount due is calculated for your records; neither ORS nor DTMB Financial Services uses this figure.)

- Make a payment for each amount, using the receipt type indicated on the form. Write down the Automated Clearing House (ACH) confirmation numbers. For more information, see section 8.03.02: How to make a payment.

- Enter the ACH confirmation numbers and the date paid for each amount on the form where indicated.

- Enter the total number of non-member/non-ORP employees where indicated.

- Complete the last two lines.

- Print and sign the form.

- Fax or email a scanned copy of the completed, signed form as directed at the bottom of the form.

*Non-member/non-ORP employees are individuals hired on or after Jan. 1, 1996 (excluding full-time faculty and full-time administrators), who would have been required to be a MPSERS member if not for the enactment of Public Act (PA) 272 of 1995. See PA 488 of 1996 for more information about this definition.

Last updated: 12/12/2014