The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

8.02.03: Incomplete reports and fees

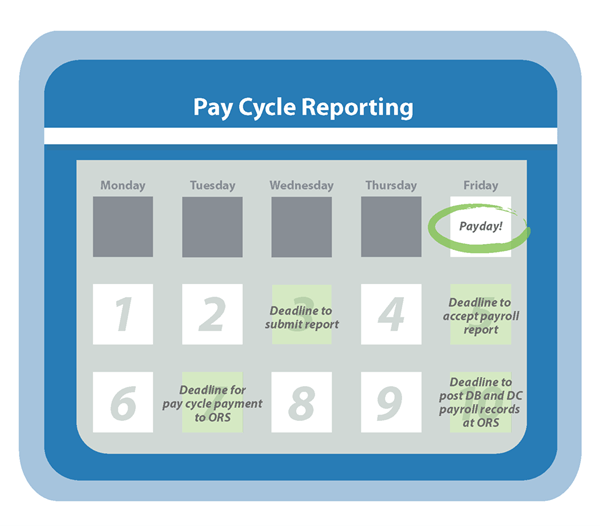

Reporting units must accept their retirement reports by the 5th state of Michigan business day after the related pay period end date. See the list of ORS Non-Business Days.

The retirement statute, Public Act 300 of 1980, specifically MCL 38.1342(7), requires ORS to charge a fee on incomplete retirement reports. Any employer with retirement reports that are not accepted by the due date are considered incomplete and will be assessed a $50 fee the day after the report was due. For every pay cycle that a retirement report is incomplete an additional $50 fee will be assessed.

To ensure you receive all email notifications, including those indicating you have been assessed a fee, make sure you maintain reporting unit contact information. See sections 12.03: Updating your user account and 12.11: Maintaining business contact information for more information.

Last updated: 09/03/2015