The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Adding to Your Service Credit

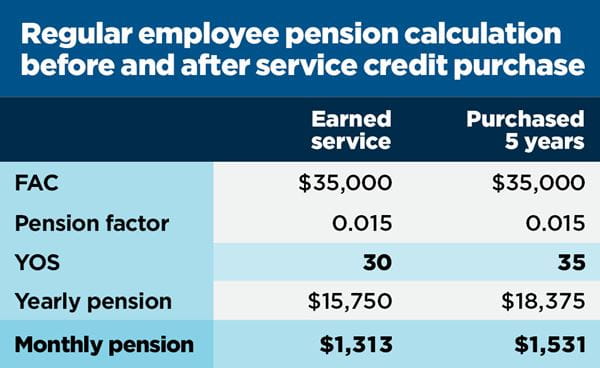

As you know, the longer you work under the Defined Benefit (DB) Plan, the higher your pension will be.

But there are other ways to increase the years of service factor in your pension calculation. Service credit for certain other employment may be granted or transferred. Service credit may be purchased. And service credit may be restored if you withdrew your personal contributions to the system after a prior period of state employment and wish to repay the full amount withdrawn, with interest.

General rules for service credit purchases.

Each type of service credit has specific rules, costs, and applications, which we describe by type in Types of Service Credit. Before you dig into the details, though, read the following tips so you're ready to make what can be a complicated and costly decision.

-

You must be an active, contributing member. Any service credit purchase or transfer must be initiated while you are an active, contributing member. The purchase must be completed before you terminate employment from the state or one of its noncentral agencies. Credit can never be purchased after you've stopped working within the retirement system.

You remain an active member as long as an employee-employer relationship exists. (You may be asked to provide verification of your approved leave of absence.)

-

Purchased service may not count toward vesting requirements. Some service credit transfers, purchases, and repayments help you reach vesting status; others do not. You are vested when you have sufficient service to qualify for a future monthly benefit, whether or not you continue working for the state. Most state employees are vested after the full-time equivalent of 10 years. (Some unclassified legislative employees, executive branch employees, and Department of Community Health employees involved in a facility closure are vested with 5 years.)

-

You must be vested for your purchase to count. Unless otherwise noted, most purchases won't count in your service credit total until you are vested. However, you don't have to be vested before purchasing service.

-

No double-dipping. When you get credit for other service, whether granted or purchased, you typically have to give up your rights to any benefit that would have been payable under the other pension system.

-

Purchasing earlier in your career is usually cheaper. The cost for many types of service credit is based on your age at the time of purchase, as well as your highest previous fiscal year earnings. Other service credit types may include accumulated interest in the cost. Keep this in mind if you're deciding when to purchase service credit.

Your purchases are personal contributions.

Your payments for service credit are put into a personal contribution account, separate from retirement system funds, along with any personal contributions from your earnings during the contributory period of the retirement system (before July 1, 1974, or after March 31, 2012). Interest is credited annually on member contributions that have been on deposit for a full year.

If you die before reaching retirement eligibility and have personal contributions remaining in your account, any balance is paid to your beneficiary. While you're an active state employee, use the Beneficiary Nomination (R0400G) form to let the Michigan Office of Retirement Services know who should receive the balance of your contributions (or, if you're vested, a monthly survivor pension).

Weigh your cost versus benefit.

"Buying time" isn't always an easy decision. You have to weigh the cost, which can be considerable, with the benefits. Fortunately, there's a terrific tool to help you decide the benefits: our online calculator. Once you know the cost of the credit you're considering, log in to our Benefit Estimator. You can enter any number of "what-if" scenarios, and the program will give you a pension estimate, quickly and easily.