The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Service Credit - Earning and Purchasing

As a contributing member of the state employees' Defined Benefit (DB) Plan, you accumulate service credit for each pay period in which you work.

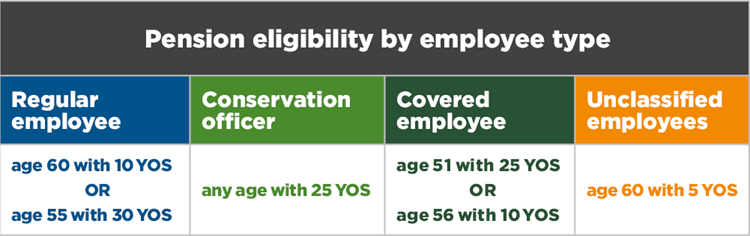

Service credit is important, because your eligibility for your pension depends on how many years of service (YOS) you have. Most members need 30 YOS to be able to retire at age 55.

In addition, your pension amount is calculated using your YOS in the DB Plan. Most members will receive a benefit that multiplies their final average compensation by 1.5% times their years of credited service.

Service Determines Eligibility and Payment Amount

- Mr. Simpson is 60 years old. He has worked for the state for 24 years, earning around $35,000 each year for the last several years.

- Mr. Simpson is eligible for his pension because he meets the age and years of service eligibility requirements.

- Mr. Simpson's yearly pension amount will be $35,000 times 1.5% times his 24 YOS.

Some categories of plan members have different eligibility and calculation rules. To find out how much service credit you'll need or how your benefit will be calculated, see Retirement at a Glance