The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

ORS State Employees' Retirement System - Defined Benefit

Welcome

Welcome to the Michigan Office of Retirement Services (ORS) website for State of Michigan employees who are in the Defined Benefit (DB) Plan.

You’re a member of the Defined Benefit (DB) Plan if you were hired before March 31, 1997, and you made one of the following elections under Public Act (PA) 264 of 2011:

- The DB Classified Plan.

- The DB 30 option. You elected to stay in the DB Plan until 30 years of service and then you will switch to the DC Plan for future service. Use this website to learn about your pension and healthcare benefits. Your pension will be based on your service credit and salary earned before you switched to the DC Plan.

- The DB/DC Blend option. You switched to the DC Plan on April 1, 2012. Use this website to learn about your pension and healthcare benefits. Your pension will be based on your service credit and salary earned before April 1, 2012.

The retirement system provides competitive retirement and healthcare benefits and encourages you to take full advantage of them to plan for your future retirement. ORS manages the retirement system carefully to preserve it for you, your beneficiaries, and other future retirees.

During your career, details from your biweekly payroll are reported to ORS. Your pension plan contributions, wages earned, and hours paid while a member of the DB Plan become part of your personal pension record.

You also can enroll in the State of Michigan 401(k) and 457 Plans (the Plans) to help supplement your pension with additional tax-deferred retirement savings. ORS administers the Plans while Voya Financial takes care of the daily management.

When you are eligible and ready, you’ll apply for retirement with ORS. Your final wage information will be reported. ORS will become your partner in retirement.

What's New

Social Security webinars offered in January

The Social Security Administration is partnering with the Michigan Office of Retirement Services to offer free webinars in January 2026.

Focused on helping you better understand Social Security and Medicare benefits, the four one-hour sessions will provide information on benefits for spouses and divorced spouses, factors in determining the right time to file, and how you can work and collect benefits. In addition, the Q&A sessions will detail when to apply for widow(er) benefits.

To register for the webinars:

- Tuesday, Jan. 13, 2026, noon-1 p.m. EST. (Registration link)

- Wednesday, Jan. 14, 2026, 3 p.m.-4 p.m. EST. (Registration link)

- Thursday, Jan. 15, 2026, 11 a.m.-noon EST. (Registration link)

- Tuesday, Jan. 20, 2026, 9 a.m.-10 a.m. EST. (Registration link)

- Tuesday, Jan. 20, 2026, 6 p.m.-7 p.m. EST. (Registration link)

ORS receives the 2025 Leadership Award for Holistic Financial Wellness

The Michigan Office of Retirement Services (ORS) has received the 2025 Leadership Award for Holistic Financial Wellness from the National Association of Government Defined Contribution Administrators.

ORS was recognized for its How Do I … ? campaign that provided participants in the State of Michigan 401(k) and 457 Plans with targeted communications about their retirement plans and retirement healthcare benefits. The effort encouraged engagement and interactions with Plans administrator Voya Financial as well as ORS.

ORS was one of five public plan administrators honored in the Holistic Financial Wellness category, with 17 others recognized in four other categories. The award celebrates the brightest ideas and most innovative solutions from across the public sector defined contribution industry.

ORS named 2025 Savings Champion by America Saves

The Michigan Office of Retirement Services (ORS) is a 2025 Savings Champion award recipient from America Saves.

ORS was honored for effectively and actively promoting savings strategies during America Saves Week, which ran April 6-12, 2025, during Financial Literacy Month. ORS was one of 18 organizations recognized out of more than 5,000 participants and one of only seven to receive the award consecutively.

During America Saves Week, ORS highlighted encouraged individuals to stay focused on personal finances, retirement savings, and long-term goals — regardless of market influence. ORS emphasized the importance of having a financial plan, making timely adjustments, reviewing savings regularly, and preparing for both short-term challenges and future needs. Whether just starting out or approaching retirement, staying the course and adapting when necessary remain key to financial stability.

ORS named America Saves Savings Champion

The Michigan Office of Retirement Services (ORS) is a 2024 Savings Champion Award recipient from America Saves.

ORS was honored for effectively and actively promoting savings strategies during America Saves Week, which ran April 8-12, 2024, during Financial Literacy Month. ORS was 1 of 18 organizations recognized out of 4,600-plus participants.

During America Saves Week, ORS highlighted savings strategies that help with retirement savings and urged saving for what matters most. You can do that by saving automatically, for the unexpected, for major milestones, and at any age. Also, realize that paying down debt is saving.

ORS named 2024 Plan Sponsor of the Year

Changes to Insurance Eligibility for Children

Public Act 158 of 2023 will take effect on Feb. 13, 2024. The new law allows for a child to remain on retiree insurance until the month in which that child turns 26, regardless of enrollment in post-secondary education or dependency status for tax purposes. For more information, please see Dependent Coverage.

If you wish to enroll a child who is now eligible as a result of this change, you may do so as soon as March 1, 2024, by completing and submitting an Insurance Enrollment/Change Request (R0452G) and all required proofs on or before Feb. 29, 2024. When ORS receives your enrollment request and required proofs, coverage will be effective the first of the following month, if your request is received prior to Sept. 1, 2024. If ORS receives your enrollment request and required proofs on or after Sept. 1, 2024, coverage will start the first of the sixth month after receipt.

Published Feb. 5, 2024

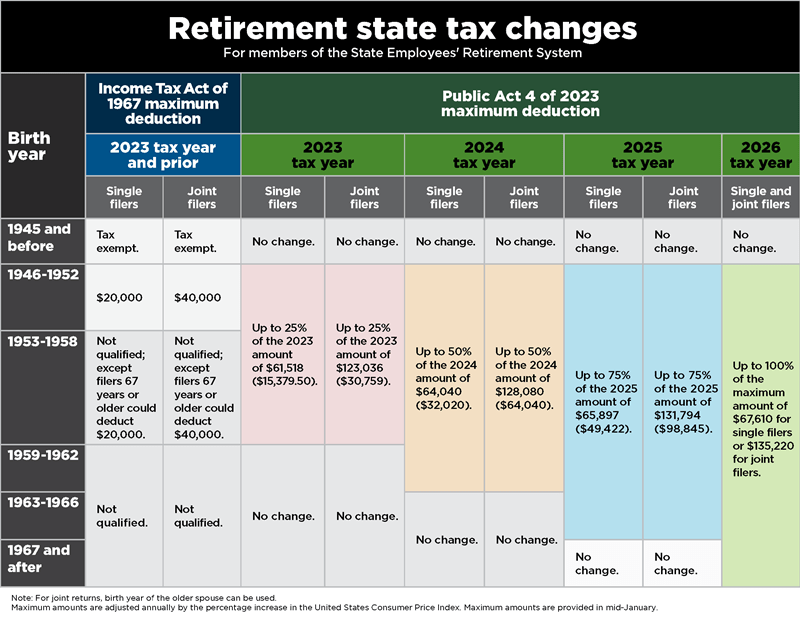

Public Act 4 of 2023 — Retirement State Tax Changes

Public Act (PA) 4 of 2023, also known as the Lowering MI Costs Plan, took effect Feb. 13, 2024. It phases in an income tax reduction over the course of four years for retirees who receive a pension. For the 2025 tax year (filed in 2026), Michigan’s tax return, forms, and instructions (e-file and paper format) incorporate all retirement and pension benefit subtraction options – including those created by PA 4 of 2023. For more details, see the Michigan Department of Treasury website.

For joint returns, the birth year of the older spouse can be used.

State employees FAQs for Public Act 4 of 2023 - Retirement State Tax Changes

The Michigan Office of Retirement Services will continue to evaluate what the law means for our members as the phase-in continues. Please consult a tax professional regarding any questions you may have. To learn more about PA 4 of 2023, see the Michigan Legislature's page.

Published on March 7, 2023

Updated on Feb. 19, 2026

Other Items of Interest

Read the latest Connections, the newsletter we deliver four times a year to our retirees.

ORS is committed to serving members and employees today and preparing them for tomorrow. With this in mind, we are now offering online opportunities to learn about your pension plan. No registration is required.

Annual Comprehensive Financial Reports

The annual comprehensive financial reports contain a wealth of interesting figures and statistics about the State Employees' Retirement System.

Retirement Act, Public Act 240 of 1943

The operation of the State Employees' Retirement System is controlled by the State Employees' Retirement Act, Public Act 240 of 1943, as amended.

State Employee Retirees Association (SERA)

A nonprofit organization for current and future retirees of the State of Michigan.