The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Health, Dental, and Vision Insurance

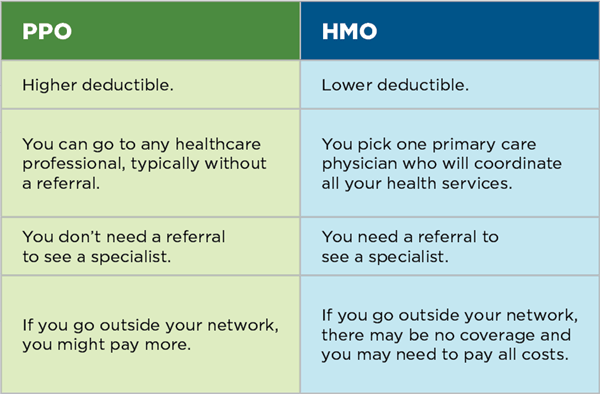

The Employee Benefits Division of the Michigan Civil Service Commission negotiates carriers, coverage, and rates for retirees just as it does for active employees. In addition to the State Health Plan PPO administered by Blue Cross Blue Shield of Michigan, some HMOs that offer plans for active employees also offer coverage for retirees. Providers and plans may change. Visit the Employee Benefits section of the Civil Service website to find out which providers participate, compare coverage, and check premium rates.

No gap in your coverage

Your eligibility to enroll in retiree insurance begins on your retirement effective date. Since your coverage as an active employee continues through the end of the month in which you terminate employment, there should be no gap in coverage as you go from active to retired status if you apply for retirement on time. Refer to the Timely application and proofs section below for more information.

However, if you file your application after the month in which you terminate employment, or if you waive coverage when you're first eligible to enroll, there could be a six-month wait to begin your coverage. (See Enrolling or changing your enrollment after retirement, below.)

If you have questions about insurance claims or if you want to know if a particular service is covered, contact your insurance carrier directly. If you have enrollment questions or problems, contact the Michigan Office of Retirement Services (ORS). If you need health services before your cards arrive, contact your insurance carrier directly to get your policy number or to verify coverage.

Insurance premiums

When you meet age and service requirements, the state will subsidize your health insurance premiums. If your insurance premiums exceed your pension payments, ORS will create a monthly payment plan for you.

You will be notified of any rate changes, which occur in January. Premium rates for each carrier are available on the Employee Benefits section of the Civil Service website.

Timely application and proofs

Insurance coverage always begins on the first day of the calendar month. We must have your completed enrollment request and all required proofs before we can enroll you, and we cannot enroll you retroactively.

- Non-Medicare: Coverage begins the first of the month after we receive your completed enrollment request and proofs. For example, if ORS receives your enrollment request and proofs July 10, your coverage will begin Aug. 1.

- Medicare: Coverage begins the first of the second month after we receive your enrollment request and proof of the qualifying event. For example, if ORS receives your enrollment request and proofs of the qualifying event July 10, your coverage will begin Sept. 1.

We must receive a complete enrollment request and proofs for everyone you want to enroll no later than 30 calendar days after your retirement effective date. For any received later, coverage will not begin until the first day of the sixth month after we receive the complete enrollment request including required proofs.

How Medicare affects your coverage

What you need to know

Medicare is the federal health insurance program for people who are 65 or older, or otherwise receiving Social Security disability benefits for 24 months.

Medicare is divided into four parts, which cover specific services. You'll only need to focus on these three if you enroll in a state-sponsored retiree insurance plan:

- Part A (hospital).

- Part B (medical).

- Part D (prescription drug).

Medicare Part D (prescription drug) is a federal program administered by your group insurance plan. When you enroll in a retiree prescription drug plan, we'll automatically enroll you in Medicare Part D, if appropriate. Don't sign up for a Medicare Part D prescription drug plan or any other supplemental prescription drug plan. Doing so will result in a loss of medical and prescription drug coverage through the retirement system's plan. Learn more about Medicare and sign up for Medicare.

What you need to do

Your experience with Medicare and your retirement insurance will vary based on whether you, your spouse, or your dependents are eligible for Medicare when you retire, become eligible for Medicare after your retirement or qualify for Medicare before age 65.

As soon as you, or anyone else covered by your health insurance, become eligible for Medicare, that person must enroll in both Part A (hospital) and Part B (medical). You must have Medicare parts A and B to enroll in the retiree insurance and prescription drug plans. If you do not enroll in Medicare Part A and Part B when you first become eligible, the health and prescription drug insurance for you, your spouse, and any covered dependents will be canceled. If your spouse or covered dependents do not enroll in Medicare Part A and Part B when they first become eligible, the health and prescription drug insurance will be canceled for that person. If you want to reenroll, your coverage will begin on the first day of the sixth month after ORS receives your enrollment request and required proofs.

Eligible for Medicare when you apply to retire

- Need to apply for your Medicare card. If you, your spouse, or your dependent will be eligible for Medicare when you apply to retire and haven't enrolled yet, you should contact the Social Security Administration to enroll in both Medicare Part A (hospital) and Part B (medical) at least three months before your retirement effective date. You'll get a Medicare number once you're enrolled that you'll need to provide to ORS when you enroll in a retiree insurance plan.

- Enrolled in Medicare. When you apply to retire, you’ll have a chance to enroll in a retiree insurance plan in step two of the online application. Enter your Medicare number and effective dates for parts A and B when prompted. You’ll pick a carrier from the list of available options in your area.

Once you're enrolled in the Medicare plans of your choice, you can expect ID cards and welcome kits from your selected carrier(s). If you apply for your retiree insurance at least three months before your insurance effective date, your cards will usually arrive before your coverage begins. If you need health services before your cards arrive, contact the insurance carrier directly to get your policy number or to verify coverage. For more information, go to your insurance carrier's website.

Eligible for Medicare after enrolling in retiree insurance plan

If you, your spouse, or your dependent are enrolled in retiree insurance before becoming eligible for Medicare, the information below will help you understand what you need to do to complete the process.

Provide ORS with your Medicare number and effective date for parts A and B

When you enroll in Medicare you'll receive your Medicare card from the Social Security Administration. As soon as you receive your card, provide ORS with your Medicare number and effective dates for parts A and B. You can submit your Medicare enrollment information one of the following ways:

- Log in to miAccount and send a secure message on the Message Board, using the Submit My Medicare Number category. Include the name, Medicare number, and effective dates for parts A and B in your message.

- Update your insurance enrollment information in miAccount to include the new Medicare information and mail or fax the confirmation page to ORS.

- Make a copy of the Medicare card. Write the retiree's name, member ID, address, and date of birth on the copy and mail or fax it to ORS.

- Mail or fax a completed Insurance Enrollment/Change Request (R0452G) form to ORS with the Medicare information.

- Call ORS and provide the Medicare number and effective dates for parts A and B over the phone.

Your insurance carrier will enroll you in the version of your plan for Medicare eligible members. Your carrier will send you ID cards and welcome kits. If you provide ORS with your Medicare number at least two months before your Medicare starting date, your insurance cards will usually arrive before your coverage begins. If you need health services before your cards arrive, contact your insurance carrier directly to get your policy number or to verify coverage. For more information, go to your insurance carrier's website. Waiting to enroll in Medicare could affect your insurance eligibility and coverage.

Effects of other group insurance

It's your responsibility to keep ORS informed of any changes that may affect your own, your spouse's, and your dependent's eligibility and/or coverage, so be sure to notify ORS when anyone on your insurance has coverage under another plan.

In addition, you cannot enroll your spouse in your insurance if they're separately enrolled as an eligible state employee or retiree.

Enrolling or changing your enrollment after retirement

While you're actively employed, you can only change your insurance enrollments during the annual open enrollment period. As a retiree, you can change your insurance enrollments at any time using miAccount, or by submitting an Insurance Enrollment/Change Request (R0452G) form.

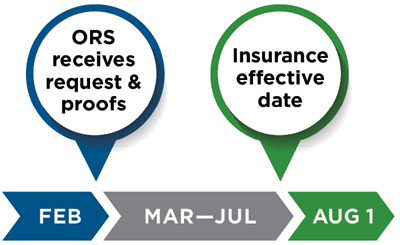

Enrolling for the first time. If you're enrolling in your retiree insurance after your retirement effective date, your coverage will begin on the first day of the sixth month after ORS receives your enrollment request and required proofs. For example, if we receive your Insurance Enrollment/Change Request (R0452G) form with necessary proofs of eligibility Feb. 10, your coverage will begin Aug. 1.

If you have a qualifying event, such as an involuntary loss of other group coverage or a change in family status, and you submit the required documents (see below) within 30 days, the six-month waiting period does not apply.

For retirees who do not have Medicare, coverage can begin the first of the month after we receive your completed enrollment request, required proofs, and proof of the qualifying event.

For retirees with Medicare, coverage can begin first day of the second month after we receive your enrollment request and proof of the qualifying event. For example, if we receive your enrollment request and proof of the qualifying event July 14, your coverage will begin Sept. 1.

If we get your enrollment request and proofs in later, but within 30 days of the qualifying event, you will not be enrolled until a month later.

If you're changing insurance coverage, ORS will adjust your premiums, if needed, the month your insurance change takes effect. We cannot refund premiums withheld before or in the month you report the change If you're adding a spouse or dependent to your coverage, their coverage will begin the first day of the sixth month after ORS receives the completed enrollment request, unless you have a qualifying event.

Changing plans. To change your insurance plan, log in to miAccount and click Insurance Coverage, or complete the Insurance Enrollment/Change Request (R0452G) form and return it to ORS along with all required proofs. If you're currently enrolled in any health insurance plan with the retirement system, you can change your enrollment to another plan regardless of your Medicare status. Your change in coverage will be the first day of the second month after ORS receives your enrollment request and required proofs. For example, if ORS receives your enrollment change request and any required proofs Jan. 10, your coverage with the new plan will begin March 1.

Coverage in the new plan will begin the first day of the second month after ORS receives your materials if you're enrolling in Blue Cross Blue Shield of Michigan or moving out of an HMO coverage area. Coverage will begin the first day of the second month if you're voluntarily changing HMOs.

If you have a qualifying event

The following are considered qualifying events for adding a spouse and dependents. You must submit proofs with the enrollment request within 30 days of the qualifying event. Photocopies are acceptable.

- Involuntary loss of coverage in another group plan: Provide a statement on letterhead from the terminating group insurance plan explaining who was covered, the type of coverage it was, why coverage is ending, and the date coverage ends.

- Adoption: Acceptable proof is adoption papers, a sworn statement with the date of placement, or a court order verifying placement AND the child's government-issued birth certificate. In a legal adoption, a child is eligible for coverage as of the date of placement. Placement occurs when you become legally obligated for the total or partial support of the child in anticipation of adoption.

- Birth: Acceptable proof is a government-issued birth certificate.

- Death: Acceptable proof is a death certificate.

- Divorce: For enrollment, provide a statement on letterhead from the terminating group insurance plan explaining who was covered, the type of coverage it was, why coverage is ending, and the date coverage ends. For disenrolling a former spouse, no proof is needed.

- Marriage: Both proof of marriage and age are needed. Acceptable proof of marriage is a government-issued marriage certificate OR a copy of you and your spouse’s valid driver’s licenses showing matching addresses AND your most recent IRS Form 1040 showing you filed as married. Acceptable proof of age is a government-issued birth certificate, OR valid passport, OR a valid driver’s license or state ID.

- Medicare Part B enrollment. Acceptable proof is a letter from the Social Security Administration showing confirmation of Part B enrollment. This qualifying event applies if the enrollee was previously terminated or if enrollment was denied because they didn't have Part B coverage.

- Public Act (PA) 158 of 2023. This act allows a child to remain on retiree insurance until the month in which that child turns 26, regardless of enrollment in post-secondary education or dependency status for tax purposes. Proof of this qualifying event is not required. This qualifying event applies to retirees who have children who are now eligible for coverage as a result of the law change. You may enroll your child by completing and submitting an Insurance Enrollment/Change Request (R0452G) form and all required proofs. Coverage will start the first of the sixth month after ORS receives your enrollment request and all required proofs.

If you have an insurance question

Your insurance carrier is your best resource for answers about insurance cards, claims, or if you want to know if a particular service is covered. The Employee Benefits Division can also help with claims or coverage problems. Go to the Employee Benefits section of the Civil Service website or call 800-505-5011.

If you have questions or a problem with insurance enrollment, need to add or remove a spouse or dependent, or change your insurance carrier, use miAccount. You can also complete the Insurance Enrollment/Change Request (R0452G) form found on our website.

Your medical records are private

The Health Insurance Portability and Accountability Act, or HIPAA, and related rules require group health plans to protect the privacy of its members' health information. If you have state-sponsored health insurance, the Civil Service website explains how your medical information may be disclosed and how you can get access to this information.

Enroll in Part A & B |

|---|

|

Enroll in Medicare Part A and B when you're first eligible, and to notify ORS if that happens before you are age 65. If you are enrolled in Part A but not Part B because you are actively working, enroll in Part B at least two months before your retirement effective date to ensure continuous coverage into retirement. |