Preliminary information for the Wholesale Marihuana Tax is now available.

What should I do if I filed my 2020 Michigan Individual Income Tax Return (MI-1040) without claiming the federal unemployment exclusion but I have not yet paid the tax due?

Michigan taxpayers who filed their original tax year 2020 MI-1040 without claiming the federal unemployment income exclusion must file an amended MI-1040 to show a reduced amount owed or a refund. If a tax due was calculated on your original return and a payment was not made, do not claim a payment amount on line 31 of the Michigan 1040.

For Electronic Filers

If you filed your original return electronically using a software product, we recommend attempting to file your amended return using that same product. Most software vendors have updated their products to account for the unemployment exclusion. E-filing your amended return will ensure greater accuracy and faster processing times.

Note: If you are unable to file an amended return electronically, follow the instructions for paper filers.

For Paper Filers

Michigan individual income tax forms for tax year 2020 can be located on Treasury's web site. Here are some helpful reminders:

- Use the MI-1040 and check the amended box.

- Include all forms and schedules previously filed with your original return.

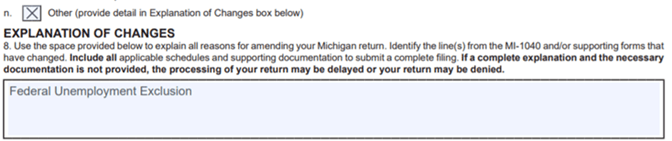

- Include Schedule AMD which captures the reason why you are amending the return. Check box "n" and provide the explanation of "Federal Unemployment Exclusion" in box 8. (see example below

Note: The IRS will process federal returns without requiring an amended return.