The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.06.04: Adjusting posted DTL4 records for new members

It is important to monitor your employees who are new to MPSERS during their 75-day election window, because employees can elect the Defined Contribution (DC) Plan in the middle of a pay cycle. This can alter your totals and affect the amount you withhold from the employee's paycheck. Our system starts calculating DC contribution rates immediately after the employee elects the DC plan, regardless of the employee's deferral percentage before the change.

The View DC feedback file screen will indicate a delayed pay period effective date. Once Voya receives a DTL4 record that shows the employee's DC benefit structure, Voya will feed back the updated contribution rates to our system. Be sure to review your download details and DC Feedback files, and report deferral rate changes as soon as an employee elects the DC benefit plan.

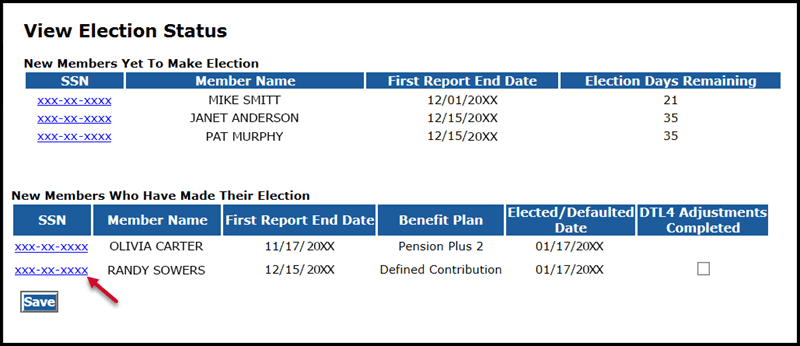

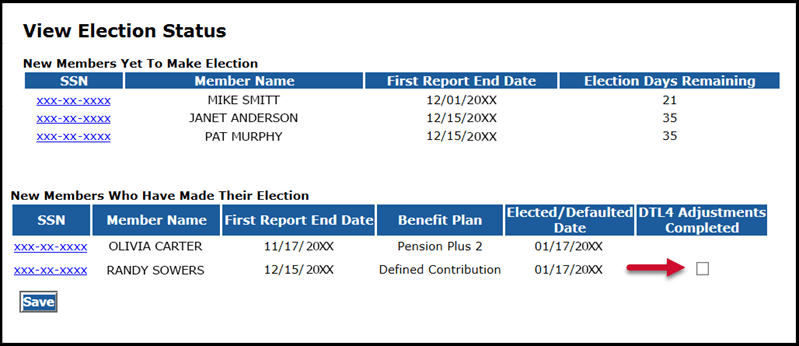

- After an employee has elected the DC plan, determine which pay periods need to be adjusted. Click View Election Status on the Things To Do menu and go to the section called New Members Who Have Made Their Election. Click an employee's SSN.

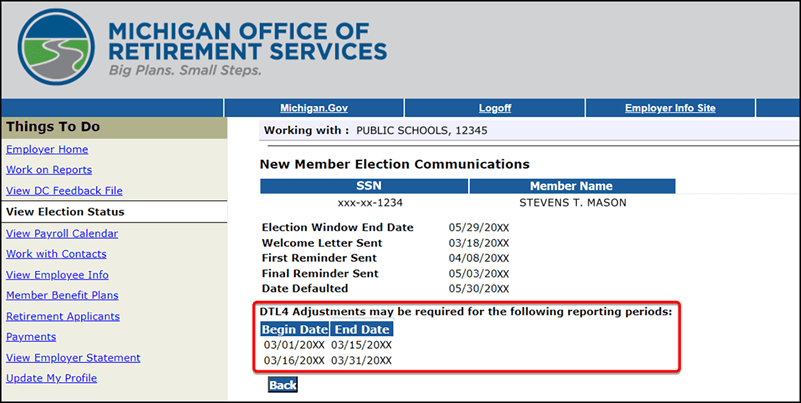

- The New Member Election Communications screen will appear. The last section lists pay periods that may require an adjustment DTL4 record. Check the Download Detail report or click View Employee Info on the Things To Do menu to see the rate used for DC contributions on that payroll report. If the Pension Plus 2 rate was used, submit a positive adjustment DTL4 record on a current payroll report to update member and employer contribution amounts to the DC plan rate levels. The pay period with the most recent date may not need an adjustment. No adjustment is needed if the DC rate was used to calculate the dollar amount due for the most recent pay period.

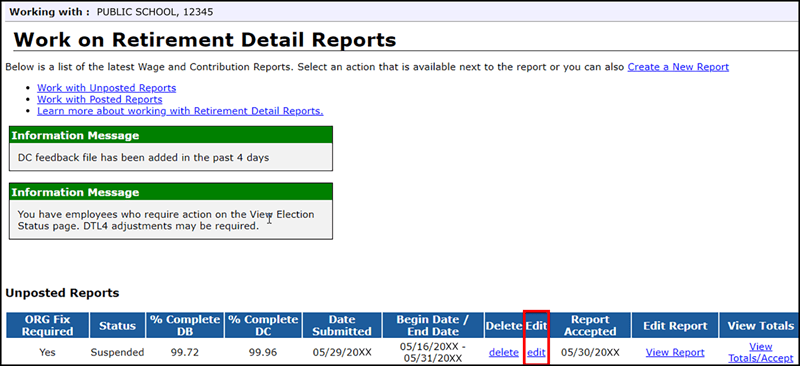

- To add a positive adjustment DTL4 record, click Work On Reports and find the most current pay period report that has not yet posted. Remember that adjustment records will suspend if they are added to a payroll report with begin and end dates the same as the pay period being adjusted. Click the edit link. (NOTE: Payment for the additional member and employer contributions is due at the time the adjustment records are added to a payroll report. Adding these records to a current pay period decreases the risk for payment shortfall fees and interest.)

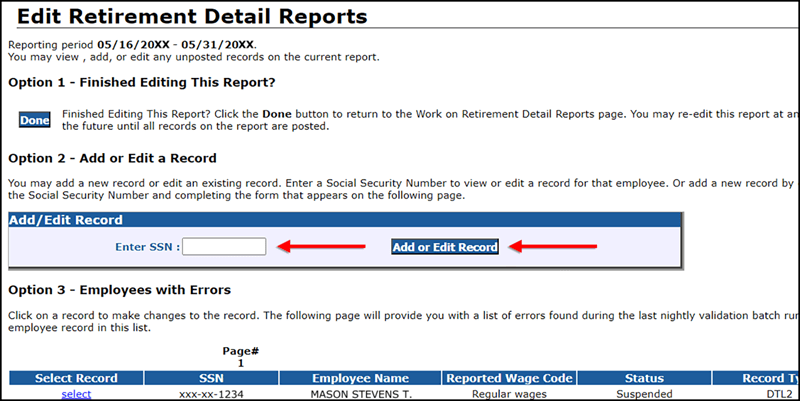

- On the Edit Retirement Detail Reports screen, enter the employee's SSN in the box under Option 2 -Add or Edit Record. Click the Add or Edit Record button.

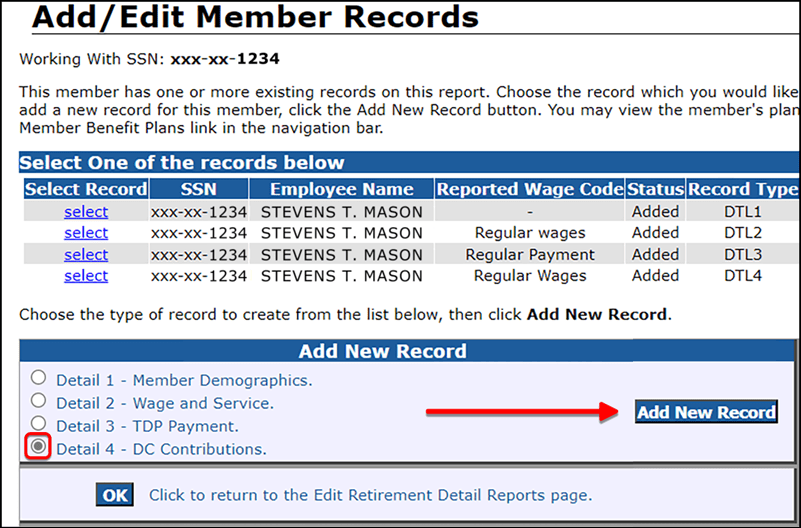

- On the Add/Edit Member Records screen in the Add New Record box, select the radio button for Detail 4 - DC Contributions and click Add New Record. (If the employee has no records on the report you chose, no records will be displayed.)

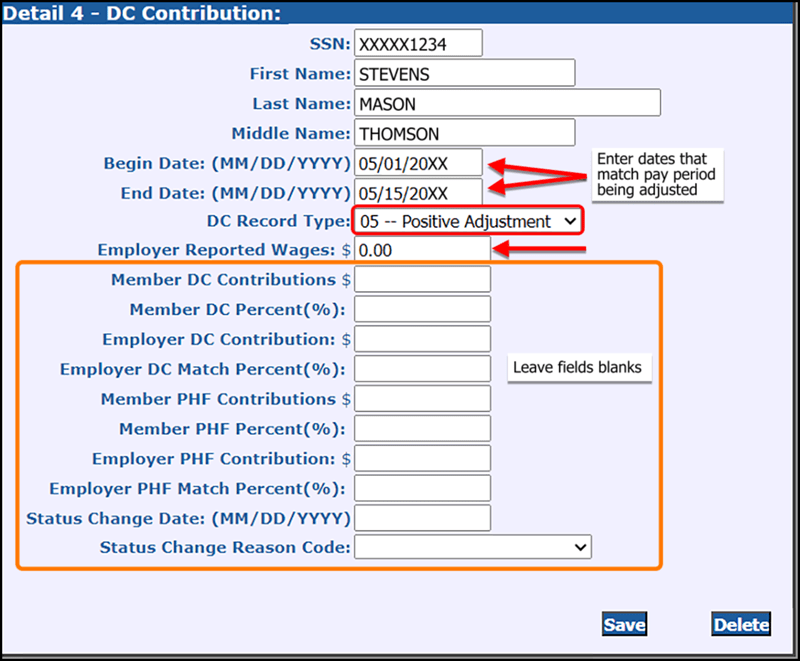

- Change the begin date and end date to match the begin and end dates of the pay period being adjusted.

- Select DC Record Type 05 - Positive Adjustment.

- Enter 0.00 for Employer Reported Wages. Leave all other fields blank. ORS will calculate amounts when record goes through the overnight batch processing.

- Click the Save button.

- The added DTL4 record will show up on the Add/Edit Member Detail Reports page under existing records. Continue to enter adjustment DTL4 records until all pay periods requiring adjustments have been added.

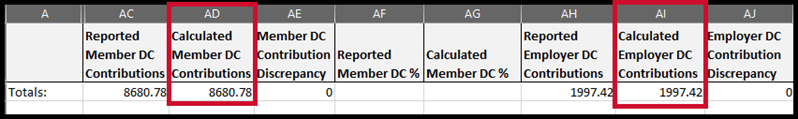

- To view the amounts that ORS has calculated for the additional employee and employer contributions due, wait until the day after the overnight edit/validation process has run. Open the report's download detail spreadsheet (see section 7.01.08: Using the Download Detail link). Column AD -Calculated Member DC Contributions and column AI - Calculated Employer DC Contributions will display the dollar amount calculated by ORS for the additional contributions due. The amounts due will be reflected on the current payroll statement totals.

- Once you have completed the DTL4 adjustment records, go to the View Election Status screen to check the box on the DTL4 Adjustments Completed column. Until this box is checked, the name will continue to appear on the View Election Status screen.

- Click the Save button.

When the new DTL4 record displays, it should have the employee's SSN and name and current payroll begin and end dates.

Last updated: 07/01/2024