The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.03.06: Reporting professional services leave/professional services released time on a DTL2 record

Professional services leave (PSL) and professional services released time (PSRT) wages and hours are reported on a DTL2 - Wage and Contribution record. See Professional services leave or professional services leave time in section 3.02: Special membership circumstances for more information.

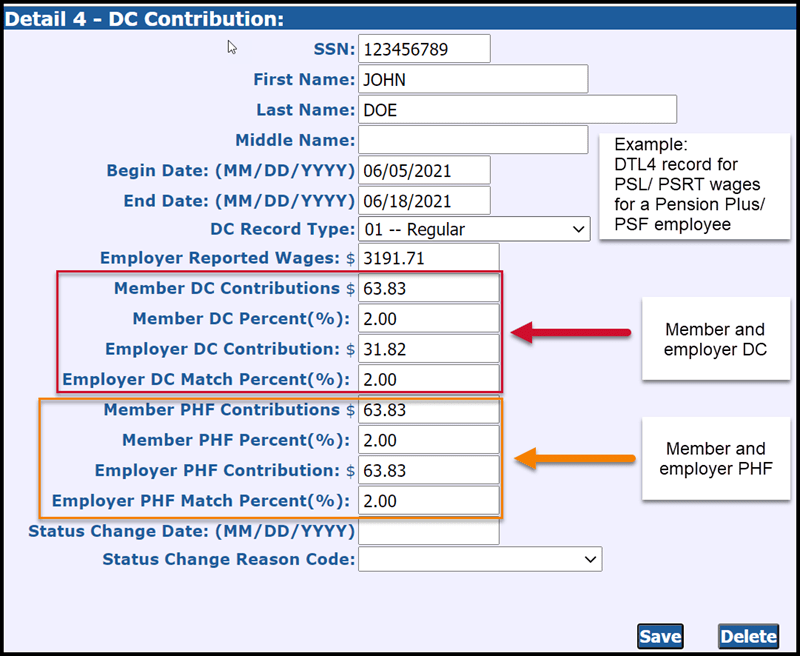

For employees with a defined contribution (DC) component, include a DTL4 - DC Contribution record to report member and/or employer DC contributions as required based on the employee's benefit plan.

If the employee has both regular wages and PSL/PSRT wages in the same pay period, report the regular wages on a DTL2 record separately from the PSL/PSRT wages. Qualified participants requiring more than one DTL2 record would require only one DTL4 record to report DC/PHF for the total of both regular and PSL/PSRT wages.

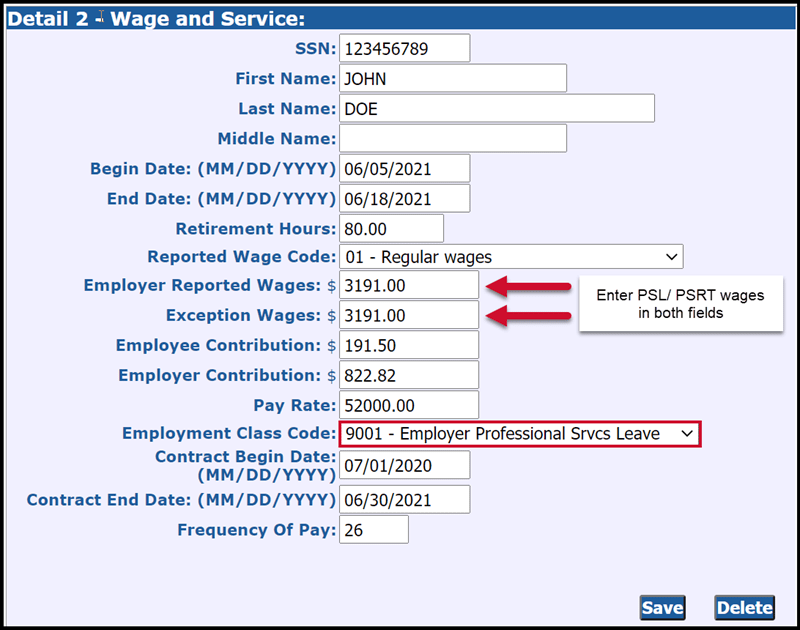

On the DTL2 record enter the total PSL/PSRT wages in both the Employer Reported Wages field and in the Exception Wages field. Use class code 9001 when reporting professional services leave or professional services released time.

On the DTL4 record (if needed), enter the total PSL/PSRT wages in the Employer Reported Wages field and enter any Member and Employer DC and/or PHF contribution dollar amounts and percent amounts in the fields appropriate to the qualified participant's benefit plan.

Last updated: 07/06/2016