The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.02.03: Reporting tax-deferred payment deductions on a Detail 3 record

7.02.03: Reporting tax-deferred payment deductions on a Detail 3 record

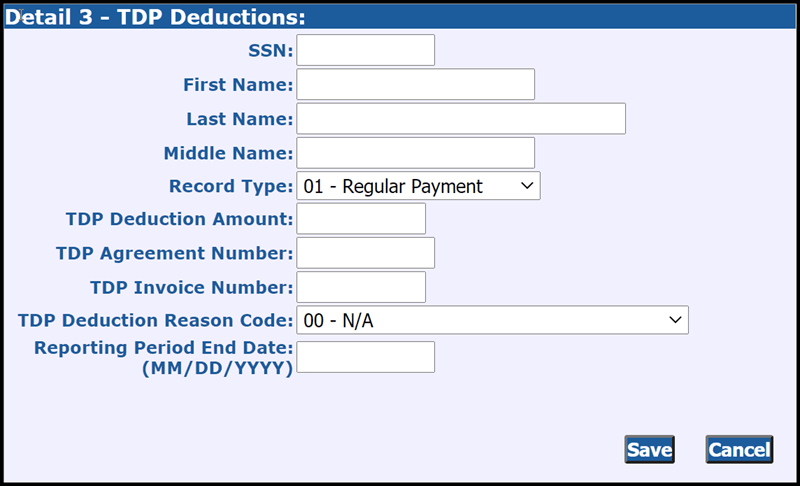

Detail 3 -TDP Deductions (DTL3) records report tax-deferred payment (TDP) deductions for your employees to ORS. Include them in your report upload to ORS with your other DTL records.

The DTL3 record includes the employee's Social Security number, name, record type, deduction amount, agreement number, invoice number, deduction reason code, and the reporting period end date. Submit DTL3 records only for employees who have active or open TDP agreements with your reporting unit.

Last updated: 04/13/2012