The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.01.06: Viewing and verifying report totals

Always verify your retirement detail report totals before accepting a report to post wages and service to a member's account. Once a report has posted, the final contribution totals are due to ORS even if they do not agree with your in-house accounting records. Making sure the totals are correct before you accept a report could save you late payments and interest fees.

You can view your totals immediately after copying forward or using the empty report/data entry method. If you upload your report, you must wait to view your totals until the next day after the report has run through the overnight batch process. If the totals on an uploaded report are off by a large amount and no records have posted, you may choose to delete your report and start over as long as your statement has not been created. See section 7.05.01: Deleting a report.

ORS recommends that you view your report totals each time you edit or accept your report as well.

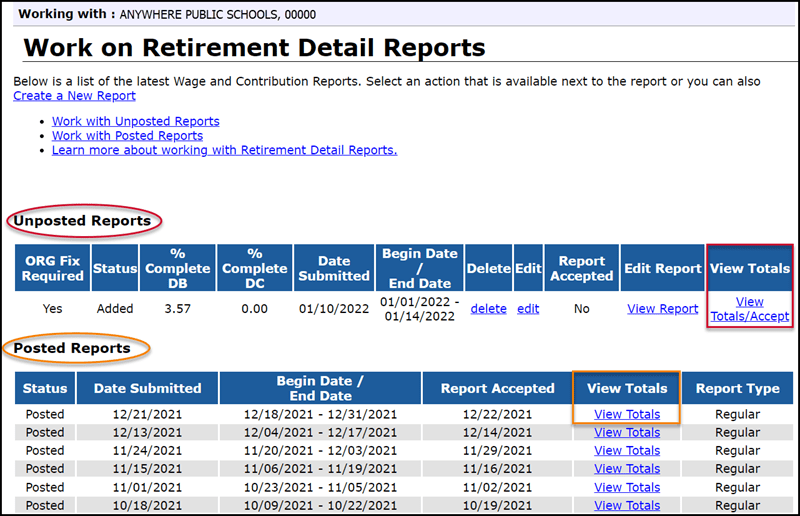

- On the Work On Reports screen, locate the report for which you want to check totals. For an unposted report, click the View Totals/Accept link in the View Totals column. For a posted report, click the View Totals link in the View Totals Column. Remember that the totals on a posted report cannot be changed; they are for information only.

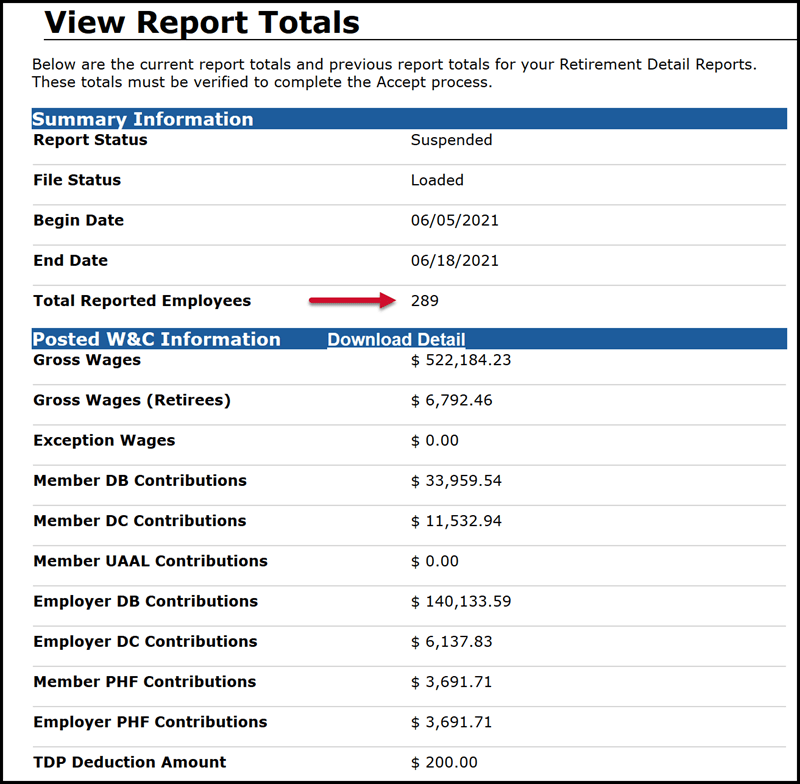

- When reviewing the View Report Totals page, verify the Employee count in the Summary Information section. This number should match the number of employees for whom you are submitting wages. If it doesn't match, you should be able to account for the difference.

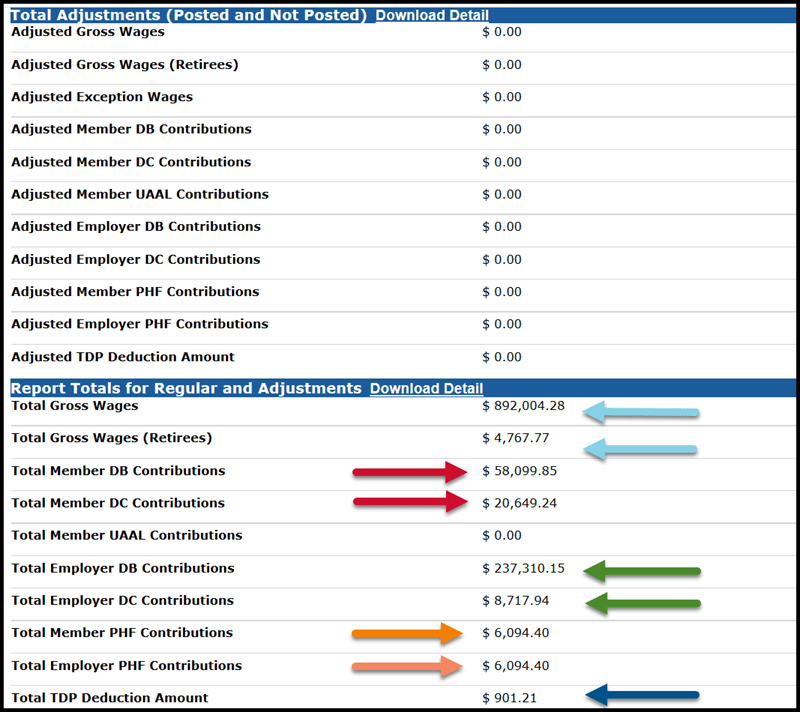

- In the lowermost section, verify that the combined total posted and unposted wages matches the gross wages on your in-house payroll for wages and retiree wages, or you should be able to account for the difference. The View Totals screen displays the defined benefit (DB) member and employer contribution amounts but excludes adjustment records. These totals may not match the member contribution amounts you have calculated. Sometimes this is due to a rounding difference or adjustments, or sometimes the amount is calculated incorrectly on your side.

Your reporting unit calculates contributions for an employee who is new to MPSERS at the Pension Plus 2 rate until the new employee makes an election Once ORS receives and processes the election, we will post the contribution amounts calculated by our system to each employee's account. If there are differences, these differences will need to be reconciled in your payroll records. The Download Detail report provides a person-by-person accounting of any difference between the member and employer contribution amounts you have reported and the ORS calculation. See section 7.01.08: Using the Download Detail link for more information.

The DC member and employer calculations are provided by your reporting unit through the DTL4 records. Verify that the totals match exactly the amount needed for all your employees who have DC benefit plan and/or Personal Healthcare Fund contributions. If the totals are off, a DTL4 record may be missing or you may have over- or under-reported contribution amounts on the DTL4 record.

The total TDP deduction amount should match your payroll TDP deductions exactly.

Last updated: 07/01/2024