The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.05.10: Adjusting DC Wages on a DTL4 Record

Any employer and employee contribution payment required as a result of a positive adjustment record is due on the same date as payment for the report on which the adjustment appears.)

To make DTL4 DC Contribution adjustments:

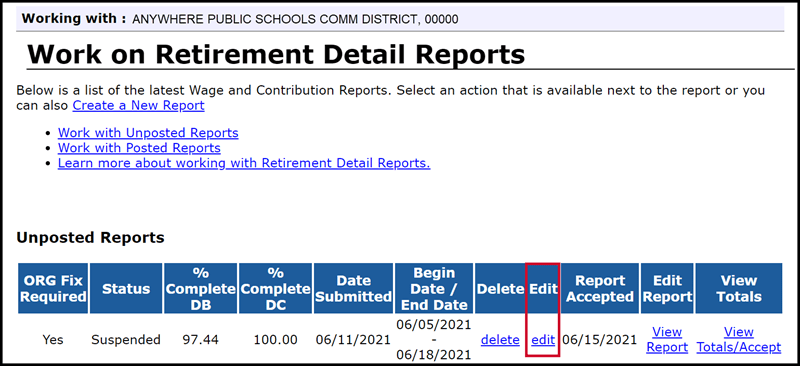

- On the Work on Reports screen, locate your most recent unposted payroll report with an end date later than the end date of the pay period to be adjusted. Click Edit.

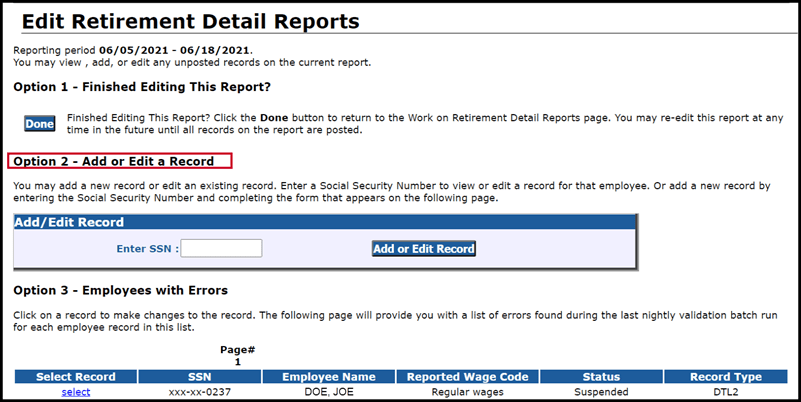

- Under Option 2 - Add or Edit Record, enter the SSN of the member in the field provided and click Add or Edit Record.

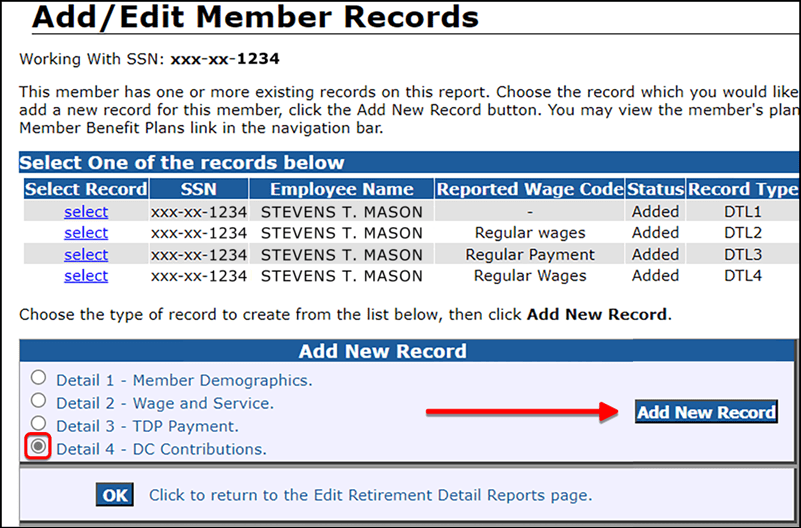

- In the Add New Record box, click the radio button for Detail 4 - DC Contributions. Click Add New Record. Do not click the OK button.

- Complete the DTL4 record fields as needed. Keep these points in mind:

- Make sure the begin and end dates entered on the DTL4 adjustment record match the begin and end dates for the pay period being adjusted.

- Use the correct Record Type:

- 05 - Positive Adjustment

- 06 - Negative Adjustment

- If adding or subtracting gross wages, enter an amount in the Employer Reported Wages field equal to the dollar amount being added or subtracted.

- Enter dollar and percent amounts in corresponding fields for member and employer DC and/or member and employer PHF as needed.

- Unless the employee is leaving your reporting unit, leave both the Status Change Date and Status Change Reason Code fields blank. If you populate one field and leave the other blank, the record will suspend.

- Click the Save button.

Last updated: 03/05/2018