The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

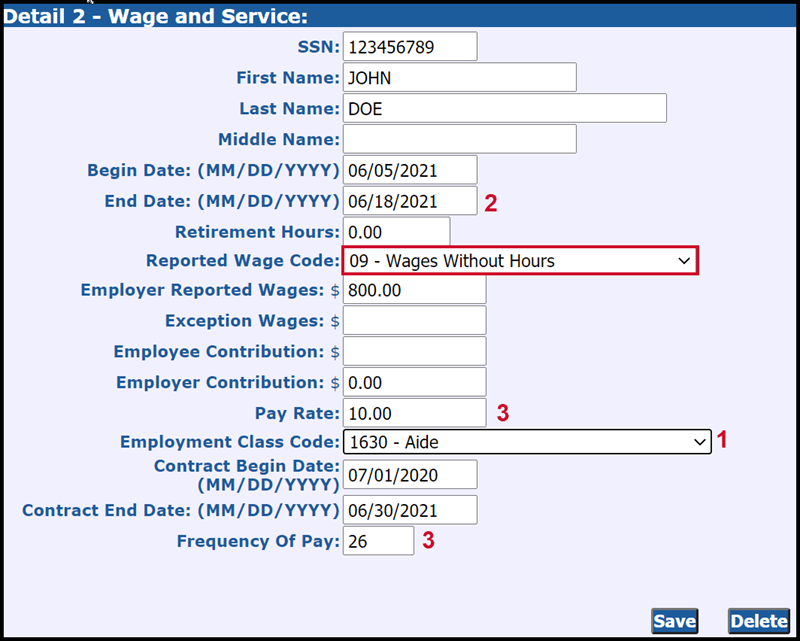

7.03.07: Reporting wages without hours on a DTL2 record

Wages without hours payments, such as longevity pay that is paid regularly to all employees, are considered reportable wages. Some reporting units include wages without hours payments combined with their employee's regular pay and report them together under Wage Code 01 – Regular Wages. Other reporting units pay wages without hours in a separate lump sum payment.

Note: When reporting a new employee to your reporting unit, you cannot report wages without hours on a Detail 2 (DTL2) – Wage and Service record in the first pay period you report their wages. A DTL2 record with hours must post first. To report wages with hours on a DTL2 record see 7.02.02: Reporting DB wages, hours, and contributions on a DTL2 record.

Use these codes when wages without hours are paid in this way:

- Wage Code 09 – Wages Without Hours.

- Wage Code 15 – Wages Without Hours Positive Adjustment.

- Wage Code 16 – Wages Without Hours Negative Adjustment.

When creating a separate DTL2 record for wages without hours, note the following:

- Use the same class code as the employee's regular pay. For example, use class code 1240 – Teaching for a teacher's regular wages as well as for a teacher's wages without hours payment.

- The end date of the record must match the pay period end date of the report.

- The pay rate and frequency of pay must match those for regular wages. Note that the pay rate is the current rate of pay for the class code used on the regular DTL2 record.

To adjust a previously reported wages without hours payment (reported with wage code 09):

- Subtract the posted wages using wage code 16 – Wages Without Hours Negative Adjustment.

- Add wages without hours to a previously posted Wage Code 09 – wages without hours record using the Wage Code 15 – Positive Adjustment Wages Without Hours.

Last updated: 03/06/2023