The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.06.01: Determining a member's benefit plan

7.06.01: Determining a member's benefit plan

Before reporting a new employee for the first time, always search for the employee in the Member Benefit Plan link to determine the employee's benefit plan. Minimize the risk of starting a second account for this new employee by making sure you have an accurate Social Security number on file.

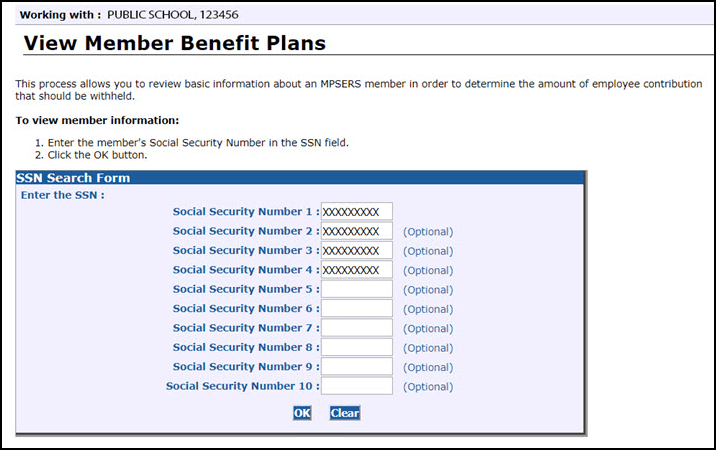

1. From the Employer Home Page, click Member Benefit Plans on the Things To Do menu.

2. Enter the social security number(s) of the employee(s) and click OK.

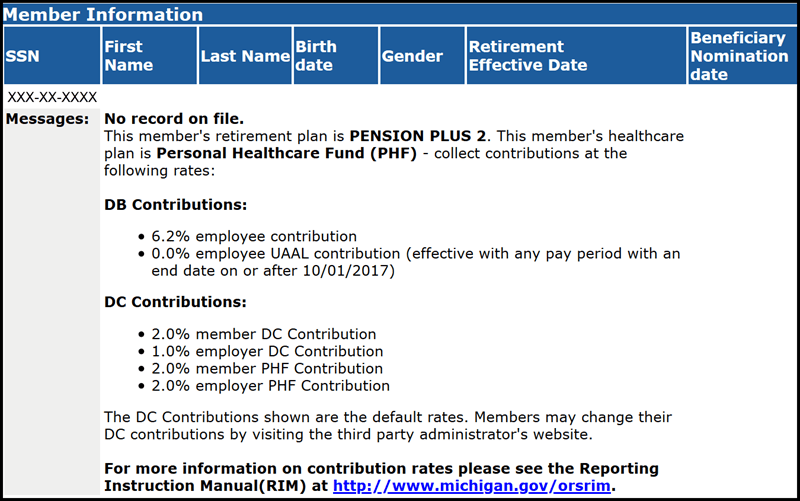

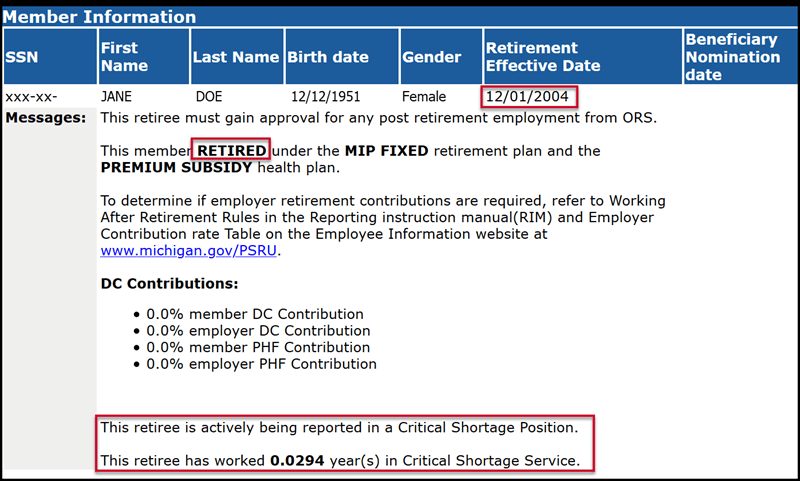

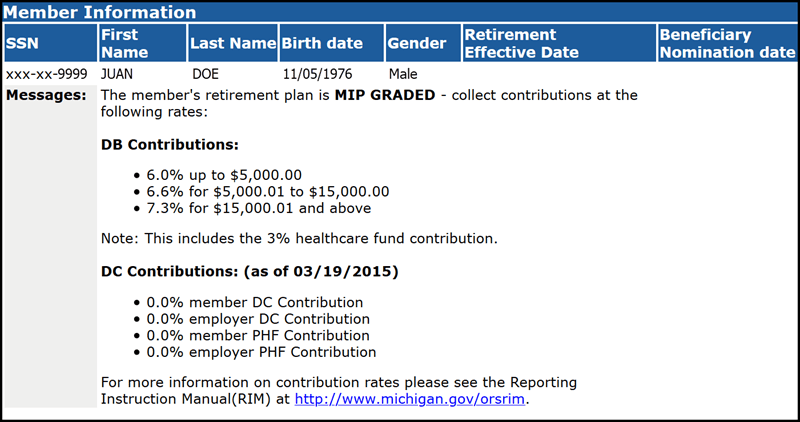

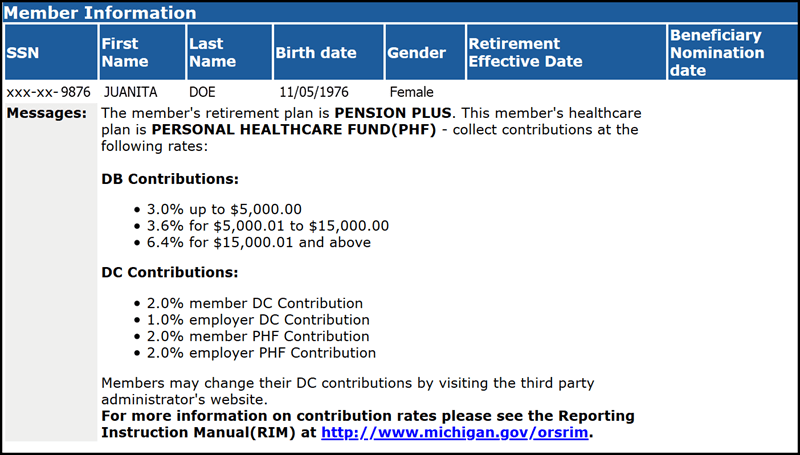

The Member Information Display screen will show the benefit plan and healthcare option along with the contribution rates for the social security number entered. See the examples below.

New member who has never been reported to the MPSERS system before:

Retiree with an effective date of 12/01/2004:

Active member of a defined benefit (DB) plan with the premium subsidy benefit:

For active members, this screen will show the applicable DB contribution rate (including the 3% healthcare contribution for those with the premium subsidy benefit), and the DC contribution rates for those with a DC component.

Note: Rehired employees who worked for a Michigan public school before Jan. 1, 1987, but have not worked for a reporting unit since then, are placed in the MIP Graded plan with the 3% healthcare upon rehire.

Active member of Pension Plus with Personal Healthcare Fund:

Last updated: 02/01/2018