The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.03.05 Reporting other compensation for a member receiving weekly workers' compensation

7.03.05 Reporting other compensation for a member receiving weekly workers' compensation

You may need to report compensation verifiably tied to a specific weekly workers' compensation (WWC) claim. Sometimes a member is receiving both workers' compensation (while not present at work) and one of the following as an additional wage:

- Sick leave pay.

- Payment meant to bridge the differential between WWC and gross wages that is verifiably tied directly to a WWC claim.

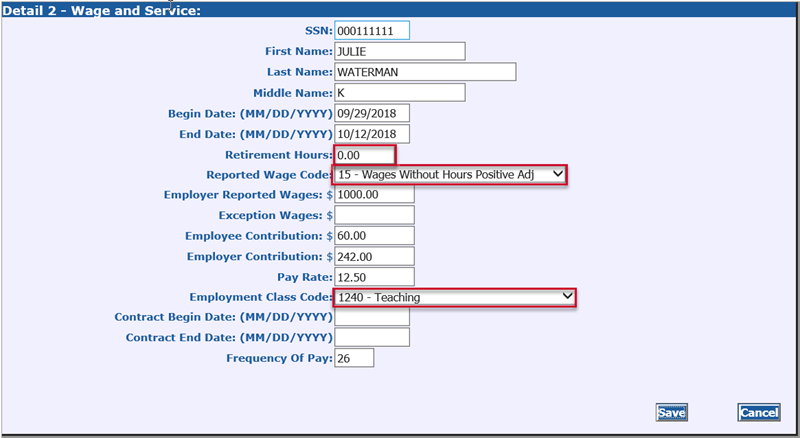

In this case, report additional wages that are verifiably tied to an existing WWC payment by submitting an additional DTL2 record for each pay period during the affected time frame.

- Enter the begin and end dates reflecting each of the affected pay periods.

- Do not include hours. All the reportable hours belong on the DTL2 record that reports the workers' compensation wages (class code 8000; wage code 01).

- Use wage code 09 if reporting current wages or 15 if adjusting a prior pay period.

- Enter the total wages for the period.

- Use the regular, active employment class code.

In the circumstance above, all hours were previously reported under class code 8000 - Weekly Workers' Compensation.

|

Type of compensation |

Class code |

Amount |

Hours |

|---|---|---|---|

|

WWC |

8000 |

$743 |

60 |

|

Sick Leave (or Bridge pay) |

1240 |

$1,000 |

0 |

Reporting compensation when employee works while receiving WWC

Occasionally, a reporting unit will have employees on workers' compensation who also work at temporary jobs. Examples of how to report this circumstance:

Example 1: employee who works 80 hours per pay period (full time)

|

Type of compensation |

Class code |

Amount |

Hours |

|---|---|---|---|

|

For work performed at a temporary job |

Regular class code |

$300 |

24* |

|

WWC |

8000 |

$743 (set by law) |

80* |

*Note: due to service credit caps, this employee will be credited with 60 hours of service per bi-weekly pay period.

Example 2: employee who works 20 hours per pay period (part time)

|

Type of compensation |

Class code |

Amount |

Hours |

|---|---|---|---|

|

For work performed at a temporary job |

Regular class code |

$50 |

5 |

|

WWC |

8000 |

$160 (set by law) |

20 |

Please report the actual wages and hours for the work performed at a temporary job. The actual wage paid for WWC should be reported in full under class code 8000 regardless of who makes the payment (third party, reporting unit, check signed over to reporting unit by employee, etc.). Also, the hours reported with the WWC class code of 8000 should reflect the total hours the employee would have worked if the injury had not occurred (full time or part time).

See also section 7.03.04: Reporting workers' compensation on a DTL2 record

Last updated: 03/20/2019