The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Online Registration and Seeking Work Waiver

The Registration and Seeking Work (RSW) waiver allows a worker to collect benefits during a short-term layoff period while not being required to register and seek work.

The Criteria for establishing a waiver are:

1. The separation must be a lay off for lack of work.

2. The layoff is temporary (work will be available within 45 days).

3. The request must be received before the lay off occurs (no later than the week prior to the lay off).

The Unemployment Insurance Agency (UIA) has made it faster and easier for employers to request an RSW waiver by requesting one online. The request and approval can be completed in minutes! Waivers can be requested through the Michigan Web Account Manager (MiWAM).

- Login to your MIWAM account

- Under Accounts tab select UI Tax

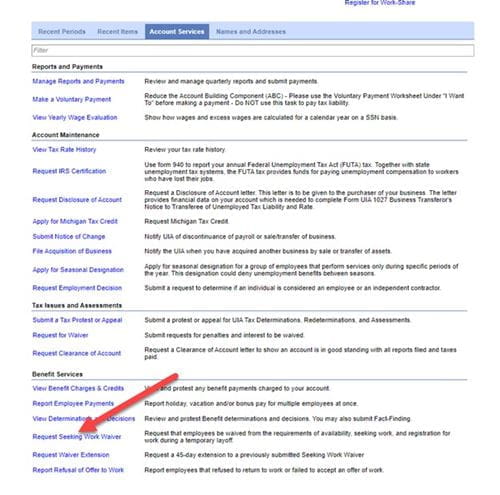

- Select Account Services tab

- Scroll down, under Benefit Services submenu, select Seeking Work Waiver

Employers request waivers during periods of short-term unemployment periods because they want their workforce to be available and return to work as needed.

Requests can be extended beyond the 45 calendar days, up to an additional 90 calendar days if one or more of the following conditions are met:

- Equipment retooling.

- Parts shortage.

- Temporary production volume adjustment.

When completing the online application, an employer will provide a last date worked and a return-to-work date. The same information should be provided to your employee for them to enter when completing the application for unemployment benefits for the waiver to be applied.

The Unemployment Compensation Notice to Employee, (form UIA 1711), which employers are required to give their employees upon separation, contains important information for unemployed workers. Employers should fill out the information, print, copy and distribute to workers when they are laid off. The information ensures that the worker provides accurate information when they file their claim. This improves the proper charging to employers and reduces overpayments of benefits.

For questions about an RSW Waiver, contact the Office of Employer Ombudsman at 1-855-484-2636.