The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Submit Reports and Payments

-

Quarterly Reports

-

Your Tax Rate

-

Tax Rate Disputes

-

Payments

-

Email Reminders

Quarterly Reports

In Michigan, unemployment tax and wage reports and tax payments are due quarterly on the following dates:

APRIL 25 | JULY 25 | OCTOBER 25 | JANUARY 25

3 Important notes about filing quarterly reports:

1. You must file an Employer’s Quarterly Wage/Tax Report every quarter, even if you are unable to pay or have no payroll for the quarter.

2. If you do not submit your reports and payments accurately and on time, penalty and interest will be applied to your account.

3. You can sign up for email reminders through MiWAM so you never miss a date.

How do I file my quarterly report?

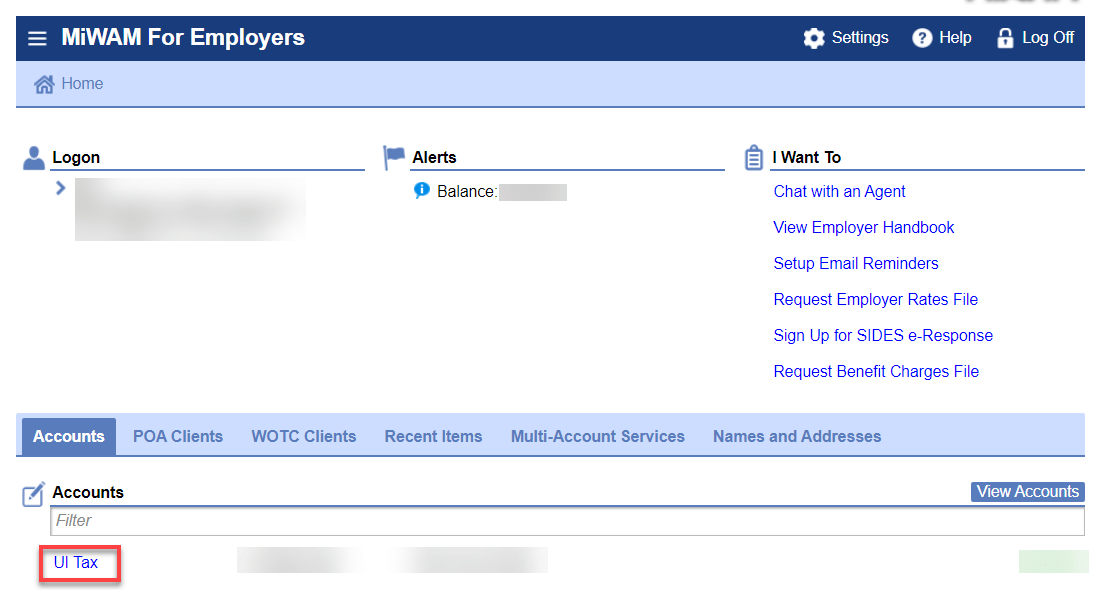

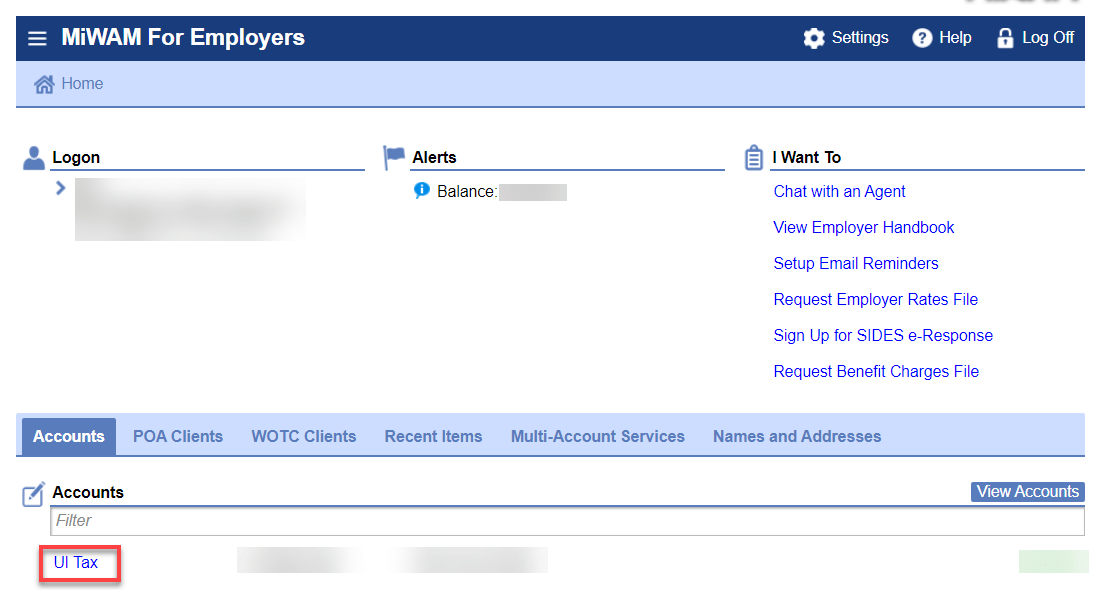

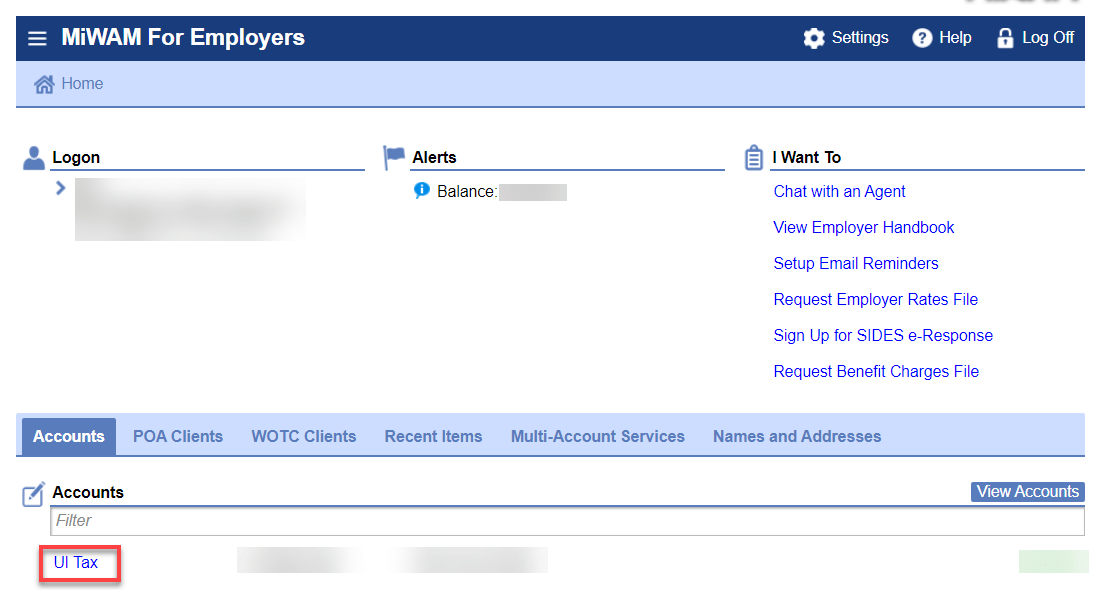

1. Login to MiWAM. Under the “Accounts” tab click “UI Tax.”

2. Choose the quarter you want to file for.

3. If you have an outstanding return, it will appear under “Period Alerts.” If not, select “File, view, or amend a report.”

4. Enter the wage and tax information for that quarter. After entering your employees’ wages, you’ll be prompted to enter your MiWAM password. Enter your password and click “OK.” Your report will then be submitted.

Still can’t find what you’re looking for? Contact Employer Support.

Your Tax Rate

The unemployment tax rate for employers is calculated using two main factors:

1. The amount an employer has paid in wages to their employees.

2. The number of former employees who have collected unemployment benefits.

You can view your current tax rates in MiWAM.

Late reporting and payments can increase your unemployment tax rate. The exact formula for calculating the rate is determined by UIA and can vary from year to year. Learn more about Unemployment Tax Rates.

Still can’t find what you’re looking for? Contact Employer Support.

Tax Rate Disputes

After receiving the Tax Rate Determination (UIA 1771), you have 30 calendar days to protest your tax rate.

1. Login to your MiWAM account and click “UI Tax.”

2. Click the “Account Services” tab.

3. Under “Tax Issues and Assessments,” click “Submit a Tax Protest or Appeal.”

4. Click “Add Tax Protest/Appeal."

5. Choose the relevant protest or appeal.

Still can’t find what you’re looking for? Contact Employer Support.

Payments

You have two options for making payments:

Mail a check and a completed Employer Quarterly Tax Payment Coupon (UIA 4101) to

P.O. Box 33598

Detroit, MI 48232-5598.

|

OR

|

Online:

Follow the steps below.

1. Login to MiWAM and click “UI Tax” under the “Accounts” tab.

2. On the “Recent Periods/View Periods” page, click the “Make Payment” link next to the pending report.

3. Your payment profile info and amount due will appear. If you need to pay a different amount, enter it and confirm. Then click "Submit," enter your MiWAM password, and click "OK."

Still can’t find what you’re looking for? Contact Employer Support.

Email Reminders

You can avoid missing quarterly filing dates by setting up email reminders in MiWAM.

1. Login to MiWAM. Under the “I Want To” column, select “Setup Email Reminders.”

2. Select to be reminded 10 or 25 days before your report is due.

Still can’t find what you’re looking for? Contact Employer Support.