The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Your 1099-G Tax Form

Your 1099-G Tax Form

Unemployment benefits are taxable, so any unemployment compensation received during the past year must be reported on tax returns. If you received unemployment benefits you will be provided with a Form 1099-G Certain Government Payments.

The statements are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld the past year.

You can use MiWAM to view or download your 1099-G or change your delivery preference.

To view or download your 1099-G or change your delivery preference:

- Sign into your MiWAM account:

- Click on "I Want To".

- Click on the "1099-G" link.

- Click on the 1099-G letter for the most recent tax year.

To change your preference:

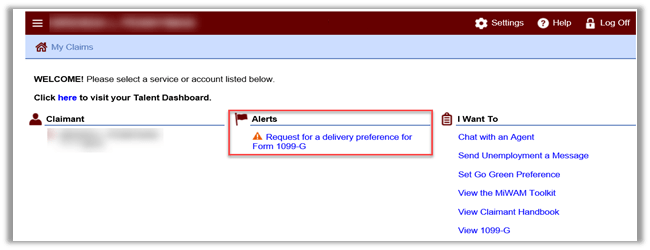

1 - Log into MiWAM

2 - Under Account Alerts, click "Request a delivery preference for Form 1099-G.

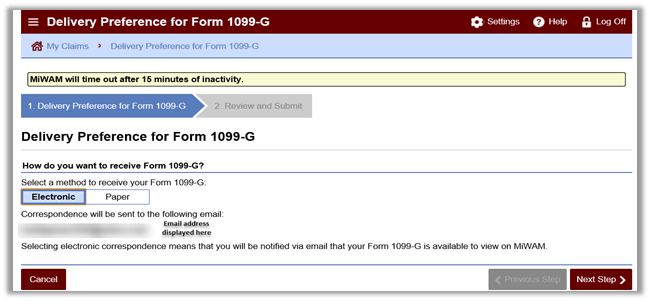

3 - Under Delivery Preference for Form 1099-G, click Electronic.

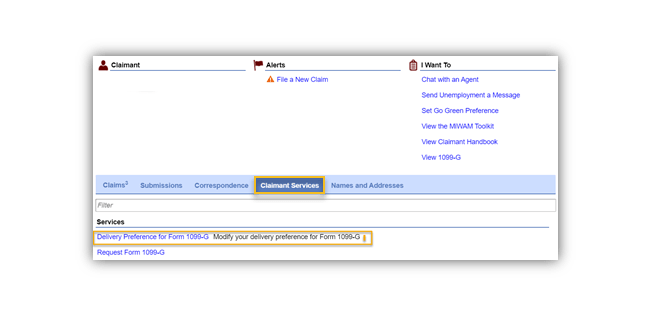

If your Account Alert doesn't have a 1099-G link, click on the Claimant Services tab; then select "Delivery Preference for Form 1099-G."

To receive your copy by mail, follow the steps above and select Paper as your delivery preference.

Request a Corrected 1099-G

If your 1099-G has an incorrect amount in "total payment" or "tax withheld," you can request a revised form.

To request a corrected form: Complete Form UIA 1920, Request to Correct Form 1099-G, and submit it to UIA. Mail completed forms to:

Unemployment Insurance Agency

1099-G, P.O. Box 169

Grand Rapids, MI 49501-0169.

Frequently Asked Questions

Q: My tax preparer/program requires the state ID for box 10b. What number should I use?

A: All state withholding taxes were paid to the state of Michigan. If required, enter "MI' in box 10a, and 38-6000134 in box 10b.

Q: Why is my overpayment, which I repaid, not reported on my Form 1099-G?

A: Please refer to the back of your 1099-G RE: Restitution, Penalties and Interest. Money repaid to the UIA during the tax year is not deducted from the amount shown in Box 1. Refer to your federal 1040 instruction booklet for further information.

Q: If I repaid an overpayment during the tax year, will I have to repay the taxes that were withheld?

A: Yes, UIA paid taxes on your behalf to the federal and state taxing authority at the time your benefit payment was created or issued. Because it was determined that you were not entitled to the payment, the tax withholding paid on your behalf is also considered to have been overpaid. As a result, you must also repay UIA for the federal and state taxes paid on your behalf.

Q: Are PUA amounts included in the 1099-G?

A: Yes. Your 1099-G will include a combined total of benefits paid on any program a claimant was on including UI, PEUC, EB, PUA, TRA or DUA. This will also include additional amounts such as Pandemic Unemployment Compensation (PUC) and Lost Wages Assistance (LWA).

Q: How can I get a duplicate 1099-G?

A: You can download a duplicate 1099-G from your MiWAM account. In your MiWAM account under "I Want To" click on the 1099-G link, or call UIA customer service at 866-500-0017.

Q: I paid back part or all of the amount reported on my 1099-G, Box 2. How do I get a corrected form?

A: Please refer to the back of your 1099-G RE: Restitution, Penalties and Interest. Money repaid to the UIA is not deducted from the amount shown in Box 1. Refer to your federal 1040 instruction booklet for further information. IRS Publication 17, Tax Guide (Unemployment Benefits) provides instructions to filers on how to report the repayment of unemployment compensation.

1099-G Info for Identity Theft Victims

Q: I did not file for or collect unemployment benefits. Why did I receive a Form 1099-G from UIA?

A: If you have received a Form 1099-G and you have not filed for or collected unemployment benefits, you may be a victim of identity theft.

Q: What should I do if I am a victim of identity theft, and received a 1099-G notice?

A: Report it to the UIA at Michigan.gov/UIA. Click on "Report Identity Theft" and include as much detail as possible. Also, submit a completed version of Form UIA 6349, Statement of Identity Theft, with your report.

- UIA will investigate your report regarding identity theft. Once identity theft is confirmed, UIA will issue a corrected 1099-G to you and the Internal Revenue Service (IRS).

- Please be patient. The rampant imposter fraud and identity theft across the country requires that UIA individually review each claim of suspected fraud. If you have already provided information to the UIA, there is no need to resubmit information unless asked by UIA.