The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.00.01: Payroll calendars and due dates

7.00.01: Payroll calendars and due dates

ORS requires that you report wages when they are paid, not when they are earned. We use your pay period start and end dates to create your payroll calendar. Much of ORS programming for wage reporting and granting service credit is based on consistency of payroll reporting frequency.

Before the start of each school fiscal year (July 1), ORS will automatically add payroll calendars for the new fiscal year to your Employer Reporting website based on the previous year's calendar. ORS will notify reporting units and ask you to verify the added pay dates or to submit a request for ORS to change your payroll calendar.

All changes to a payroll calendar at any time of the year must be made by ORS. ORS policy allows calendar modifications due to a change of payroll frequency, such as changing from a biweekly to semi-monthly frequency, or in the event of a fiscal year with 27 pay periods.

ORS cannot change a reporting unit's payroll calendars after a pay period begin date has passed. Only future pay periods may be changed. ORS will not change calendar dates in the event that a pay period end date falls on a holiday or weekend. Employees may be paid ahead of the holiday or weekend date but you must use the holiday or weekend date for your detail report header when reporting to ORS.

If you pay employees on a day other than your pay period end date, adjust your record end date accordingly, while keeping the same report end date. For example: If your pay period end date falls on January 1, 20xx, but you pay your employees on December 30, 20xx, you would submit a report header with a pay period end date of January 1, 20xx and records within the report with a date of December 30, 20xx. This is especially important for IRS limits associated with DC/PHF contributions on a Detail 4 (DTL4) record. Note: records will flag if their begin and end dates do not match your payroll calendar, and if the record posts the employee may receive inaccurate service credit.

Important Note: Adjustments to your payroll calendar will result in changes to your report and payment due dates.

To view your payroll calendar or check your report begin and end dates, click View Payroll Calendar on the Things To Do menu. Select the fiscal year calendar you wish to view.

After clicking on a specific calendar, you will see two options. Use Option 2 to view the payroll begin and end dates for your reporting unit's pay periods.

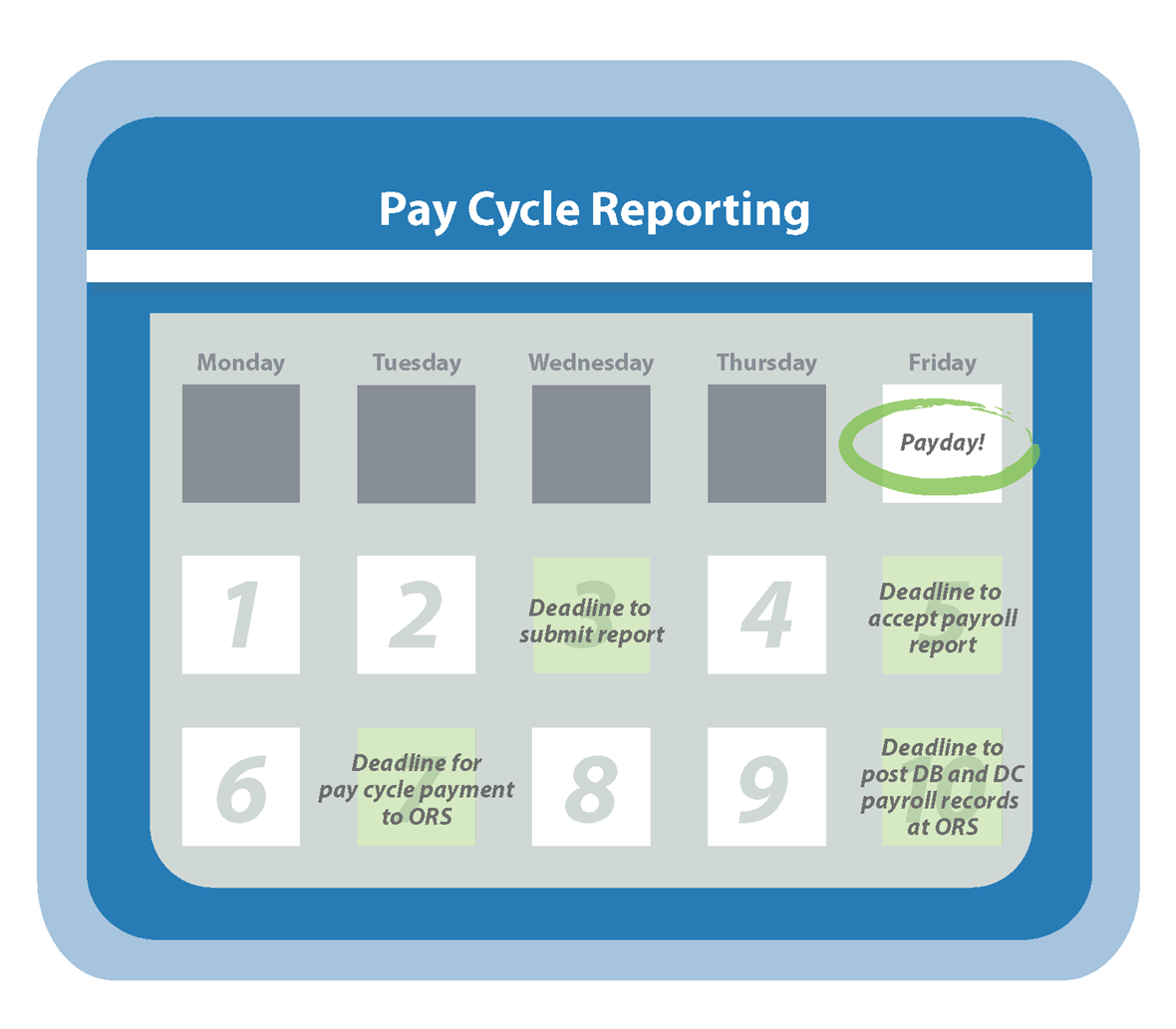

Due dates

Due dates for reports and payments are based on your reporting unit's pay cycle and the pay cycle end date. You must accept your report by the fifth business day of the pay cycle, and you must submit payment to ORS by the seventh business day after your pay cycle end date. Detail 2 (DTL2) records (for defined benefit members) and Detail 4 (DTL4) records (for defined contributions) that can be accepted and posted by the employer, must be posted by the tenth business day after your pay cycle end date.

See the list of ORS Non-Business Days.

Last updated: 04/01/2015