The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

7.04.02: Reporting a terminated employee on a DTL4 record

In order for a terminated employee to receive any refund or distribution of DC/PHF contributions, the reporting unit must notify Voya Financial of the employee’s termination date and status using a DTL4 record. Also, if a terminated employee begins work for another reporting unit but was not reported as terminated, the new employer may not receive changes to deferral percentages through the DC Feedback file.

To report an employee’s termination

Report the employee’s termination date and status only after reporting employee's final wages and contributions.

Report the termination date and status on a DTL4 record that contains no contribution information. Note: If a report contains a DTL4 record with contributions after you have reported the employee's termination on a DTL4 record, Voya will return the employee status to active. You will have to include another DTL4 record on a later payroll report to change the employee's status back to terminated.

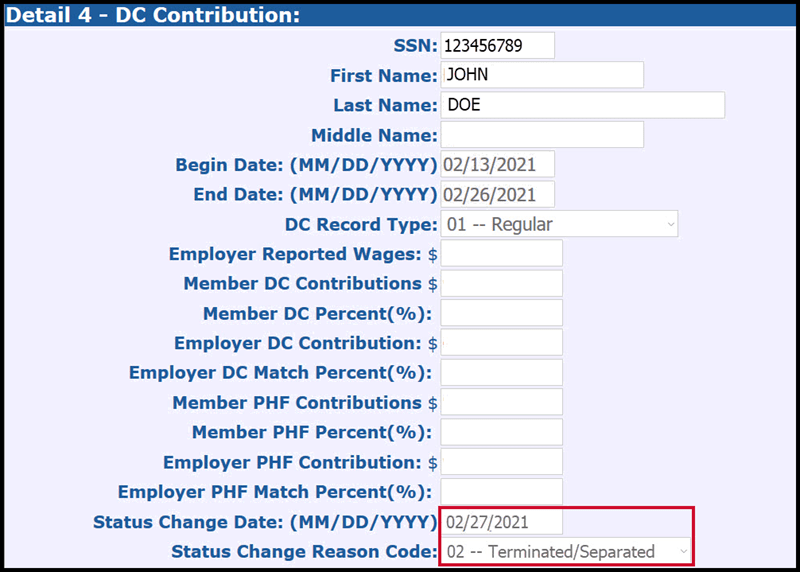

Populate both the Status Change Date and Status Change Reason Code fields. Enter the employee's termination date and use the drop-down box to select the Status Change Reason Code 02 – Terminated/Separated.

Save the DTL4 record and accept the payroll report. When the record is posted, the information will be relayed with the next ORS feed to Voya.

Last updated: 06/03/2022