The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

Michigan's Smoke-Free Indoor Air Law

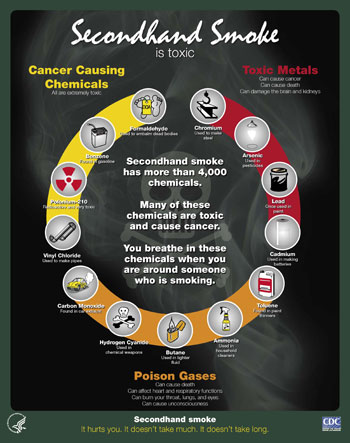

In 1993, the U.S. Environmental Protection Agency (EPA) classified secondhand smoke (also called SHS, environmental tobacco smoke, or ETS) as a Group A carcinogen, in recognition of the fact that it contains chemicals that have been proven to cause cancer in humans.

That finding has been reinforced by numerous scientific studies and reports since, including the 2006 U.S. Surgeon General’s Report.

Since the release of the EPA’s groundbreaking 1993 report, the public health community and its partners have worked to raise public awareness about the cancer-causing chemicals in secondhand smoke and the risks tobacco smoke poses to everyone, especially children, the elderly, people with existing health conditions, and non-smokers.

According to the Centers for Disease Control and Prevention, secondhand smoke exposure contributes to approximately 41,000 deaths among non-smoking adults and 400 deaths in infants each year. Secondhand smoke causes stroke, lung cancer, and coronary heart disease in adults. Children who are exposed to secondhand smoke face an increased risk for sudden infant death syndrome, acute respiratory infections, middle ear disease, increased severity of asthma, respiratory symptoms, and slowed lung growth.

Knowing the dangers posed by secondhand smoke, public health advocates have worked with policymakers to enact regulations and laws to ensure that all residents are protected from exposure to the chemicals contained in the smoke from other people’s cigarettes, cigars and pipes.

Because of their efforts, Michigan now has a number of statewide laws that protect residents and visitors from being exposed to secondhand smoke while in public places and businesses. One of the most comprehensive is Public Act No. 188 of 2009, as amended, commonly known as Michigan's Smoke-Free Indoor Air Law.

-

Michigan's Smoke-Free Indoor Air Law - What You Should Know

Michigan residents and visitors are protected from exposure to secondhand tobacco smoke in all restaurants, bars and businesses (including hotels and motels), thanks to Public Act No. 188 of 2009, as amended: Michigan's Smoke-Free Indoor Air Law.

Clean air is fundamental to good health. The public health and well-being of workers and customers alike is the best reason for state government to ensure smoke-free businesses, including restaurants and bars. Smoke-free air is good for Michigan residents, workers and visitors, and that's why Michigan serves smoke-free air.

Below, you will find more detailed information about the law and the exemptions that are allowed, as well as answers to frequently asked questions, tools for businesses, and tobacco dependence treatment information for business and citizens.

The Basics

- Public Act No. 188 of 2009, as amended: Michigan's Smoke-Free Indoor Air Law

- E-Cigarettes — What You Should Know

Tools for Businesses

- Smoke-Free Building Decal

- Smoke-Free Restaurant Postcard

- Smoke-Free Business Information Postcard

- Guide for Business Owners

- Compliance Checklist for Business Owners

- Quit Support for Business Owners

- Educational Materials

Media Resources

Enforcement Guidance

- April 2010 Memo of Agreement Between Michigan Department of Agriculture and MDCH

- How Guidance and Forms were Developed

- Responding to Complaints for Food Establishments, Part 129

- Smoke-Free Workplace Violation and Complaint Form

- Guidance for Responding to Violations During Inspection, Part 129

- Responding to Complaints in Worksites and Public Places, Part 126

Reporting Violations of the Law

- Public Act No. 188 of 2009, as amended: Michigan's Smoke-Free Indoor Air Law

-

Michigan's Smoke-Free Indoor Air Law - FAQs

Visit our Frequently Asked Questions page to learn more about the law and how it helps protect the health of Michigan's residents and visitors.

-

Other Michigan Laws Related to Commercial Tobacco Use

Smoke-Free Indoor Air Protection

Public Act 198 of 1986, as Amended: Michigan Clean Indoor Air Act

(Public Act 198 of 1986, as Amended)

Restricts smoking to designated areas in publicly owned buildings and in certain private facilities; places stronger restrictions on childcare centers and some health care facilities.Smoking in Elevators

(Public Act 227 of 1967)

Prohibits smoking in elevators.Smoking in Nursing Homes and Homes for the Aged

(Public Act 103 of 1976)

Requires facilities to inquire about smoking status upon admission; prohibits staff smoking in patient rooms; requires a sign stating smoking is allowed only in designated areas; prohibits sale of tobacco on premises.Tobacco-Free Schools

(Public Act 140 of 1993)

Prohibits the use of tobacco in public school buildings at all times; tobacco use is allowed on school grounds after 6:00 p.m. on class days or at any time on days when classes are not in session.Smoking in Group and Family Day Care Homes

(Public Acts 211, 217, and 219 of 1993)

Prohibits smoking in licensed group day care (7-12 children) and family daycare homes (1-6 children) during hours of operation.

Preventing Youth from Gaining Access to Tobacco

Michigan Youth Tobacco Act

(Public Act 314 of 1988)

Prohibits the sale or distribution of tobacco products to minors; prohibits the possession of tobacco products by minors; requires retailers to post a sign warning against the sale of tobacco to minors.Restrictions on Tobacco Vending Machines

(Public Act 271 of 1992)

Prohibits placement of tobacco vending machines in places and locations open to minors; exemption for restaurants with Class C liquor licenses (with restrictions) and private clubs and workplaces not open to the public (with restrictions).Ban on Sale of Single Cigarettes

(Public Act 272 of 1992)

Prohibits the sale of cigarettes apart from their original packaging.Restrictions on Free Tobacco Samples through the Mail

(Public Act 273 of 1992)

Prohibits the distribution of tobacco at no cost through the mail unless it is part of a direct mail campaign in which the individual has signed an authorization card agreeing to receive the products.Regulations and Taxes on Tobacco Products

Tobacco Excise Taxes

(Public Act 327 of 1993)

Levies a tax of 75 cents per pack on cigarettes (20 count); levies a tax of 16% of wholesale price on non-cigarette tobacco products; earmarks 6% of tobacco tax revenues for health purposes; preempts local ordinances on the sale or distribution of tobacco products.(Public Act 503 of 2002)

Levies an additional 50 cents per pack on cigarettes (20 count) for a total of $1.25; it increases the tax on other tobacco products (OTP) – excluding cigars, to 20% of the wholesale price.(Public Act 164 of 2004)

Levies an additional tax of 75 cents per pack on cigarettes (20 count) for a total of $2/pack; increases the tax on other tobacco products (OTP) — excluding cigars, to

32 percent of wholesale price.Surgeon General’s Warning on Smokeless Tobacco Billboards

(Public Act 295 of 1988)

Requires smokeless tobacco billboards to carry the same Surgeon General warnings as required on smokeless tobacco packages.Tobacco Tax Stamp

(Public Act 187 of 1997, as amended)

Requires that all tobacco products distributed and sold in the state, must carry a stamp indicating that a tax has been paid. The intent is that the tax is ultimately paid by the consumer of the tobacco product.Digital Tobacco Tax Stamp

(Public Act 188 of 2012)

Transitions the wholesalers of tobacco products from heat-applied cigarette tax stamps to digital, pressure applied, cigarette tax stamps (“Digital Stamps”).Tobacco Billboard Ban

(Public Act 464 of 1998)

Billboards advertising any tobacco product are prohibited on all roads and highways in Michigan.Tobacco Products Regulation

(Public Act 182 of 1999)

Prevents the introduction of cigarettes into Michigan that were intended for foreign markets or were manufactured in other countries to be sold illegally in the United States.

Download this list of Michigan tobacco laws as a PDF document

For more information about any of these laws and their enforcement, please contact the MDHHS Tobacco Section at 517-335-8376.

Return to Tobacco Section home page

Photo credit: The images on this page show posters developed by the Centers for Disease Control and Prevention as part of the 2006 Surgeon General's Report — The Health Consequences of Involuntary Exposure to Tobacco Smoke resource materials. Clicking on an image will take you to a larger version of that poster.